Due to the sharp drop in sales of Gucci and YSL, Kering Group's sales fell sharply by 13% in the third quarter, falling short of expectations, becoming another giant in the luxury goods industry that fell sharply after LVMH due to a slowdown in demand.

On October 25, luxury goods group Kering (Kering) announced results for the third quarter ending September 30 this year. The group's sales fell 9% at a fixed exchange rate to 4,464 billion euros, down 13% at the immediate exchange rate, falling short of analysts' expectations of 4.52 billion euros.

Looking at specific brands, based on comparable ranges and exchange rates, Kering Group's core brandsGucci(Gucci)The sales volume has declined7%, to22.2100 million euros, down from 2.51 billion euros in the second quarter.Saint Laurent(Yves Saint Laurent)The decline in sales12%, to 7.68100 million euros.

Additionally, revenue for Bottega Venetta (Bottega Venetta) fell 7% to 380 million euros during the quarter, while revenue from other departments where Balenciaga (Balenciaga) is located fell 15% to 805 million euros.

In a conference call after the financial report, Kering Deputy CEO Jean-Marc Duplaix said that after Kering made senior personnel adjustments, he believes Kering has established the right organizational structure to revive momentum and market position.

Jean-Marc Duplaix believes that Gucci's profit margin growth target this year is unlikely to be achieved. Gucci accounted for two-thirds of the group's profit last year, and profit margins will still be under pressure next year because the group will increase investment to reshape its brand. Duplaix says:

Kering is also cutting wholesale sales channels to achieve greater price control. This project has dragged down sales, particularly in the US, but is expected to be largely completed in 2024.

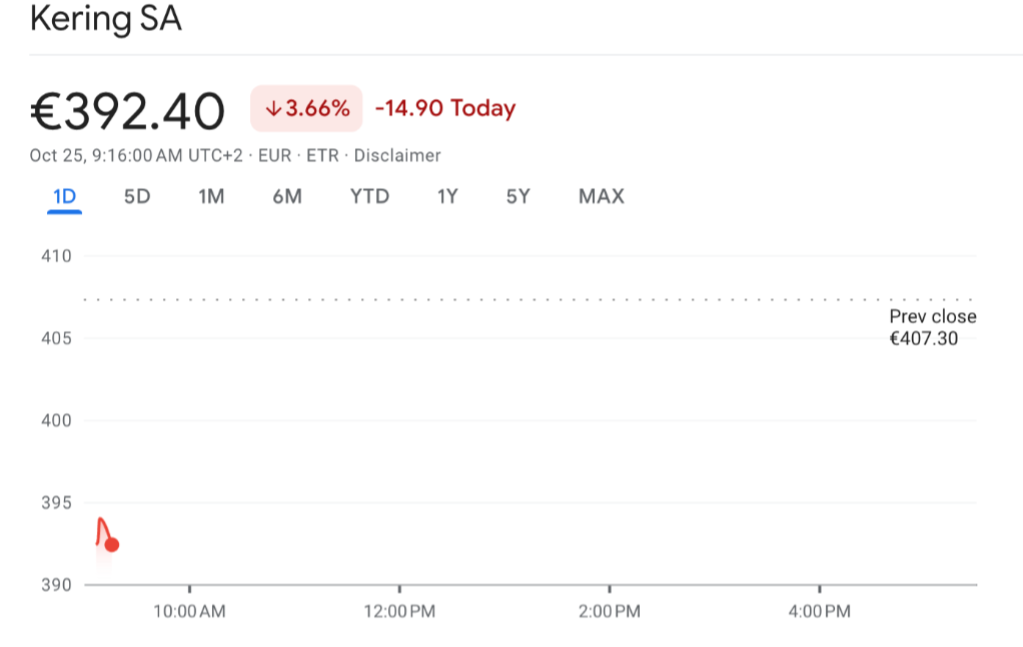

After the financial report was announced, Kering's European stock market fell nearly 4% to 392.4 euros at opening today.

Poor demand for luxury?

Yesterday, the world's top luxury brand Hermès announced financial results. Under the influence of headwinds in the luxury goods industry, the company's third-quarter sales increased 15.6% year-on-year to 3.37 billion euros at a fixed exchange rate, exceeding analysts' expectations of 14% increase, but the growth rate slowed down from 27.5% in the second quarter.

By the end of September, Hermès Group's consolidated revenue reached 10.063 billion euros (equivalent to 76.806 billion yuan), an increase of 22% year-on-year at a fixed exchange rate and 17% at the current exchange rate

Earlier this month, LVMH announced financial results for the third quarter of this year. Revenue for the third quarter was 19.06 billion euros, lower than analysts' expectations of 21.14 billion euros. Organic revenue based on existing business increased 9% year-on-year, while organic revenue growth for the first three quarters of this year slowed to 14%.

Wall Street News notes that this is the first time this year that LVMH's revenue has fallen short of expectations. The third quarter was also the quarter with the lowest revenue growth. Revenue in the first and second quarters both increased 17%, and the growth rate in the third quarter was almost half that of the previous two quarters.

After announcing the financial report for the second quarter in July of this year, Wall Street sources mentioned that the days of big luxury brands “making money with their eyes closed” came to an end. LVMH, Prada, and Cartier's parent company, Lifeng Group, all reported that sales growth in the US was slowing down. China's rebound from the market continues, but at a slower pace than some expected.

Analysts generally believe that although poor demand in the luxury goods industry is a reality, Kering's decline far exceeds that of the other two companies. They are cautious about Kering's ability to withstand risks, and it is also difficult to judge whether Gucci can resume growth after personnel adjustments. Barclays analysts have lowered Kering's revenue guidelines for the whole year:

“We remain cautious about Kering's future recovery as it is unclear whether the main brand, Gucci, will be able to successfully relaunch brand momentum through its new aesthetic and lower its goals for the whole year.”

Although LVMH's growth is slowing, UBS analysts believe that LVMH is still attractive in the long run. UBS reports that its first-class brand portfolio, good industry fundamentals, and pricing ability in an inflationary environment still make LVMH one of the most valuable stocks to own.