If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. That's why when we briefly looked at Interpublic Group of Companies' (NYSE:IPG) ROCE trend, we were pretty happy with what we saw.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Interpublic Group of Companies:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = US$1.4b ÷ (US$17b - US$8.4b) (Based on the trailing twelve months to September 2023).

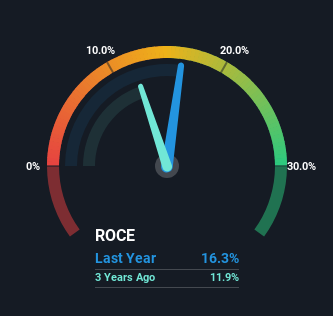

Therefore, Interpublic Group of Companies has an ROCE of 16%. In absolute terms, that's a satisfactory return, but compared to the Media industry average of 8.2% it's much better.

View our latest analysis for Interpublic Group of Companies

In the above chart we have measured Interpublic Group of Companies' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What The Trend Of ROCE Can Tell Us

While the current returns on capital are decent, they haven't changed much. Over the past five years, ROCE has remained relatively flat at around 16% and the business has deployed 83% more capital into its operations. 16% is a pretty standard return, and it provides some comfort knowing that Interpublic Group of Companies has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 49% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously. Although because current liabilities are still 49%, some of that risk is still prevalent.

The Bottom Line On Interpublic Group of Companies' ROCE

The main thing to remember is that Interpublic Group of Companies has proven its ability to continually reinvest at respectable rates of return. And the stock has followed suit returning a meaningful 47% to shareholders over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

If you're still interested in Interpublic Group of Companies it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While Interpublic Group of Companies may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.