Unfortunately for some shareholders, the AVITA Medical, Inc. (NASDAQ:RCEL) share price has dived 32% in the last thirty days, prolonging recent pain. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 114% in the last twelve months.

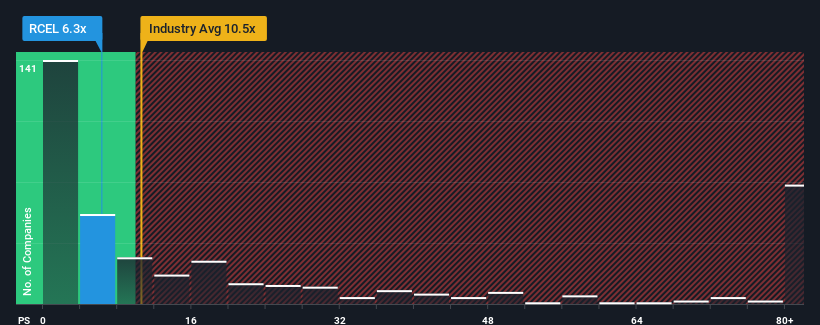

After such a large drop in price, AVITA Medical may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 6.3x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 10.5x and even P/S higher than 42x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for AVITA Medical

How Has AVITA Medical Performed Recently?

AVITA Medical certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on AVITA Medical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, AVITA Medical would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. The strong recent performance means it was also able to grow revenue by 186% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 39% each year during the coming three years according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 103% per year, which is noticeably more attractive.

In light of this, it's understandable that AVITA Medical's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On AVITA Medical's P/S

The southerly movements of AVITA Medical's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of AVITA Medical's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with AVITA Medical.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.