We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example the Global Blue Group Holding AG (NYSE:GB) share price dropped 50% over five years. We certainly feel for shareholders who bought near the top. The last week also saw the share price slip down another 14%.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Global Blue Group Holding

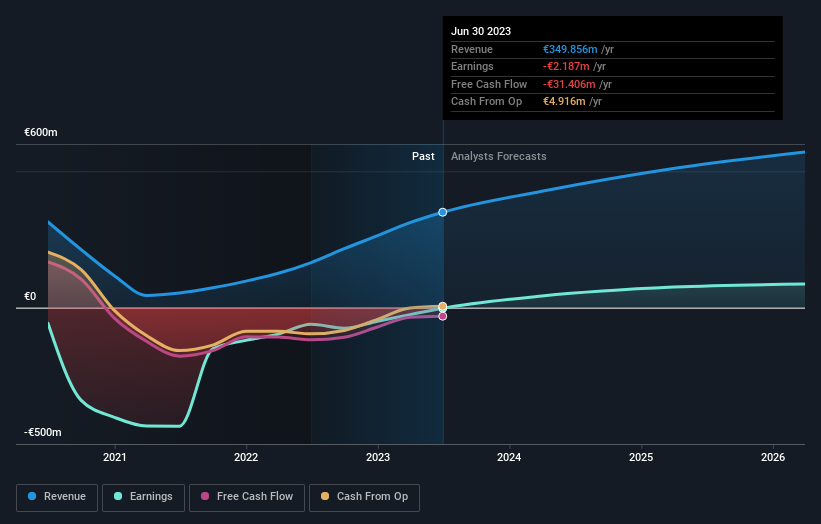

Given that Global Blue Group Holding didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Global Blue Group Holding's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Global Blue Group Holding shareholders have received a total shareholder return of 21% over one year. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Global Blue Group Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.