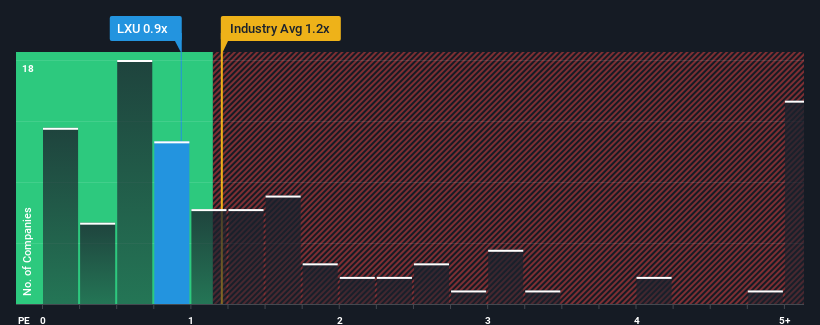

With a median price-to-sales (or "P/S") ratio of close to 1.2x in the Chemicals industry in the United States, you could be forgiven for feeling indifferent about LSB Industries, Inc.'s (NYSE:LXU) P/S ratio of 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for LSB Industries

What Does LSB Industries' P/S Mean For Shareholders?

LSB Industries could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think LSB Industries' future stacks up against the industry? In that case, our free report is a great place to start.How Is LSB Industries' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like LSB Industries' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 126% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 6.5% each year during the coming three years according to the eight analysts following the company. That's not great when the rest of the industry is expected to grow by 10% per annum.

With this in consideration, we think it doesn't make sense that LSB Industries' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of LSB Industries' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you take the next step, you should know about the 2 warning signs for LSB Industries (1 shouldn't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on LSB Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.