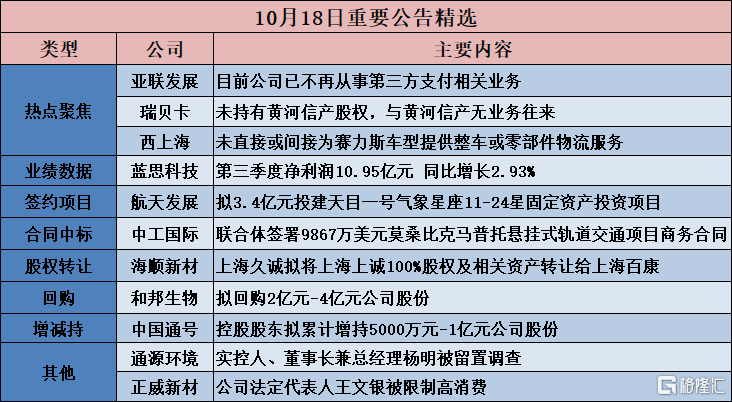

[hot spot focus]

Asia Union Development (002316.SZ): at present, the company is no longer engaged in third-party payment related business.

Asian Union Development (002316.SZ) announced abnormal fluctuations in stock trading. Kaidian Bao Technology Group Co., Ltd., the holding subsidiary of the company, which was originally engaged in third-party payment business and merchant service business, will no longer be included in the scope of the company's consolidated statements since December 2022, and the company is no longer engaged in third-party payment related business.

Rebecca (600439.SH): does not hold the equity of Huanghe Xinjian and has no business relationship with Huanghe Xinjian.

600439.SH announced abnormal fluctuations in stock trading. The company's shares closed with a cumulative deviation of more than 20% during the three consecutive trading days of October 16, October 17 and October 18, 2023, which belongs to the case of abnormal fluctuations in stock trading. Xuchang Ruidong Electronic Technology Co., Ltd. (hereinafter referred to as "Xuchang Ruidong") holds 40% of the equity of Yellow River Science and Technology Group Information Industry Development Co., Ltd. (hereinafter referred to as "Yellow River Xinshan"). The company's controlling shareholder holds 60% of Xuchang Ruidong's equity, and the listed company does not hold the equity of Huanghe Xin Industry and has no business with Yellow River Xin Industry.

Sheng long Co., Ltd. (603178.SH): the operating income of matching oil pumps and other products for Cyrus is relatively small.

Sheng long shares (603178.SH) announced abnormal fluctuations in stock trading, and the company recently noticed that some media listed the company as Huawei's automobile concept stock. In the previous periodic report, the company disclosed that the company provided Cyrus with electronic oil pumps and other products through Castle Peak Industry, Chongqing Xiaokang and other products, and obtained the project fixed point. In 2022 and 2023, the operating income of the company's matching oil pumps and other products was 19.151 million yuan and 10.2288 million yuan respectively, accounting for 1.29% and 1.50% of the company's operating income respectively, accounting for relatively small, and the profit and loss generated by the project had little impact on the company.

West Shanghai (605151.SH): no logistics services for complete vehicles or spare parts are provided directly or indirectly for Selis models.

West Shanghai (605151.SH) announced that investors asked about the company's supply of Huawei cars and Cyrus cars at the company's 2023 half-year results presentation and Shanghai E interactive platform. In the first half of 2023, the company obtained a new project from customers to provide seat cover products as a secondary supplier. The business is currently in the product development stage and has not yet generated sales revenue, which does not have any impact on the company's main business income in 2023. The company also does not directly or indirectly provide complete vehicle or spare parts logistics services for Selis models. The company is engaged in the research and development, production and sales of auto parts, as well as providing comprehensive logistics services for the automotive industry. At present, the production and operation of the company is normal, and the main business has not changed.

[contract project]

Aerospace Development (000547.SZ): plan to invest 340 million yuan in the fixed assets investment project of Tianmu-1 Meteorological Constellation 11-24 Star.

Aerospace Development (000547.SZ) announced that in order to carry out the business related to commercial space-based meteorological data services, the board of directors of the company agreed that Aerospace Tianmu (Chongqing) Satellite Technology Co., Ltd. to invest in the construction of Tianmu-1 meteorological constellation 11-24 fixed assets investment project, the total estimated amount of investment is 340.4 million yuan, the source of funding for the project is raised by the construction unit.

Chutian Expressway (600035.SH): plans to jointly invest 41.7 billion yuan with controlling shareholders in the reconstruction and expansion project of Wuhan-Yichang section of Shanghai-Chongqing Expressway

Chutian Expressway (600035.SH) announced that it plans to jointly invest in the reconstruction and expansion project of Wuhan-Yichang section of Shanghai-Chongqing Expressway with controlling shareholder Hubei Transportation Investment Group Co., Ltd. (hereinafter referred to as Hubei Exchange Investment Group). The total investment of the project is estimated to be about 41.7 billion yuan, of which the company contributes about 4.253 billion yuan as project capital.

[contract won the bid]

China Engineering International (002051.SZ): consortium signs commercial contract of US $98.67 million for Maputo suspended rail transit project in Mozambique

China Industrial International (002051.SZ) announced that on October 17, 2023, a consortium of China Industrial International Engineering Co., Ltd. And FUTRAN LIMITED (referred to as "Fuchuan Co., Ltd.") signed a business contract for the Maputo suspended rail transit project in Mozambique at the third Belt and Road Initiative Forum for International Cooperation entrepreneurs.The Maputo suspended rail transit project in Mozambique, which has a commercial contract of US $98.67 million, is located in the Mozambican capital Maputo and involves the construction of a 12-kilometer suspended rail transit line in the center of Maputo. This includes the construction of 12 stations and a depot. The scope of work includes survey and design, equipment supply, construction, installation and commissioning, etc. The duration of the contract is 18 months.

Tengda Construction (600512.SH): won the bid of 472 million yuan project

Tengda Construction (600512.SH) announced that recently, the company received a "bid winning notice" from Hangzhou Yuhang Major Infrastructure Construction Co., Ltd., confirming that our company is the winning bidder of the first phase of Hangzhou "Kangliang Road (Beijing-Hangzhou Grand Canal-Canal Viaduct) Project (Yunxi Viaduct-Hu-Hangzhou High Speed Railway)". The winning price is 472.04097 million yuan.

Tunnel shares (600820.SH): the subsidiary won the bid of 1.952 billion yuan

Tunnel shares (600820.SH) announced that recently, Shanghai Infrastructure Construction and Development (Group) Co., Ltd., a wholly owned subsidiary of Shanghai Tunnel Engineering Co., Ltd., participated in the public tender for the investment and development project of Qidong Wujiang High-end Manufacturing Industrial Park. According to the bid winning notice issued by the tenderer-Jiangsu Qisheng Group Co., Ltd., determine the specimen project in Shanghai capital construction. The project is located in Qidong City, Nantong City, Jiangsu Province, mainly for the construction and investment of housing, municipal roads, supporting public service facilities in Qidong Wujiang High-end Manufacturing Industrial Park. The winning price of the project is 1951630000 yuan, and the winning period is 3650 days.

[Equity acquisition]

Haishun New material (300501.SZ): Shanghai Jiucheng plans to transfer 100% equity and related assets of Shanghai Shangcheng to Shanghai Baikang.

Haishun new material (300501.SZ) announced that recently, the company received a letter from Shanghai Jiucheng, a subsidiary of Shanghai Jiucheng, informing it that Shanghai Jiucheng signed the "Equity transfer Agreement on Shanghai Shangcheng Packaging Co., Ltd." with Shanghai Baikang Electronic components Co., Ltd. (referred to as "Shanghai Baikang"). Shanghai Jiucheng will take a 100% stake in Shanghai Shangcheng with a consideration of 88.18 million yuan, and Shanghai Shangcheng holds a 100% stake in Shanghai Haohai Road, Songjiang District, Shanghai. The ownership of the house with a total floor area of 10741.87 square meters (including all ancillary facilities and equipment) and the right to the use of state-owned construction land with a land area of 26861 square meters (hereinafter referred to as "target property") are transferred to Shanghai Baikang. After the completion of this transaction, Shanghai Baikang will hold 100% of Shanghai Shangcheng, and Shanghai Jiucheng will no longer hold Shanghai Shangcheng.

Xianyu Pharmaceutical (002332.SZ): Baian Medical plans to transfer 16% stake in Hangzhou Vesbo.

Xianyu Pharmaceutical (002332.SZ) announced that according to the development plan, Baian Medical, a subsidiary of the company, intends to transfer its 16% stake in Hangzhou Vesbo by publicly listing on the property rights exchange in accordance with the state-owned assets disposal procedure and not less than the equity value corresponding to the target valuation. After the completion of the proposed public listing transfer, Baian Medical will no longer hold the equity of Hangzhou Vesbo, and the company's 53.9933% equity will remain unchanged, which will not affect the scope of the company's consolidated statements.

[Performance data]

300433.SZ: net profit in the third quarter was 1.095 billion yuan, up 2.93% from the same period last year.

300433.SZ released its report for the third quarter of 2023, with operating income of 13.631 billion yuan for the reporting period, up 9.98% over the same period last year. Net profit belonging to shareholders of listed companies was 1.095 billion yuan, up 2.93% from the same period last year. Net profit belonging to shareholders of listed companies after deducting non-recurring profits and losses was 985 million yuan, down 4.58% from the same period last year; and basic earnings per share was 0.22 yuan.

Zhongju High-tech (600872.SH): net loss of 1.272 billion yuan in the first three quarters

China Torch Hi-Tech (600872.SH) released its third-quarter report that its operating income was 3.953 billion yuan, down 0.08% from the same period last year, with a net loss of 1.272 billion yuan, deducting 460 million yuan from non-net profit, an increase of 14.78% over the same period last year, and basic earnings per share of-1.6505 yuan.

Plum Blossom Biology (600873.SH): net profit in the third quarter was 790 million yuan, down 9.05% from a year earlier.

Plum Blossom Biology (600873.SH) released its third quarter report of 2023, with operating income of 6.938 billion yuan during the reporting period, up 5.10% from the same period last year; net profit belonging to shareholders of listed companies was 790 million yuan, down 9.05% from the same period last year; net profit belonging to shareholders of listed companies after deducting non-recurring profits and losses was 692 million yuan, down 19.02% from the same period last year; and basic earnings per share was 0.27 yuan per share.

Huatong Cable (605196.SH): net profit in the first three quarters is expected to increase by 66.09% to 89.82% over the same period last year.

Huatong Cable (605196.SH) announced that according to preliminary estimates, the net profit attributed to the owner of the parent company in the first three quarters of 2023 is expected to be 280 million yuan to 320 million yuan, an increase of 111.4217 million yuan to 151.4217 million yuan over the same period last year, an increase of 66.09% to 89.82% over the same period last year. It is estimated that the net profit attributable to the owner of the parent company after deducting non-recurring gains and losses in the first three quarters of 2023 is 278.5 million yuan to 318.5 million yuan, an increase of 96.187 million yuan to 136.1871 million yuan compared with the same period last year, and an increase of 52.76% to 74.7% compared with the same period last year.In the first three quarters of 2023, the company's total sales revenue increased year-on-year, the proportion of high-margin business sales increased, driving the overall gross profit margin to rise, the continued appreciation of the US dollar and other factors, jointly promote the company's operating results in the first three quarters of 2023 year-on-year growth.

JinkoSolar Holding Co Ltd (688223.SH): the net profit of returning home increased by 266.36% to 290.22% in the first three quarters.

JinkoSolar Holding Co Ltd (688223.SH) released a forecast of results for the first three quarters of 2023. According to preliminary estimates by the financial department, the net profit attributed to the owner of the parent company is expected to be 6.14 billion yuan to 6.54 billion yuan in the first three quarters of 2023, an increase of 4.4640362 billion yuan to 4864,0362 yuan compared with the same period last year, an increase of 266.36% to 290.22%.It is estimated that the net profit attributable to the owners of the parent company after deducting non-recurring gains and losses in the first three quarters of 2023 is 5.83 billion yuan to 6.23 billion yuan, an increase of 4.3142551 billion yuan to 47142551 million yuan compared with the same period last year, an increase of 284.63% to 311.02%.

The performance in the first three quarters of 2023 is expected to increase significantly compared with the same period last year, mainly due to the continued strong demand for advanced products in the global photovoltaic market. The company relies on its advantages in N-type TOPCon technology, global operation and integrated production capacity, while realizing the increase in photovoltaic module shipments and the proportion of N-type shipments. Efforts have been made to overcome the short-term challenges brought about by price fluctuations in the industrial chain and the international trade environment, and gradually establish a differentiated market competitive advantage, resulting in a substantial increase in income and profits compared with the same period last year.

603893.SH: net profit in the third quarter was 52.5166 million yuan, up 1318.46% from the same period last year.

603893.SH released its third quarter 2023 report that operating income during the reporting period was 602 million yuan, an increase of 83.26% over the same period last year; net profit belonging to shareholders of listed companies was 52.5166 million yuan, up 1318.46% from the same period last year; net profit belonging to shareholders of listed companies after deducting non-recurring profits and losses was 51.4181 million yuan; basic earnings per share was 0.13 yuan per share.

600529.SH: net profit in the third quarter was 229 million yuan, an increase of 32.28% over the same period last year.

Shandong Pharmaceutical Glass (600529.SH) released the third quarter report of 2023, the operating income for the reporting period was 1.251 billion yuan, up 23.63% over the same period last year; the net profit belonging to shareholders of listed companies was 229 million yuan, up 32.28% over the same period last year; the net profit belonging to shareholders of listed companies after deducting non-recurring profits and losses was 224 million yuan, up 35.21% from the same period last year; and basic earnings per share was 0.3447 yuan per share.

[buyback]

Southeast Network frame (002135.SZ): plan to spend 150 million-300 million yuan to buy back shares

Southeast Network frame (002135.SZ) announced a notice on the plan to buy back the company's shares (Phase II) by centralized bidding transaction, the company intends to use its own funds to buy back part of the company's public shares in the form of centralized bidding transaction, and all the repurchased shares will be cancelled and the company's registered capital reduced in accordance with the law. The total amount of the repurchase capital is not less than 150 million yuan (inclusive) and does not exceed 300 million yuan (inclusive), and the repurchase price does not exceed 8.97 yuan per share (inclusive), this price is not higher than 150% of the average trading price of the company's shares in the 30 trading days prior to the adoption of the buyback resolution by the company's board of directors. According to the price ceiling of the company's repurchase shares, the expected number of repurchases is 16.722408 million to 33.444816 million shares, and the specific number of repurchases shall be based on the actual number of shares repurchased at the expiration of the repurchase period. The implementation period of the repurchase of shares shall be within 12 months from the date of consideration and approval of the repurchase plan by the general meeting of the shareholders of the company.

Weilong shares (002871.SZ): it is proposed to spend 30 million-60 million yuan to buy back shares.

Weilong shares (002871.SZ) announced that the company intends to use its own funds to buy back some of the company's issued RMB common shares (A shares) through centralized bidding for the follow-up implementation of employee stock ownership plans or equity incentive plans. The total amount of funds to be used for repurchase shall not be less than RMB 30 million yuan (inclusive), no more than RMB 60 million yuan (inclusive), and the repurchase price shall not exceed RMB 15.50 yuan per share. According to the total amount of funds to be used for the repurchase and the upper limit of the repurchase price, it is estimated that the number of repurchased shares is about 3870967 shares, accounting for 1.76% of the total share capital of the company, and the specific number of repurchased shares shall prevail on the actual number of shares repurchased at the expiration of the repurchase period. The implementation period of this share repurchase shall be no more than 12 months from the date of consideration and approval of the share repurchase plan by the board of directors of the company.

Hubang Biology (603077.SH): plans to buy back 200-400 million yuan of company shares

603077.SH announced that the total capital of the proposed share buyback will be no less than Rmb200m, no more than Rmb400m, and the repurchase price shall not exceed Rmb5.87 per share, which will be used for employee stock ownership plans or equity incentives.

Honghua Mathematical Science (688789.SH): plans to spend 40 million to 80 million yuan to buy back shares

Honghua Mathematical Science (688789.SH) announced that the company intends to use its own funds to buy back some of the RMB common shares (A shares) publicly issued by the company through the trading system of the Shanghai Stock Exchange, the total amount of repurchase shares shall not be less than 40 million yuan (inclusive), no more than 80 million yuan (inclusive), and the repurchase price shall not exceed 139.00 yuan per share (inclusive).

[increase or decrease holdings]

China General account (688009.SH): the controlling shareholder intends to accumulate an increase of 50 million yuan to 100 million yuan in the company's shares

China General account (688009.SH) announced that on October 18, 2023, the company's controlling shareholder, China Railway Communications signal Group Co., Ltd., with its own capital of about 9.7828 million yuan, increased its A-share holdings by centralized bidding through the trading system of the Shanghai Stock Exchange, accounting for about 0.02% of the company's total issued shares. The company's controlling shareholder, General account Group, intends to continue to increase its A-share holdings within 6 months from the date of this increase, with a cumulative increase of no less than RMB 50 million and no more than RMB 100m in the manner permitted by the Shanghai Stock Exchange.

Lehui International (603076.SH): the controlling shareholder in unison intends to increase its stake in the company by 30 million yuan to 60 million yuan.

603076.SH announced that Ningbo Lecheng Enterprise Management Partnership (limited partnership), the company's controlling shareholder, plans to increase its holdings in the Shanghai Stock Exchange within 6 months from the date of disclosure of this announcement (including but not limited to centralized bidding and bulk trading, etc.). The amount of the proposed increase is not less than 30 million yuan and not more than 60 million yuan. The price of this increase does not exceed 42.27 yuan per share.

[other]

General Source Environment (688679.SH): investigation on the retention of Yang Ming, the actual controller, chairman and general manager

688679.SH announced that the company recently received a "lien notice" and a "filing notice" issued by the county supervisory committee, and Mr. Yang Ming, the actual controller, chairman and general manager of the company, was retained.

Tongling Nonferrous (000630.SZ): sign the investment cooperation agreement for the dangerous chemicals wharf project in Limaoshan Operation Zone, Changshan Port District, Tongling Port.

Tongling Nonferrous (000630.SZ) announced that on October 18, 2023, the company, Tongling Port and Shipping, and Dajiang Investment formally signed the Investment Cooperation Agreement for the dangerous Chemicals Wharf Project in Limaoshan Operation Zone, Changshan Port District, Tongling Port. The total investment of the project is about 99.908 million yuan, one and five 1000m3 loading and unloading transfer tanks of 3000 tons of liquid bulk cargo are arranged, and the production and auxiliary facilities such as office building, fire storage tank, control room, loading and unloading facilities and weighing scale are set up at the same time.

Zhengwei New material (002201.SZ): Wang Wenyin, the legal representative of the company, is restricted to high consumption.

Zhengwei New Materials (002201.SZ) announced that Wang Wenyin, the company's legal representative, has been restricted from high consumption because of matters related to Zhengwei Group, which serves as its legal representative. The consumption restriction order is a consumption restriction order issued against Zhengwei Group and its legal representative (Wang Wenyin) and has no significant impact on the operation of the Company.