Buying shares in the best businesses can build meaningful wealth for you and your family. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the Anhui Golden Seed Winery Co., Ltd. (SHSE:600199) share price is up a whopping 418% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. In the last week shares have slid back 3.1%.

In light of the stock dropping 3.1% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for Anhui Golden Seed Winery

Given that Anhui Golden Seed Winery didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Anhui Golden Seed Winery can boast revenue growth at a rate of 1.3% per year. That's not a very high growth rate considering the bottom line. So shareholders should be pretty elated with the 39% increase per year, in that time. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

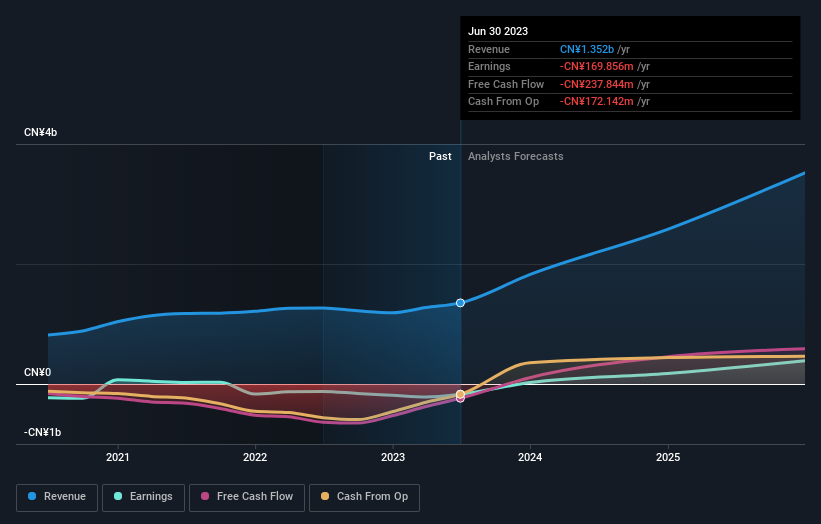

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Anhui Golden Seed Winery's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Anhui Golden Seed Winery shareholders have received a total shareholder return of 8.9% over the last year. However, that falls short of the 39% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. You could get a better understanding of Anhui Golden Seed Winery's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Anhui Golden Seed Winery may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.