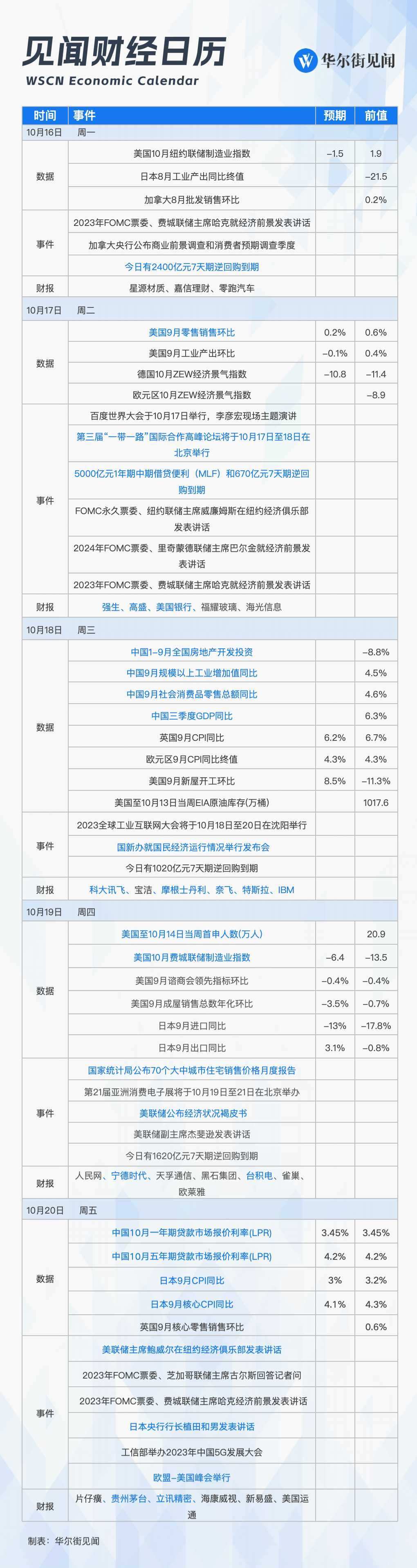

There are a lot of highlights next week, focusing on China's September economic report card, housing prices in 70 cities, central bank's 500 billion MLF maturing renewal status, US retail sales data for September, and Europe's September CPI announcement; on the central bank side, the Federal Reserve announced the Beige Book on economic conditions, Federal Reserve Chairman Powell delivered a speech, and Bank of Japan Governor Ueda Kazuo delivered a speech.

In addition, important listed companies such as Ningde Times, Kweichow Moutai, Tesla, TSMC, and Netflix announced their latest financial reports. The 3rd “Belt and Road” International Cooperation Summit will be held in Beijing from October 17 to 18, and the Baidu World Conference 2023 will be held at Beijing's Shougang Park on October 17.

China's economic data for September

On Wednesday, October 18, the National Bureau of Statistics will release major economic data such as industrial value added for September, fixed asset investment, total retail sales of social consumer goods, and GDP for the third quarter.

According to data previously released by the Bureau of Statistics, China's GDP grew 5.5% year on year in the first half of the year and 6.3% year on year in the second quarter. In the first half of the year, the Chinese economy as a whole showed a positive trend of recovery. Many industry experts are optimistic about the data for the third quarter. The GDP growth rate for the third quarter may be above 4% year on year.

In the report, Wen Bin, chief economist of Minsheng Bank, predictedChina's GDP grew 4.8% year on year in the third quarter, and 5.2% year on year in the first three quarters.Seen from the outside, the momentum for global economic recovery is gradually slowing down, and the interest rate hike process in developed countries such as the US, Europe, and the UK is nearing its end, but interest rates will remain high for a long time. Export pressure caused by declining external demand since May has continued throughout the third quarter.

By industry, it is expected that tertiary industries such as catering and lodging, transportation, wholesale and retail, business leasing, and information software services will maintain steady growth; the growth rate of industry, construction, and real estate will remain low; and the growth rate of the financial industry, agriculture, forestry, fishery and animal husbandry will decline slightly.

Looking at the base figure, China's GDP growth rate in the third quarter of last year rebounded significantly from the second quarter. It was also higher than in the fourth quarter of the same year. The relative base figure is higher. This will cause the GDP growth rate in the third quarter of this year to fall back compared to the second quarter, but it is expected that the month-on-month growth rate and the two-year year-on-year growth rate will pick up somewhat.

In terms of economic data for September, data released earlier showed that the value added of industries above scale in China increased 4.5% year on year in August, total retail sales of social consumer goods in August were 4.6% year on year, and national real estate development investment fell 8.8% year on year in January-August.

Zhang Wenlang, chief macro analyst at CICC's research department, said that the industrial production boom has improved,Industrial value added is expected to increase 4.3% year-on-year in September,However, due to the base figure, the year-on-year growth rate may decline slightly.

Wen Bin said that considering the decline in the base figure for the same period last year,The growth rate of total retail sales of consumer goods is expected to rise back to around 5.5% in September. Zhang Wenlang, on the other hand, believes that with service consumption falling and commodity consumption improving, the zero social growth rate in September may be basically the same as in August.

Judging from real estate development investment, Zhang Wenlang is expected to drop from -8.8% in January-August to around -8.9%.According to high-frequency data, the average daily transaction area of commercial housing in large and medium-sized cities was -22.0% in September 30, narrower than -23% last month. The land transaction area of the top 100 medium-sized cities was -43% year-on-year, up from -39% last month.

Zhang Wenlang expects fixed asset investment to increase 3.3% year-on-year in January-September (3.2% in January-August), and the improvement in PPI growth rate year-on-year will boost nominal investment growth. In terms of investment in manufacturing, investment in manufacturing is expected to increase 6.1% year-on-year in January-September (5.9% in January-August), driven by marginal improvements in fundamentals and policy support.

On the US side, the US will release retail sales data for September. The market expects overall and core retail sales for September to slow to 0.2% and 0.1%, respectively, while the increase in August was 0.6%. According to recent US consumer credit data, US consumers drastically cut spending in September, which increased the risk of an unexpected decline in data.

Furthermore, Germany will announce the October ZEW Economic Sentiment Index and the October ZEW Economic Status Index; the EU will announce data such as the EU CPI for September and the Eurozone CPI for September.

Will LPR and MLF cut interest rates?

On the central bank side, China's 500 billion yuan MLF will expire next Tuesday. At that time, we need to pay attention to the central bank's operating scale and interest rate. The October 1/5 LPR quotation will be released on Friday.

Since this year, the central bank has carried out two downgrades (announced 0.25 percentage point cuts in March and September, respectively) and two interest rate cuts (both LPR for June term varieties were lowered by 10 basis points; in August, 1-year LPR prices were lowered by 10 basis points, and LPR prices for 5-year terms and above remained unchanged).

So how much room is left for monetary policy this year? CITIC Securities clearly believes thatConsidering the background of financial concession entities, there is still a possibility that LPR will be lowered in the future. Lin Yingqi, an analyst at CICC, predicts that there is still room for LPR interest rate cuts during the year, by 5-10 bps. The form may be that MLF drives LPR cuts, or it may be that MLF will remain unchanged and LPR will be lowered separately.

On the US side, at 2:00 a.m. on Thursday, October 19, Beijing time, the Federal Reserve will publish the latest edition of the Beige Book on economic conditions to assess the current economic situation. On Friday, October 20, Federal Reserve Chairman Powell will also deliver a speech at the New York Economic Club.

On the one hand, US Treasury yields are soaring, and more and more senior Fed officials are making speeches saying,The rise in US bond yields has tightened the financing environment, making it less necessary for the Fed to raise interest rates again.However, the US CPI rebounded beyond expectations in September, indicating that inflation is still stubborn, and the market is looking forward to saying this from Federal Reserve Chairman Powell.

After the US CPI report was released, “New Federal Reserve News Agency” Nick Timiraos believes that progress in anti-inflation came to a standstill in September. This is a sign that the prospects for completely eliminating price pressure are uncertain. However, the current situation is that the Fed still cannot rule out the possibility of raising interest rates in December.It is unlikely to announce that it will enter the stage of suspending interest rate hikes.

According to the Fed's calendar, after next Friday,Fed officials will enter a period of silence before the interest rate meeting. The following are the speaking times for Fed officials next week:

On Monday at 22:30 the 2023 FOMC voting committee and Philadelphia Federal Reserve Chairman Huck delivered a speech on the economic outlook.

At 4:30 on Tuesday, 2023 FOMC voting committee and Philadelphia Fed Chairman Huck delivered a speech on economic prospects; 22:00 FOMC Permanent Voting Committee and New York Federal Reserve Chairman Williams delivered a speech at the New York Economic Club; 22:45 2024 FOMC Voting Committee and Richmond Fed Chairman Barkin spoke on economic prospects.

At 00:00 on Thursday, Federal Reserve Governor Waller delivered a speech on economic prospects; at 00:30 FOMC Permanent Voting Committee and New York Federal Reserve Chairman Williams delivered a speech; at 3:15, 2023 FOMC voting committee and Philadelphia Federal Reserve Chairman Huck delivered a speech on labor challenges; at 6:55, Federal Reserve Governor Lisa Cook delivered a speech on the Fed's mission; at 21:00, Fed Vice Chairman Jefferson delivered a speech.

At 00:00 on Friday, Federal Reserve Chairman Powell delivered a speech at the New York Economic Club; at 01:20 the 2023 FOMC voting committee and Chicago Fed Chairman Goulsby participated in the question and answer session; at 5:30, the 2023 FOMC voting committee and Philadelphia Fed Chairman Huck delivered a speech on the economic outlook; at 7:00 2023 FOMC voting committee and Dallas Fed Chairman Logan delivered a speech; 21:00, the 2023 FOMC voting committee and Philadelphia Fed Chairman Huck delivered a speech on the economic outlook.

The third quarterly report hits: Goldman Sachs, Tesla, TSMC, etc. announce financial reports

Next week, apart from Bank of America (announced on October 17) and Morgan Stanley (announced on October 18), the market is currently most concerned about Goldman Sachs (announced on October 17)'s third-quarter performance. After exploring the retail business was thwarted, the IPO market is still a bit lackluster recently, which is not optimistic for Goldman Sachs. In addition to well-known investment banks on Wall Street, many regional banks will also release financial reports next week, and it is not ruled out that they will return “victims of high interest rates.”

Tesla will also publish its three-quarter report. According to recently released delivery data, Tesla delivered 435,059 million vehicles in the third quarter, lower than analysts' expectations of 456.722 million vehicles. This is also the first time since the second quarter of 2022 that Tesla has experienced a month-on-month decline in deliveries.

Many analysts have begun to lower their optimistic expectations for Tesla's earnings. According to FactSet data, Wall Street generally believes that Tesla's profit for the third quarter was 74 cents per share and revenue was 24.32 billion US dollars. Meanwhile, in the second quarter, Tesla achieved revenue of 24.927 billion US dollars and earnings of 78 cents per share.

TSMC previously announced that it is expected to hold a quarterly legal conference on October 19, at which time it will announce the third quarter operating results. TSMC has now announced consolidated revenue for July and August, totaling NT$366.302 billion. At present, consolidated revenue for July and August has been announced, totaling NT$366.302 billion.

According to data recently released by TSMC, sales in September were NT$18.43 billion, down 13% from the previous year. According to calculations, TSMC's sales for the third quarter were about NT$546.7 billion, down 11% from the previous year. Sales so far this year were NT$1.54 trillion, down 6.2% year on year.

After the revenue results are released, in its financial report for the third quarter, TSMC will also disclose various financial data such as gross profit, operating expenses, and net profit, as well as data on the revenue share of each major process process.

Other important data, meetings and events

The 3rd “Belt and Road” International Cooperation Summit will be held in Beijing from October 17 to 18

This year marks the 10th anniversary of the joint construction of the “Belt and Road” initiative. This summit forum is the country's key home event this year, and it is also a high-level international event to promote the joint construction of the “Belt and Road” initiative.

The theme of this year's summit forum is: Build the Belt and Road with high quality, and work together to achieve common development and prosperity. In addition to the opening ceremony, 3 high-level forums will also be held at the same time, with in-depth exchanges on topics such as connectivity, green development, and the digital economy, and 6 parallel thematic forums will be held on topics such as smooth trade, mutual understanding of people, exchange of think tanks, clean Silk Road, local cooperation, and maritime cooperation. The “Belt and Road” Entrepreneurs Conference will also be held during the forum.

This year's summit forum will issue a presidential statement, sort out and summarize the consensus reached by all participants, and clarify the direction and key areas of cooperation to promote high-quality joint construction of the “Belt and Road” in the next stage.

Baidu World Conference 2023 will be held at Shougang Park in Beijing on October 17

As a trendsetter for the AI industry, the conference will bring a cumulative total of 30 hours of AI keynote speeches, dozens of native AI applications, and nearly 50 AI technology exhibitions. The 2023 Global Industrial Internet Conference will be held in Shenyang from October 18 to 20. The 2023 China 5G Development Conference is scheduled to be held from October 20 to 21, 2023. The 5G conference consists of a main forum, sub-forums, and exhibitions. The main forum focused on 5G network construction, technology industry, integrated applications, etc., to discuss 5G development trends in depth and share the latest developments.

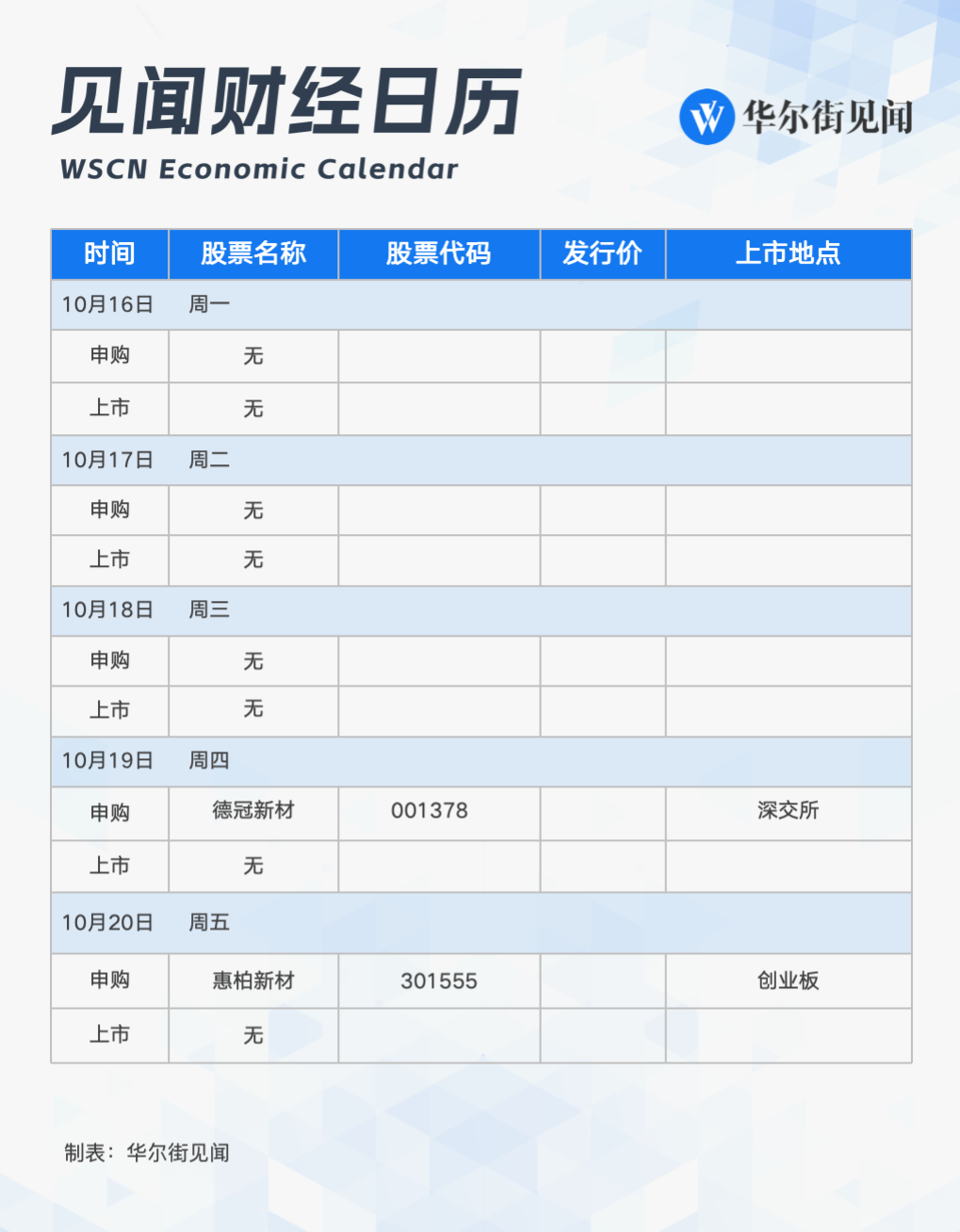

Two A-shares will be issued online. Among them, Deguang New Materials will be issued on Thursday, October 19. The company is mainly engaged in R&D, production and sales of functional films and functional masterbatches, and provides customers with functional BOPP films, BOPE films, and functional masterbatches. Huibai New Materials was released on Friday, October 20. The company's main business is the R&D, production and sale of a series of epoxy resin products modified with special formulations.

The 2023 China 5G Development Conference will be held next week

The General Office of the Ministry of Industry and Information Technology issued a notice on hosting the 2023 China 5G Development Conference. The notice said that in order to further promote the development of 5G technology, deepen 5G industry collaboration, and promote 5G application innovation, the 2023 China 5G Development Conference will be held from October 20 to 21, 2023. The 5G conference consists of a main forum, sub-forums, and exhibitions. The main forum focused on 5G network construction, technology industry, integrated applications, etc., to discuss 5G development trends in depth and share the latest developments. The sub-forum set up several topics, including 5G network construction, 5G lightweight technology industry development, 5G to help new industrialization, and investment and financing matchmaking. The exhibition and conference forum were held at the same location, focusing on showcasing the latest achievements in the development of the 5G technology industry and innovative special applications in the form of a boutique exhibition.

Nvidia cancels AI summit scheduled to be held in Israel on October 15

Nvidia announced that due to the current situation in Israel, it has decided to cancel the AI summit originally scheduled to be held in Tel Aviv from October 15 to 16. According to Nvidia's previous report, founder and CEO Hwang In-hoon will present the latest generative AI and cloud computing achievements at the summit. The conference will explore topics such as accelerated computing, robotics, cybersecurity, and climate science. The event is expected to attract more than 2,500 developers, researchers and decision makers.

Shenzhen Stock Exchange Releases Shenzhen Stock Exchange 50 Index

On October 13, Shenzhen Securities Information Co., Ltd., a wholly-owned subsidiary of the Shenzhen Stock Exchange, announced that it will release the Shenzhen Stock Exchange 50 Index on October 18. The Shenzhen Stock Exchange said that this is an important step for the Shenzhen Stock Exchange to increase the supply of high-quality indices and serve investors' indexed investment needs.

The reverse repurchase of 446 billion yuan expires

A total of 446 billion yuan of reverse repurchases in the Central Bank of China's open market will expire next week, of which 20 billion yuan, 67 billion yuan, 102 billion yuan, 162 billion yuan, and 95 billion yuan from Monday to Friday are respectively.

Open up new opportunities

Next week (October 16 to October 20), 2 new A-shares will be issued online. Of these, Deguang New Materials will be issued on Thursday, October 19. The company is mainly engaged in R&D, production and sales of functional films and functional masterbatches to provide customers with functional BOPP films, BOPE films, and functional masterbatches.

Huibai New Materials was released on Friday, October 20. The company's main business is the R&D, production and sale of a series of epoxy resin products modified with special formulations.

This week (October 16 to October 20), a total of 33 new funds (combined statistics of Class A and Class C) were issued, including 16 bond-based funds, 9 partial equity hybrid funds, 2 ODII funds, 4 index funds, and 2 FOF.