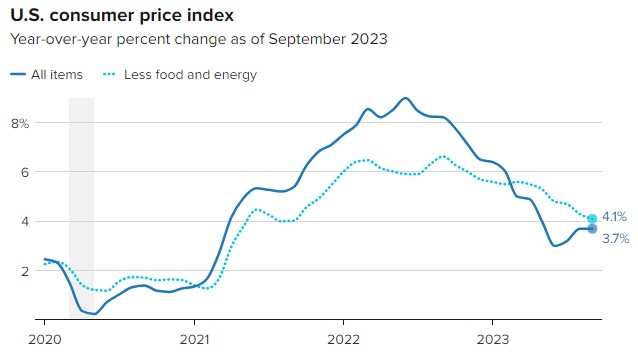

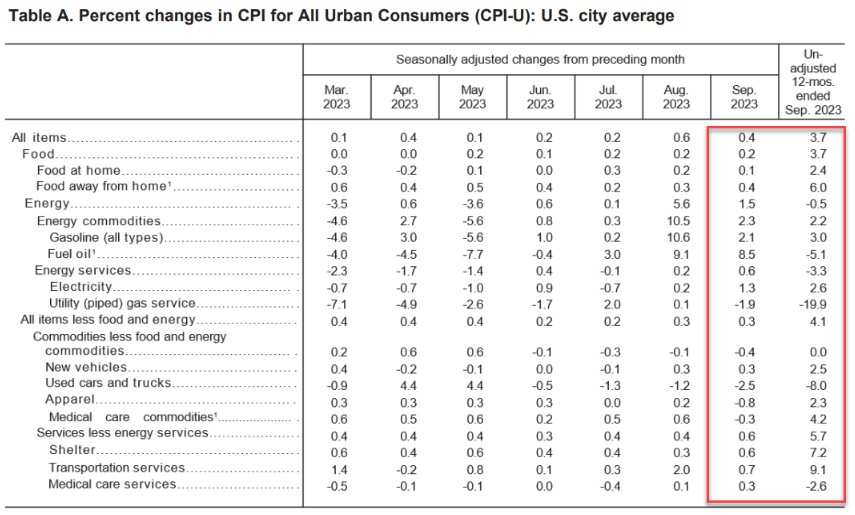

According to a report released by the US Labor Department on Thursday, US CPI rose 3.7 per cent in September from a year earlier, slightly higher than expected of 3.6 per cent and 3.7 per cent. Us core CPI rose 4.1 per cent in September from a year earlier, in line with expectations, with a previous value of 4.30 per cent. Us CPI grew 0.4 per cent month-on-month in September, with an expected 0.30 per cent and a previous value of 0.60 per cent. Us core CPI rose 0.3 per cent month-on-month in September, in line with expectations, with a previous value of 0.30 per cent.

In line with recent trends, housing costs remain a major factor in rising inflation. The housing inflation index, which accounts for about 1/3 of CPI, rose 0.6 per cent month-on-month and 7.2 per cent year-on-year. Car prices were mixed, with new cars up 0.3% month-on-month and used cars down 2.5%. The rise in the gasoline index was also the main reason for the monthly increase in all data, with energy prices rising 1.5% month-on-month, of which gasoline prices rose 2.1%, fuel oil prices rose 8.5%, and food prices rose 0.2% for the third month in a row.

The rise in energy inflation is another cause for concern. For example, the across-the-board higher-than-expected PPI data for September in the US suggest that rising energy costs continue to hinder the path to sustainable low inflation. Data released by the Bureau of Labor Statistics on Wednesday showed that US PPI rose 2.2 per cent in September from a year earlier, higher than market expectations of 1.6 per cent and 1.6 per cent, and 0.5 per cent month-on-month, higher than market expectations of 0.3 per cent and lower than the previous value of 0.7 per cent. In addition, the US core PPI rose 2.7 per cent in September from a year earlier, higher than market expectations of 2.3 per cent and previous values of 2.2 per cent, and 0.3 per cent month-on-month, higher than market expectations of 0.2 per cent and previous values of 0.2 per cent.

In addition to the recent rise in international oil prices caused by the gap between supply and demand, a big uncertainty facing the market is whether the war between Israel and Hamas will spread and affect oil supplies in the region. For now, the recent surge in oil prices has abated, but more importantly, capacity has returned to normal. Demand is fairly stable; the capacity of global airlines is finally back to pre-pandemic levels.

"if the risks between inflation and economic growth have become more balanced in the past few months, then the conflict between Israel and Hamas has now skewed the balance back towards upward inflation risks," said Bloomberg economists Wong and Stuart Paul. Our preset benchmark scenario is that the Fed will keep interest rates stable for the rest of the year, but we believe that the risk of raising rates again cannot be ignored, which the market may have underestimated. "

Wong and Paul warned that rising tensions in the Middle East could have a negative impact on supply and push up energy prices. Economists say, for example, that if oil prices reach $100 a barrel, headline CPI inflation could return to 4 per cent by the end of the year.Wong and Paul wrote: "as long as inflation expectations are stable, the Fed may not care about price increases." However, sustained and greater oil supply shocks could increase the risk of inflation expectations spiralling out of control, eventually prompting the Fed to continue to raise interest rates. "

The yield on 10-year Treasuries rose 4 basis points to 4.60 per cent after the CPI data. The dollar index DXY rose 35 points in the short term, hitting 106, up 0.32% on the day. Spot gold fell $4 in the short term to $1881.97 an ounce. The gains of the three major stock index futures in the United States have narrowed.

The US consumer price index rose rapidly for the second month in a row in September, underscoring the Fed's intention to keep interest rates high for longer.Some analysts believe the recent inflation data highlight how the strong job market supports consumer demand, which could keep price pressures above the Fed's target. It is unclear whether this will make the central bank inclined to raise interest rates again this year, especially given the recent surge in bond yields, which some officials say could replace more tightening. But at least it supports policymakers' desire to keep borrowing costs high for some time.

El Erian, chief adviser to Allianz, pointed out that the US core inflation rate was in line with expectations, while the overall indicator was higher than widely expected. In particular, core CPI rose 0.3% in September, bringing the annual inflation rate to 4.1%. Coupled with the relatively low and lower-than-expected weekly jobless claims of 209000 people, the market's direct reaction was a rise in US bond yields.From an analytical point of view, this is a reminder of the challenges facing the "last mile" of fighting inflation, especially when inflation in core services remains high and there are fears that rising energy prices will spread to core CPI.

Bryson, chief economist of Wells Fargo & Co, expressed the same view that it would be difficult to get the last kilometer of inflation to 2 per cent. That is why the Fed will remain tight for quite a long time, he added.

The minutes of the Fed's September meeting, released on Wednesday, also reflect divisions within the Federal Open Market Committee (FOMC), which sets interest rates. At the end of the September meeting, the committee chose not to raise interest rates, but the minutes showed lingering concerns about inflation and concerns that upside risks remained.

Due to the higher-than-expected CPI increaseTraders think it is more likely that the Fed will raise interest rates again this year and keep them unchanged for longer next year.Futures contracts based on the fed's policy rate currently reflect a 40 per cent chance of a rate hike in December, compared with about 28 per cent before the report was released.If interest rates were raised by another 25 basis points, the Fed's policy rate would reach a range of 5.5 per cent and 5.75 per cent.Traders now expect interest rates to fall by about one percentage point to 4.6 per cent by the end of next year. Before the release of the report, futures contracts showed interest rates at 4.5 per cent at the end of next year.

Stuart Cole, chief macroeconomist at Equiti Capital, said: "overall, this report may not be enough to show the FOMC that it needs to tighten policy again in November, but it will see it as justifying the message that its policy needs to 'keep tightening for a longer period of time', as the possibility of another rate hike still exists."

However, the average real hourly wage fell 0.2 per cent in September from the previous month due to the difference between inflation and nominal income growth of 0.2 per cent, according to another report from the labour department; pay rose 0.5 per cent on an annualised basis. According to the Bureau of Labor Statistics, of the more than 370 job categories tracked in the United States from January to September this year, only nearly 1/4 of job wage growth outpaced inflation. In the year to august, CPI has soared 16.6 per cent since the beginning of 2021, while the average hourly wage of private sector employees has risen by just 13 per cent. For the auto shipping industry, which has attracted a lot of attention recently, the average hourly wage of auto workers has increased by 10% since 2021, but the weekly working hours have also increased accordingly.