Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term Shenzhen TXD Technology Co.,Ltd. (SZSE:002845) shareholders have enjoyed a 69% share price rise over the last half decade, well in excess of the market return of around 43% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 51%.

The past week has proven to be lucrative for Shenzhen TXD TechnologyLtd investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Shenzhen TXD TechnologyLtd

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Shenzhen TXD TechnologyLtd actually saw its EPS drop 2.7% per year.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

In contrast revenue growth of 18% per year is probably viewed as evidence that Shenzhen TXD TechnologyLtd is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

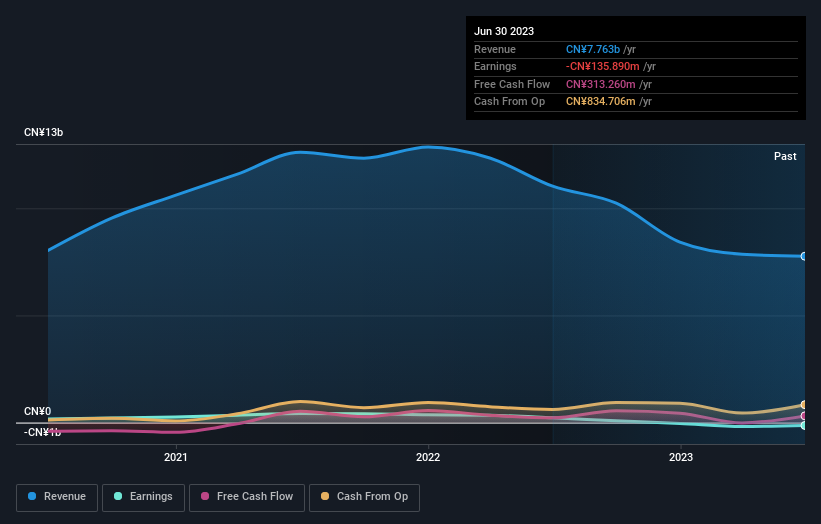

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Shenzhen TXD TechnologyLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Shenzhen TXD TechnologyLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Shenzhen TXD TechnologyLtd shareholders, and that cash payout contributed to why its TSR of 72%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that Shenzhen TXD TechnologyLtd shareholders have received a total shareholder return of 51% over one year. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Shenzhen TXD TechnologyLtd (1 is a bit unpleasant) that you should be aware of.

Of course Shenzhen TXD TechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.