While Yunnan Tourism Co., Ltd. (SZSE:002059) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 12% in the last quarter. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 12%, less than the market return of 57%.

Although Yunnan Tourism has shed CN¥385m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Yunnan Tourism

Yunnan Tourism isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade Yunnan Tourism's revenue has actually been trending down at about 28% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 2% per year over that time. That's pretty decent given the top line decline, and lack of profits. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

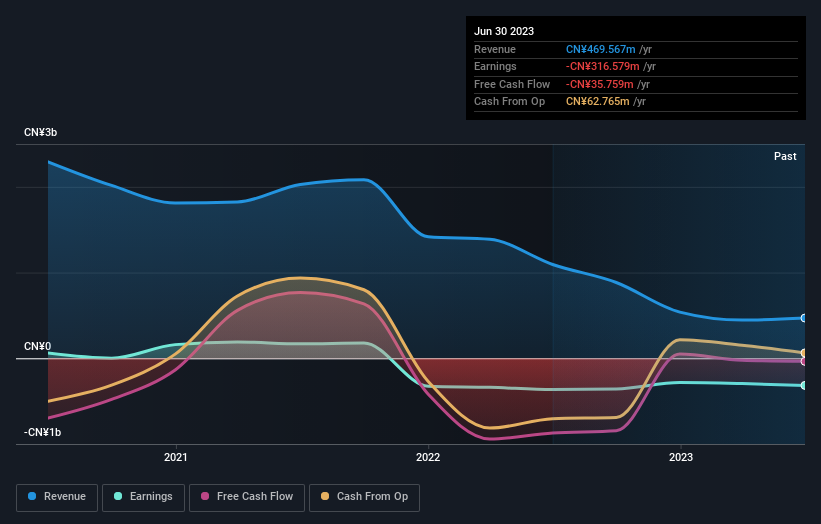

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We've already covered Yunnan Tourism's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Yunnan Tourism's TSR of 14% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Yunnan Tourism has rewarded shareholders with a total shareholder return of 3.2% in the last twelve months. That gain is better than the annual TSR over five years, which is 3%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Yunnan Tourism better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Yunnan Tourism .

We will like Yunnan Tourism better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.