MediWound Ltd. (NASDAQ:MDWD) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, despite the strong performance over the last month, the full year gain of 3.2% isn't as attractive.

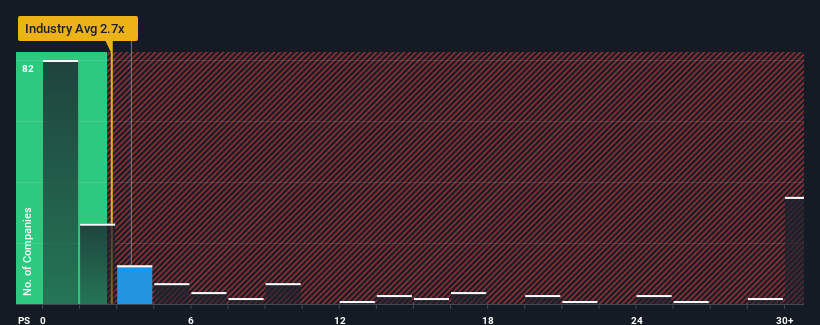

After such a large jump in price, MediWound's price-to-sales (or "P/S") ratio of 3.6x might make it look like a sell right now compared to the wider Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 2.7x and even P/S below 0.7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for MediWound

How MediWound Has Been Performing

With revenue growth that's inferior to most other companies of late, MediWound has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on MediWound will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For MediWound?

In order to justify its P/S ratio, MediWound would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow revenue by 36% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 25% each year during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 31% per year growth forecast for the broader industry.

In light of this, it's alarming that MediWound's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

MediWound's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for MediWound, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 3 warning signs for MediWound (1 is a bit concerning!) that you need to take into consideration.

If you're unsure about the strength of MediWound's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.