Newlink Technology Inc. (HKG:9600) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

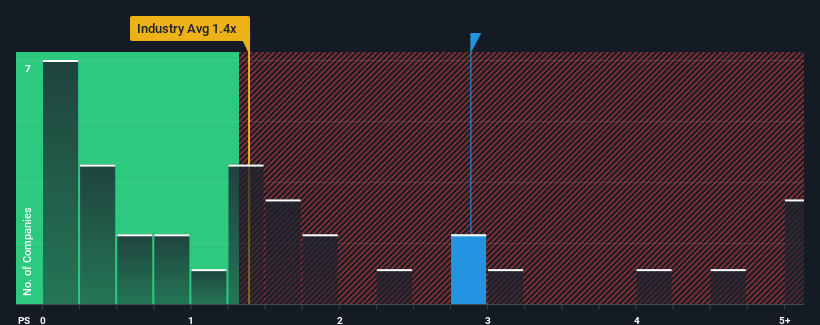

In spite of the heavy fall in price, you could still be forgiven for thinking Newlink Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.9x, considering almost half the companies in Hong Kong's IT industry have P/S ratios below 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Newlink Technology

How Has Newlink Technology Performed Recently?

The recent revenue growth at Newlink Technology would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Newlink Technology's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Newlink Technology would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 3.2% gain to the company's revenues. Pleasingly, revenue has also lifted 73% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 10% shows it's noticeably more attractive.

In light of this, it's understandable that Newlink Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

There's still some elevation in Newlink Technology's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Newlink Technology can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Newlink Technology that you need to take into consideration.

If you're unsure about the strength of Newlink Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.