On September 25, at Huawei's most exciting press conference, Yu Chengdong, the chairman of Huawei Auto BU, unveiled two “far ahead” new models — the Zhijie S7, which surpasses the Tesla Model S, and the “best SUV within 10 million”, the “best SUV within 10 million”, which has aroused a buzz in the market.

On the same day, Celis, a good car-building partner of Huawei, silently issued an announcement stating that Ganfeng Lithium would subscribe for an additional 100 million yuan of registered capital of its subsidiary, Ritz Electric, for 1 billion yuan. Under the current boom in cross-border car building, does Lithium King also have ambitions to build cars collaboratively?

1. Does Lithium King also want to cooperate to “build cars”?

As a subsidiary of Celis, Ritz New Energy focuses on the NEV logistics vehicle market and has achieved remarkable results.

In the first half of this year, its sales volume reached 11,128 units, accounting for 12.11% of the NEV logistics vehicle market, ranking second. This is different from Celis's focus on NEVs.

Ganfeng Lithium's many investments in the automotive sector, including investments in GAC Aian and Gangtu Auto, show that it has certain strategic considerations in the field of new energy vehicles. Although the company has always promoted business diversification and upstream and downstream integration, until now, it has mainly focused on power batteries in the field of new energy vehicles.

Therefore, it is unlikely that Ganfeng Lithium will actually go out of business and cooperate with car companies to build cars.

However, in the face of a slump in the lithium salt market, Ganfeng Lithium is shifting its focus to its secondary business: lithium batteries. Although it is unlikely that it will directly manufacture automobiles, the company is likely to cooperate directly with new energy vehicle companies to provide power batteries.

This strategic shift not only strengthened its position in the supply chain, but also increased the possibility of cooperating with end companies.

Currently, Ganfeng Lithium's 20GWh lithium battery project and Xinyu phase II 10GWh lithium battery project are under construction and expansion. Solid-state batteries are also gradually being developed from first-generation hybrid solid-liquid electrolyte battery products to second-generation solid-state batteries using ternary cathodes, solid state separators, and metal-containing lithium anode materials. Ganfeng Lithium's lithium battery business is expected to truly become Ganfeng Lithium's profit growth curve.

According to Wall Street News and Insights Research, Ritz focuses on the field of new energy commercial vehicles, and commercial vehicles are relatively less sensitive to battery brands. Through such investment cooperation, Ganfeng Lithium can not only promote its own power battery products, but also establish a stronger position in the lithium battery industry. For Ganfeng Lithium, which is new to the battery sector, this is certainly a wise strategic choice.

On the one hand, the potential of the domestic NEV industry is certainly not small. In the first half of this year, domestic NEV sales reached 104,000 units, an increase of 56% over the previous year. The sales growth rate has already exceeded 37% of NEV passenger vehicles during the same period, yet the NEV penetration rate is only 7.3%, and is still in a stage of rapid development.

On the other hand, specifically when it comes to Ritz Electric itself, in the first half of this year, the sales volume of Ritz New Energy reached 11,128 units, with a total market share of 12.11%, ranking runner-up in sales of new energy logistics vehicles, and its overall potential is not small. The charge capacity of Ritchi New Energy's new energy logistics vehicle products is between 40 degrees and 50 kilowatts of electricity. Based on an average of 45 kilowatts of electricity, the power battery demand for the first half of this year alone reached 0.5 GWh.

After holding 33.33% of the shares in Ritz Electric, if Ganfeng Lithium can win all of the power battery shares of Ritz New Energy, the demand from this company alone can make Ganfeng Lithium ranked 13th in the installed capacity of power batteries. It is only one step away from entering the top ten. This will greatly enhance Ganfeng Lithium's influence in the power battery field.

2. Ritz is expected to help Ganfeng Lithium achieve a breakthrough in its lithium battery business

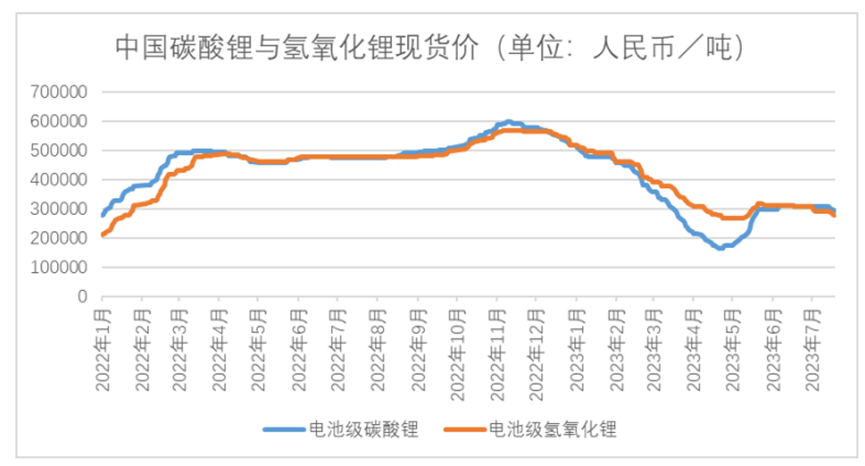

Since the end of last year, the entire lithium resource market has completely entered a downward price cycle. Even though prices have rebounded several times during this period, it still cannot change the sharp decline in the price of lithium salt from a high level of 600,000 yuan/ton to the current 180,000 yuan/ton market. This also basically determines that it is difficult for Ganfeng Lithium, which has the lithium salt business as its largest business, to perform well. In the second quarter of this year, Ganfeng Lithium's revenue and profit were under simultaneous pressure. Operating income was only 8.707 billion yuan, down 4% year on year; net profit returned to only 3.454 billion yuan, down 7.3% year on year; gross margin was only 6.64%, down 50.27 percentage points year on year.

This also basically determines that it is difficult for Ganfeng Lithium, which has the lithium salt business as its largest business, to perform well. In the second quarter of this year, Ganfeng Lithium's revenue and profit were under simultaneous pressure. Operating income was only 8.707 billion yuan, down 4% year on year; net profit returned to only 3.454 billion yuan, down 7.3% year on year; gross margin was only 6.64%, down 50.27 percentage points year on year.

At a time when the lithium salt business is difficult to change, Ganfeng Lithium, which itself focuses on integrating upstream and downstream lithium batteries, may focus more on its second largest business, the lithium battery business.

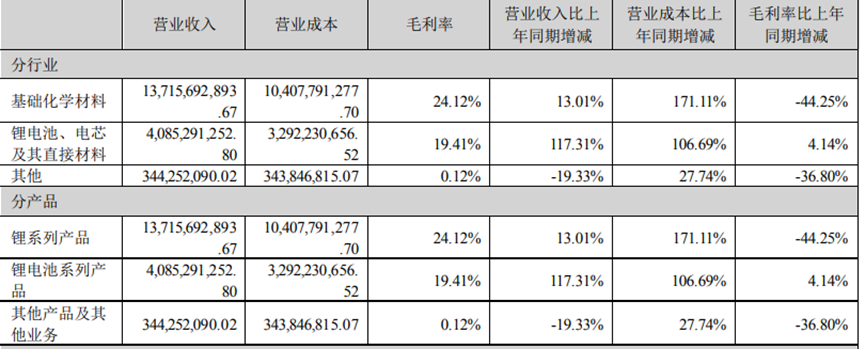

In the first half of this year, in the face of poor profit conditions in the lithium salt business, Ganfeng Lithium's lithium battery business did have a hidden trend of taking the lead. Not only did its revenue reach 4,085 billion yuan, an increase of 117.31% over the previous year, its share exceeded 20% for the first time and reached 22.5%, and gross margin also increased by 4.14 percentage points to 19.41%, making it the only business in Ganfeng Lithium to achieve positive growth in gross margin. However, even though Ganfeng Lithium Battery's ternary solid-liquid hybrid lithium-ion battery and solid-state battery have already been installed in the Celis SERE-5 and Dongfeng E70, it is far from enough to gain a foothold in the harsh lithium battery landscape.

However, even though Ganfeng Lithium Battery's ternary solid-liquid hybrid lithium-ion battery and solid-state battery have already been installed in the Celis SERE-5 and Dongfeng E70, it is far from enough to gain a foothold in the harsh lithium battery landscape.

From January to August of this year, the last power battery manufacturer ranked after ranking 10th in terms of power battery installed capacity. The overall power battery market share has fallen to 2.5%. Even some second-tier and third-tier power battery manufacturers, such as Guoxuan Hi-Tech, Sunwoda, Honeycomb Energy, and Funeng Technology, faced varying degrees of decline in market share. Naturally, this is also a challenge for Ganfeng Lithium, which has not yet entered the installed capacity list.

However, challenges nurture opportunities. If Ganfeng Lithium can open the door to power batteries for new energy commercial vehicles through investment from Ritz New Energy, it is expected to enter the top ten domestic power battery installations.

Through diversification of its own business, Ganfeng Lithium is expected to develop its own unique advantages with its huge advantages on the lithium resource side and its layout in the field of solid power batteries, so it can also truly occupy a place in the lithium battery industry.