In the first half of this year, the medical device industry is facing a rather complex external environment.

On the one hand, with the fading of the impact of the epidemic, social and economic activities are on the right track, although medical demand has recovered, but the overall recovery momentum is still not too prominent.

On the other hand, from the perspective of the capital market, both the primary market and the secondary market are relatively deserted. In the primary market, a total of 237 financing events occurred in the domestic medical device field in the first half of the year, with a financing amount of 12.3 billion yuan, with an overall trend of continuous decline, and the average transaction size continued to fall to 73 million yuan, a three-year low. In terms of the secondary market, the medical device sector has been falling all the way since 2021 and also performed poorly in the first half of this year. In fact, the same is true of the entire pharmaceutical sector, the overall valuation is already at a historically low level, and both allocation and market sentiment are at a freezing point.

Despite the pressure on the industry, the growth of companies is still big or small without pressing the pause button. Recently, the author noticed that Runmaid's first-half results are quite commendable, and its growth performance in the three years of the epidemic is quite gratifying. Now, as the entire pharmaceutical sector has the potential to repair in the bottom environment, what do you think of the company's opportunities?

1. Resilience and growth in financial statements

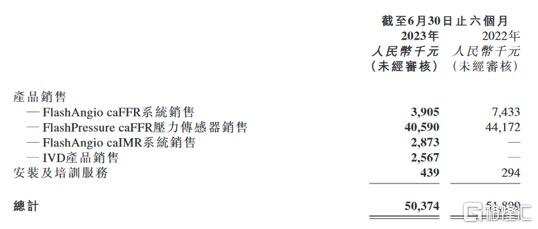

Intuitively, Runmaid's financial report data show that it achieved a turnover of 50.374 million yuan in the first half of the year, compared with previous years, the overall remained relatively stable, it can be seen that the company has strong development toughness in terms of marketing ability and management level.

(source: company financial report)

From the percentage of revenue, we can see that the vast majority of the company's revenue comes from caFFR systems, including a console (FlashAngio caFFR system) and its proprietary consumables (FlashPressure caFFR pressure sensors). At the same time, another innovative medical device caIMR system was successfully approved by the State Drug Administration in April 2023. Only one month after the product was put on the market, it quickly completed sales of 2.873 million yuan, demonstrating a good marketing ability. As the world's first approved non-invasive coronary microcirculation diagnostic product, the market potential of the caIMR system is evident.

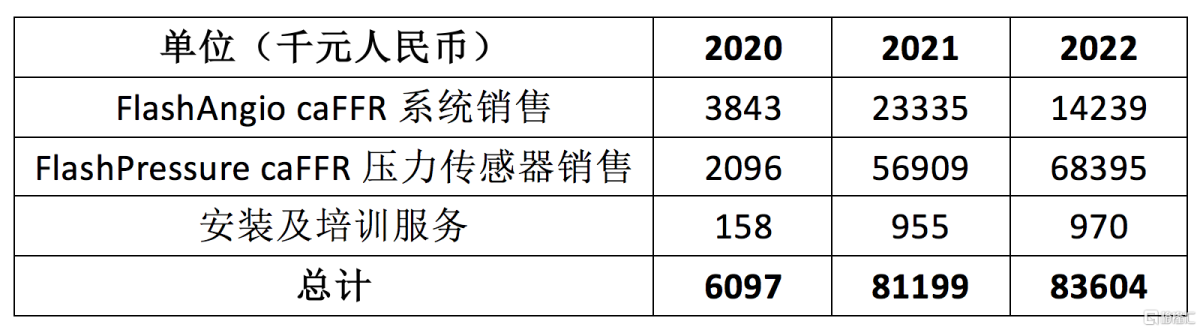

If you look at the company's past data, you can see that the core product caFFR system since its commercialization in October 2019 has brought a strong performance-driven, revenue achieved leapfrog development, leading other innovative FFR products, and established a market leading position in similar products, but also laid the groundwork for the future layout of caIMR system.

(source: company financial report)

In terms of gross margin, the company's overall gross profit margin reached 74.0% in the first half of the year, although it declined slightly, but remained at a high level as a whole. This shows that the company still maintains a high profitability in product sales, reflecting the pricing power brought about by high innovation and differentiation of products.

In terms of R & D expenditure, Runmead's R & D expenditure in the first half of the year was 22.617 million yuan, accounting for about 45% of revenue. According to annual data, the company's R & D expenditure accounted for about 53% of revenue in fiscal year 2022. This also means that Runmaid is not afraid of the temporary downturn in the industry situation, calmly and optimistically promote the company's strategic landing, for each product pipeline under development still maintain a strong investment state, and continue to promote independent innovation.

From the perspective of financial situation, as of the first half of the year, the company had bank deposits maturing for more than three months up to 205 million yuan, while cash and cash equivalents also reached 123 million yuan. It is worth noting that in the first half of the year, the company's cash and cash equivalents increased by nearly 35% over the same period last year, indicating that the company continues to consolidate its capital surface and maintain a good financial position. at the same time, it has sufficient cash reserves to support its operations, research and development and other needs.

Generally speaking, Runmaide's financial data show its strong resilience and growth advantages. with the introduction of core products to the market and the continuous release of growth potential, the company continues to increase its R & D and promote new product research and development, creating a cycle of product flywheels and bringing a strong drive to the development of the company as a whole.

two、Short-term development has performance certainty

From a short-term point of view, Runmaid has shown solid fundamentals and performance stability, and has deterministic growth expectations.

On the one hand, its core product caFFR system, as the company's main source of income, can see a significant growth trend from the sales data in the past few years, providing a solid foundation for the company's financial soundness. It is particularly noteworthy that even during the outbreak, sales of the caFFR system maintained a high level of growth, demonstrating its ability to expand the market and resist risks. At present, with the passing of the epidemic, the company continues to expand its market share, continuously consolidate its dominant position in the field of medical devices, and successfully stabilize the foundation, which will lay a solid foundation for future growth.

On the other hand, the caIMR system launched by the company in the first half of this year shows strong market potential, with the growth path of replicating caFFR system, and the possibility of explosive growth, which also increases the certainty of the company's subsequent performance release.

From the highlight of the product, in the world's first confirmatory clinical study of non-intrusive IMR products, the caIMR system is eye-catching and has a significant competitive advantage. Compared with the guide wire IMR,caIMR system, the accuracy is as high as 93.81%, and has ultra-high consistency, sensitivity and specificity, which can replace the traditional guide wire IMR, and provides a safer and non-invasive solution for clinical large-scale microcirculation evaluation. This advantage makes caIMR system attractive in the market and brings new growth opportunities for the company.

At the same time, caIMR system and caFFR system complement each other, which not only adds diversity to the company's product portfolio, but also its synergy advantages can better meet the needs of the market, and establish a strong brand reputation and competitive barriers. It is understood that the caFFR system and the caIMR system are used to measure the macroscopic circulation of arteries (accounting for 5% of all arteries) and microcirculation (95% of all arteries). Through combined use, they can provide a comprehensive assessment of coronary artery blood flow in patients with CAD. Therefore, dealers of caFFR system are generally willing to bring caIMR system into the procurement category. This synergy not only strengthens Runmaid's market position, but also creates a more competitive product portfolio for the company, which is expected to further promote it to explore greater market opportunities in the field of cardiovascular medicine.

The success of caIMR system also means that the company does not only rely on the maintenance of existing products, but also has the ability to stabilize its market position and build synergy and moat through the continuous introduction of new products.

At the marketing level, caFFR system has won wide recognition for its high accuracy and reliability, and now it has occupied a leading position and established an extensive commercial network at home and abroad. As of the first half of this year, Runmaid's distribution network has covered more than 1000 hospitals in 22 provinces, three autonomous regions and three municipalities directly under the Central Government, as well as 15 overseas countries and regions, according to the financial report. These advantages are expected to bring synergy to the follow-up new products.

At the industry level, with the significant decline in postharvest prices of coronary stents, PCI surgery is continuing to increase volume. Considering that the company's core products are necessary for accurate diagnosis and treatment of vascular diseases, it also shows that the company will continue to have market opportunities and maintain high growth in this trend.

3 、Long-term development has explosive growth.

From a longer-term perspective, the company continues to invest resources in R & D, and is expected to continue to occupy the innovation highland and build the internal driving force of growth.

According to the strategic layout of the platform-level surgical robot, it continues to increase the product matrix in research and development, and introduces the vascular interventional surgery robot FlashBot, which covers the whole process of diagnosis and treatment, as well as cutting-edge accurate treatment technologies for vascular diseases, such as shock wave balloon Flash IVL and renal artery ablation system Flash RDN. Among them, FlashBot is the first platform-level vascular interventional surgery robot in China that lays out the whole process of diagnosis and treatment. the research and development of this robot system will bring great innovation to the medical field. It can integrate caFFR system and caIMR system, so that doctors have more accurate and efficient diagnosis and treatment tools for cardiovascular interventional surgery.

As we all know, vascular interventional surgery is a highly specialized field with high requirements for precision and innovation, and Runmaid is expected to meet these needs through continuous research and development efforts. This also means that the company will continue to have a strong innovation engine in the future, can continue to launch competitive products, open up a broader imagination.

Not only that, Runmaide is also actively looking for investment M & A targets, and plans to expand the accurate diagnosis and treatment product line through M & A, so as to improve pipeline coverage and promote the company's all-round and rapid development.

As can be seen from the interim results, the company's IVD product sales also began to contribute to revenue in the first half of this year. The main source of income is Yuehe Kang, which Runmei acquired and subscribed for a 68.32% stake in March this year.

Relying on this strategic merger and acquisition, Runmaid Medical's accurate diagnostic product line will also be continuously expanded from "covering the whole process of surgery" to "on admission" and "bedside examination". In the future, the two sides will also cooperate to develop a series of cardiovascular IVD innovative accurate diagnostic products such as "clotting" and "and peptidins" to further improve the product layout. This layout action is not only in line with the strategic planning of Runmeide's cardiovascular precision diagnosis and treatment process, but also moves the strategic layout forward to actions such as immediate admission and bedside examination. it also means that in the future, the company's products will also play a key role in different stages of the medical process, improving patients' treatment experience and promoting faster and more accurate diagnosis and treatment.

With the continuous expansion of the cardiovascular medical device market, Runmaid is able to provide customized diagnosis and treatment for different patients through a diversified product portfolio, which will also help it to further consolidate its market position in the cardiovascular field. and rapid development in the field of accurate diagnosis, laying a solid foundation for future success.

Overall, both short-term and long-term, Runmaid has shown significant certainty and explosive. Under the situation of temporary downturn in the industry, the company does not rush to respond to the industry trend actively in accordance with the established strategic plan, constantly looking for new market opportunities, and continuously expanding the new growth curve, which also builds a business model for sustainable growth and shows the advantage of the moat.

4 、Conclusion

In the current pessimistic mood of the market, the bottom of the valuation of the pharmaceutical sector has appeared, and the entire industry is expected to repair clearly. Runmaid has demonstrated its attractiveness with its sound fundamentals and innovative ability.

In the long run, the medical industry is a typical long-term growth track, and the company will be full of opportunities in the future. With the continuous promotion of support policies and the gradual release of market demand, the overall performance of the expanded medical device field is about to pick up, benefiting large and small enterprises under the medical device plate. As the "first share of vascular interventional surgery robot" in the Hong Kong stock market, Runmaide is also a leader in the field of accurate coronary artery diagnosis and treatment in China, with outstanding growth potential and worth looking forward to in the future.