September 225,The major A-share indices fluctuated downward.Nearly 3,500 shares in the two markets fell, and full-day transactions amounted to 717.9 billion yuan.Northbound Capital made a sharp net sale of 8.039 billion yuan today.

On the market, Huawei held a major press conference. The Huawei industry chain further boosted in the afternoon, the diet medicine sector strengthened throughout the day, the CRO, innovative drug sector, and industrial mother machine sector strengthened in the pharmaceutical segment, while sectors such as heparin, F5G concepts, and motors registered the highest gains.Furthermore, diversified finance and brokerage stocks continued to be weak. The real estate sector declined, while sectors such as education, insurance, AI chips, and online travel registered the highest declines.

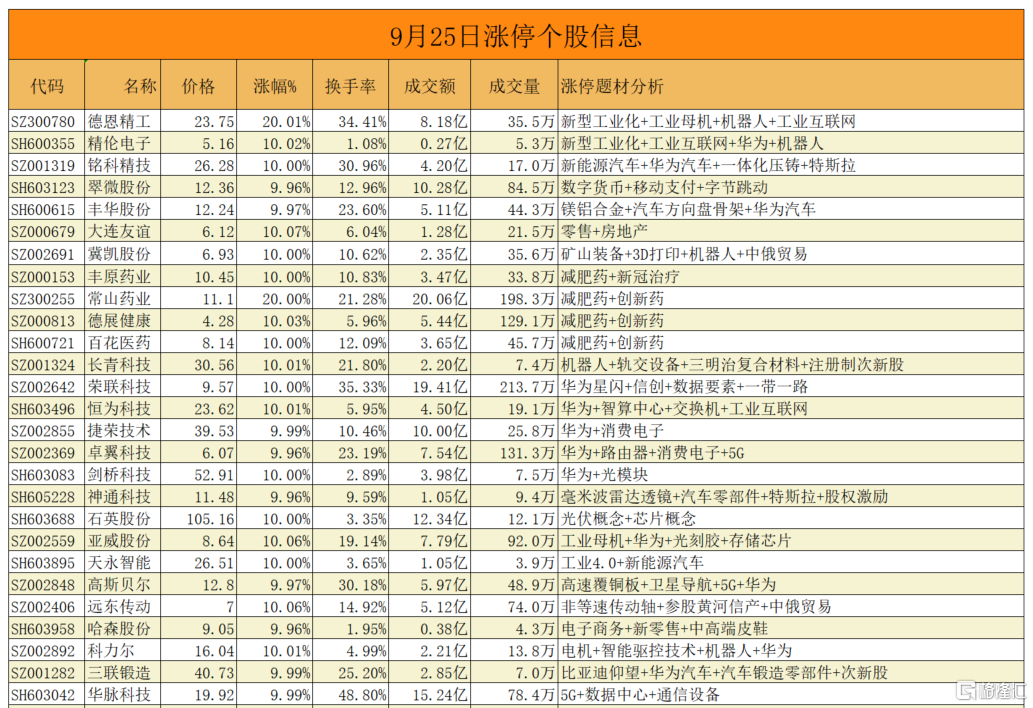

A total of 27 shares went up and down today. The total number of listed stocks was 11, and 14 shares failed to close. The closing rate was 66% (excluding ST shares, delisted stocks, and unopened new shares).

In terms of individual stocks, the Huawei industry chain has collectively exploded. In terms of consumer electronics, the Huawei consumer electronics sector, Jierong Technology, 2 boards in 3 days, Zhuoyi Technology, 2 boards in 3 days, 2 boards in 3 days, the Huawei automotive concept stock Fenghua Group, 3 boards in 3 days, Minke Jingji, the Huawei computing power sector, Huamai Technology, 2 boards, Cambridge Technology 2 boards, and Far East Transmission 4 days 2 boards, the new industrialized concept company Jinglin Electronics 4 boards, 4 days for the robot sector, Colliers 6 days, 3 boards for weight loss medicine 3 plates.

Let's take a look at today's Dragon Tiger rankings:

What are the top three net purchases in the Dragon Tiger list todayCambridge Technology,Yawei Co., Ltd.,Changshan Pharmaceutical, RMB 214 million, RMB 84.5006 million, and RMB 7.20916 million, respectively.

Borui Pharmaceutical, Ropskine, and Zhonglu Co., Ltd. were the top three in the Dragon Tiger list, with 127 million yuan, 120 million yuan, and 709.557 million yuan, respectively.

dragonsAmong the individual stocks involving exclusive institutional seats in the Dragon Tiger list, the top three in net purchases for the dayPhilingos,Quartz Co., Ltd.,Tonghua Jinma, RMB 64.5334 million, RMB 3609.1 million, and RMB 29.90829 million, respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three in net sales on the same day were Borui Pharmaceutical, Hengxing New Materials, and Nikjiu Optoelectronics, with 172 million yuan, 42,0383 million yuan, and 21.1742 million yuan, respectively.

The subject of some of the individual stocks on the list:

Cambridge Technology (F5G, WiFi, industrial Internet concept hot stocks)

1) One of the world's leading 100G high-speed optical module optical component technology companies; the company's switches and industrial Internet of Things basic hardware (JDM Division) focus on the domestic market, maintain stability with JDM business with important domestic customers, and strive to expand the ODM business of important domestic customers;

2) F5G includes high-speed optical module technologies such as 10G PON, Wi-Fi 6, and 200G/400G. Product companies in these three areas have already achieved mass production and supplied in batches to domestic and foreign customers;

3) The company's Wi-Fi6EAP products have continued to be shipped in batches to domestic and foreign customers;

Yawei Co., Ltd. (industrial mother machine concept)

Earlier, Tianfeng Securities published a research report on Yawei Co., Ltd. “Overseas Performance Improves, Intelligent Manufacturing Industry Is Growing High”. The research report gave Yawei a “buy” rating. According to the research report, net profit for 2023-2025 is estimated to be 1.36 million yuan (previous value 1.73), 1.67 (previous value 2.56), and 2.09 (previous value 401) million yuan, respectively. Corresponding PE will be 31, 25, and 20X respectively, maintaining the “buy” rating.

Changshan Pharmaceutical (diet medicine concept)

According to the news, on September 22, the FDA published the contents of Form 483 on its website. According to the report, Novo Nordisk's main plant in North America had quality control issues in May of last year — the on-site inspection failed to comply with the 483 forms. According to reports, the two public compliance issues that have arisen this time are all related to microbial contamination. Analysts pointed out that the US has extremely strict requirements for API factories. The information announced by the FDA may cause the cessation and rectification of smeglutide APIs and intermediates, and product prices are facing a sharp rise. It is recommended that attention be paid to the upstream related industrial chain of simeglutide, which is expected to explode.

Changshan Pharmaceutical issued a change announcement stating that the indications for the abenatide clinical trial currently being carried out by the company are treatment of type 2 diabetes and do not involve obesity indications. The company has not conducted clinical trials of abenatide for obesity or weight loss.

Institutions focus on trading individual stocks:

Philingcos:Today's increase was 11.04%, the full-day turnover rate was 45.53%, the turnover was 1,177 billion yuan, and the amplitude was 18.62%. According to Dragon Tiger ranking data, 4 institutions bought114 million yuan, sold by 2 institutions4918.98ten thousand yuan,Net purchases were RMB 64.5334 million, and total net sales of sales department seats were RMB 57.257 million.

Quartz shares:It went up and down today, with a turnover rate of 3.35% and a turnover of 1.23 billion yuan. According to data from the Dragon Tiger list, three institutions bought 140 million yuan, two institutions sold 104 million yuan, with a total net purchase of 3.6091 million yuan; Shanghai Stock Connect bought 902656 million yuan and sold 35.503 million yuan, with a total net purchase of 547.653 million yuan; the number of listed seats bought 257 million yuan throughout the day, with a total net purchase of 221 million yuan, with a total net purchase of 36.1916 million yuan.

Tonghua Jinma:It fell to a halt today, with a turnover rate of 18.96% and a turnover of 2.05 billion yuan. According to data from the Dragon Tiger List, Shenzhen Stock Exchange ranked in buying a seat, with a net purchase of 29.0829 million yuan; the sales department where the tourist capital “Sunan Bang” is located had a net purchase of 19822,800 yuan; the sale of a seat was Anxin Securities on Qujiangchi South Road, Xi'an, with a net sale of 51,8196 million yuan.

Borui Pharmaceuticals:Today's rise and stopIt closed at 26.28 yuan, with a turnover rate of 9.1%, a turnover of 384,500 lots, and a turnover of 962 million yuan.Judging from the daily trading data released by Dragon Tiger, the two institutions had a total net sale of 172 million yuan, and the total net sales of Northbound Capital was 6.6884 million yuan.

Hengxing New Materials:Listed on the main board of the Shanghai Stock Exchange today. The company's stock code is 603,276, the issue price is 25.73 yuan/share, and the issue price-earnings ratio is 44.35 times.Hengxing New Materials belongs to the fine chemical industry. It purchases bulk chemicals as raw materials, revolves around the organic ketones, organic esters and organic acids industry chain layout, and effectively comprehensively utilizes, develops, produces and sells specialty fine chemical products with high added value and large downstream market space.Judging from the daily trading data published by Dragon Tiger List, the total net sales of 1 institution92,3193 millionyuan.

Nikyu Optoelectronics:todayfall to a standstillIt closed at $12.62, with a turnover rate of 41.1%, a turnover of 7961 million lots, and a turnover of 1,016 million yuan.Judging from the daily trading data released by Dragon Tiger, the total net sales of institutions was 21,1742 million yuan.

In the Dragon Tiger list, there are 5 individual stocks involving exclusive Shanghai Stock Connect seats. Quartz Co., Ltd. has the largest net purchase amount for Shanghai Stock Connect special seats, with a net purchase amount of 54.7653 million yuan.

In the Dragon Tiger list, there are 5 individual stocks involving exclusive Shenzhen Stock Connect seats. Tonghua Jinma's Shenzhen Stock Connect special seat has the largest net purchase amount, with a net purchase amount of 255.334 million yuan.

Trends in volatile capital operations:

Tohoku Takenao: Net PurchasesJindi Co., Ltd.3033.95million

Stock trading to support the family:Net purchasesYawei Co., Ltd.3143.34million

Shangtang Road:Net purchasesZhuoyi TechnologyRMB 47.9949 million

Huaxin Ningbodividing:Net purchasesChangshan Pharmaceutical2707.23million

Fang Xinxia:Net purchasesHengwei TechnologyRMB 12.282,400

Southern Jiangsu gang:Net purchasesHengwei Technology 1539.32million

Zhongguancun:NetsellRonglian Technology17.9498 million yuan