FollowingOriental Fashion, I Lok HomeLater, there are shareholders of listed companies.Illegal reduction!

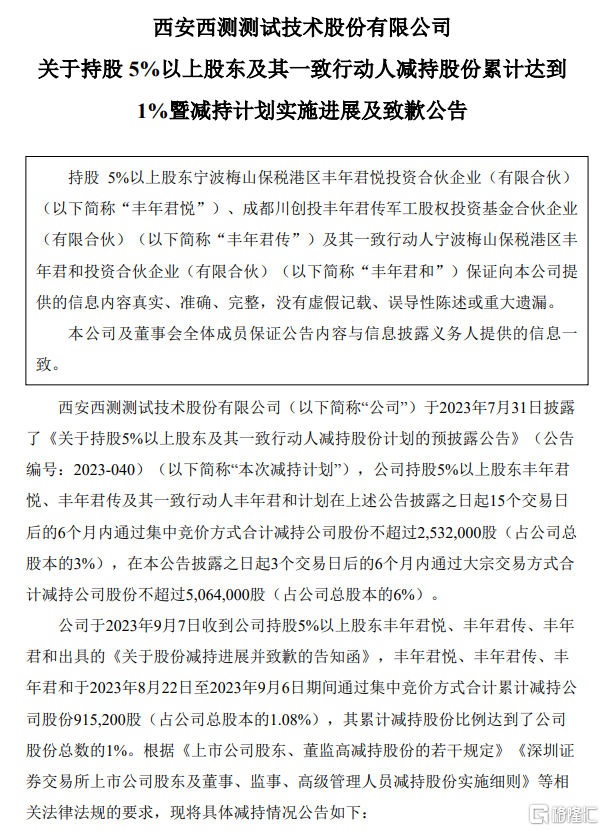

On the evening of September 18, the Western Test disclosed an apology announcement for the illegal reduction of shareholders' holdings of more than 5%.

Western test announced that the shareholders holding more than 5% of the company's Grand Hyatt misoperation, resulting in a total reduction of 915200 shares of the company, accounting for 1.08% of the company's total share capital, this reduction violated the previous commitment.

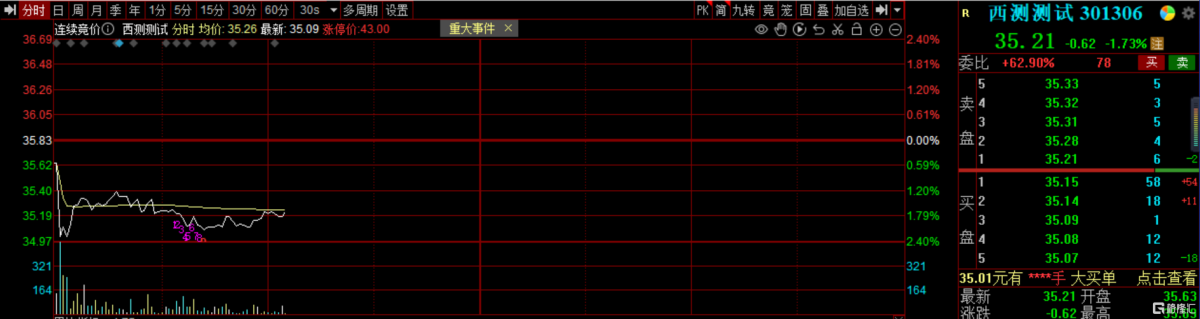

In terms of stock price performance, Western Test fell slightly today, falling 1.73% as of press time, with a market capitalization of 2.962 billion yuan.

Shareholders apologize: misoperation leads to excessive reduction of holdings

According to the announcement, on September 7, 2023, the company received a "notification letter on the progress of share reduction and apology" from shareholders with more than 5% stake in Ningbo Meishan bonded Port area Grand Hyatt Investment Partnership. Harvest year Junyue, bumper year Junhe reduced a total of 915200 shares (accounting for 1.08% of the company's total share capital) through centralized bidding from August 22, 2023 to September 6, 2023. The cumulative reduction of shares has reached 1% of the total number of shares of the company, and this reduction violates previous commitments.

The western test indicates thatThe above situation is mainly due to errors in the entry of harvest year Grand Hyatt, harvest year biography and harvest year Junhe in the securities operating system, resulting in a violation of commitment to reduce holdings, not subjective and intentional behavior. Junyue, Junzhuan and Junhe in bumper years have been deeply aware of the mistake of over-selling the company's shares.And express my sincere apologies for the misoperation that led to the over-reduction of holdings.Harvest year Grand Hyatt, harvest year biography and harvest year Junhe have made relevant commitments to strengthen internal staff's study and strict compliance with relevant laws and regulations and normative documents, strictly manage stock accounts and operate prudently to prevent similar things from happening again.

After this reduction, Grand Hyatt, Junchuan and Junhe held 4.2865 million, 3.4614 million and 2.4769 million shares of the company respectively, accounting for 5.08%, 4.11% and 2.93% of the total share capital of the company.

However, it is worth noting that the announcement does not seem to mention the repurchase of shares that will be illegally reduced, and the notification letter received on September 7 was not disclosed until the 18th.

The first loss in the first half of the year

The data show that the western testMainly engaged in military equipment and civil aircraft product inspection and testing of third-party inspection service institutions, to provide customers with environmental and reliability testing, electronic components testing and screening, electromagnetic compatibility testing and other inspection services, at the same time to carry out testing equipment research and development and sales as well as electrical equipment business.

The company's main services are environmental and reliability testing, electronic components testing and screening, electromagnetic compatibility testing, testing equipment research and development, production and sales business.

On July 26, 2022, Western Test was listed on the growth Enterprise Market of Shenzhen Stock Exchange. The total amount of funds raised by the initial public offering of shares in the Western Test Test was 912 million yuan, and the net amount raised was 809 million yuan.

In terms of performance, Western Test ushered in its first loss in the first half of this year.The operating income in the first half of 2023 was about 115 million yuan, a decrease of 2.92% compared with the same period last year; net profit attributable to shareholders of listed companiesChange from profit to lossThe loss is about 6.25 million yuan, and the basic earnings per share is 0.07 yuan.