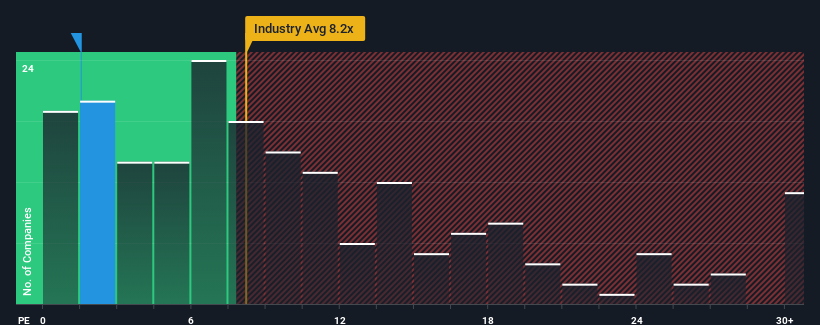

You may think that with a price-to-sales (or "P/S") ratio of 1.5x GCL System Integration Technology Co., Ltd. (SZSE:002506) is definitely a stock worth checking out, seeing as almost half of all the Semiconductor companies in China have P/S ratios greater than 8.2x and even P/S above 15x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for GCL System Integration Technology

How Has GCL System Integration Technology Performed Recently?

GCL System Integration Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think GCL System Integration Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For GCL System Integration Technology?

In order to justify its P/S ratio, GCL System Integration Technology would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 104% gain to the company's top line. Pleasingly, revenue has also lifted 64% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 153% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 39% growth forecast for the broader industry.

With this in consideration, we find it intriguing that GCL System Integration Technology's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From GCL System Integration Technology's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at GCL System Integration Technology's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for GCL System Integration Technology with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.