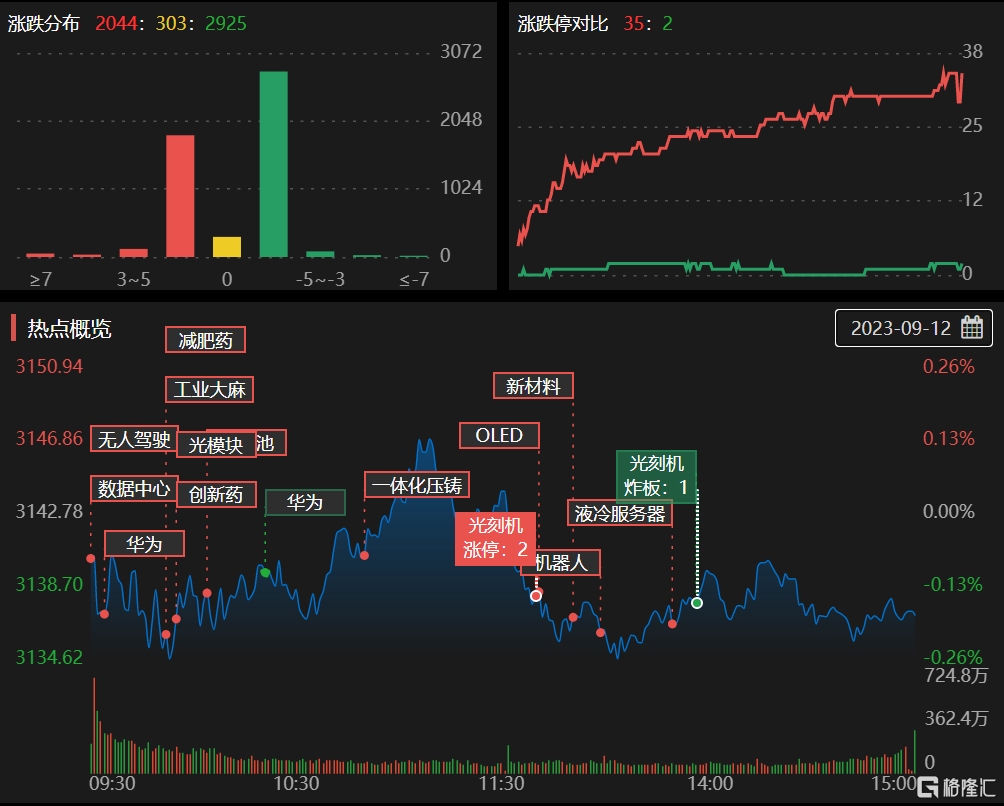

On September 12, more than 2,900 individual stocks in the two markets fell. The Shanghai and Shenzhen markets had a full-day turnover of 708.3 billion yuan, and the net sales of northbound capital was 1.98 billion yuan.

On the market, pharmaceutical stocks continued to be active, with slimming drugs leading the way, while industrial cannabis, the Huawei industry chain, and lithography machine concept stocks had the highest gains. Gaming and media stocks were collectively adjusted, and sectors such as insurance stocks, precious metals, and securities registered the highest declines.

In terms of individual stocks, the Huawei industry chain Huaying Technology is on the 7th board in 9 days, Gaohong Co., Ltd. is on the 3rd board of the Science and Technology Innovation Source Venture Board, the chip industry chain is on the 3rd board of the Joint Precision Board and the Ritexin 5 day 3 board, the diet medicine concept stock Changshan Pharmaceutical is on the 2nd board, the CPO segment Mingpu Optoelectronics is on the 2nd board, the cannabis concept stock Tonghua Jinma is on the 2nd board, and the equity transfer of Guangdong Feed is on the 2nd board.

Let's take a look at today's Dragon Tiger rankings:

Today, the top three in Dragon Tiger's net purchases are Huaying Technology, Sichuan Changhong, and Xingmin Zhitong, with 118 million yuan, 95.3222 million yuan, and 71.3444 million yuan respectively.

The top three in net sales of Dragon Tiger were Xinhua Insurance, Ronglian Technology, and Demax, with 117 million yuan, 101 million yuan, and 898.5559 million yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three net purchases on the same day were Huaying Technology, Philingcos, and Mingpu Optoelectronics, with net purchases of 72,219,500 yuan, 464.314 million yuan, and 29.134 million yuan, respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three net sales on the same day were Xinhua Insurance, Fullerton, and Demax, with 305 million yuan, 53.8679 million yuan, and 52.953 million yuan respectively.

The subject of some of the individual stocks on the list:

Huaying Technology (Huawei+panel+OLED+glass)

1. Huaying Technology announced on the interactive platform on September 4 that the company has joined the Huawei supplier system.

2. The company's main business is R&D, production and sales of display panels and display modules. The main products of the module business include large module products such as TVs and computer monitors, and small to medium module products such as smart phones, tablets, laptops, POS machines, and industrial control screens.

3. On November 26, 2020, the interactive platform replied: The company's panel products have been recognized by customers such as Huawei, Transmission Holdings, Samsung, and Lenovo. It mainly provides a full range of 5.5-inch to 14-inch mobile phone and tablet displays.

4. The subsidiary Corix is currently mainly in the glass cover business. Its customers are mainly Meizu and Asus, as well as CYBERNET's antibacterial medical industrial control products.

5. The subsidiary Huajiacai has a sixth-generation panel line with cutting-edge technology in the TFT-LCD field - metal oxide technology. It mainly produces small to medium sized display panels, and its products are mainly used in smart phones, tablets and other products.

Sichuan Changhong (Huawei Kunpeng Server+Color TV Leader+Smart TV+Robot)

1. The company is one of the traditional color TV leaders and is located in the first array in the color TV industry. The company has formed a diversified and comprehensive multinational enterprise group integrating R&D, production and sales in industries such as digital television, air conditioning, refrigerators, IT, communications, digital, networks, power supplies, commercial system electronics, and small household appliances.

2. Interaction on September 11: Changhong Jiahua, a subsidiary of the company, and Huawei have always maintained a good cooperative relationship, actively expanded the commercial market, developed a deep market, and collaborated to cultivate the industry market. Reply on the same day: The company's automobile-related business includes supplying air conditioning compressors for new energy vehicles, automobile die-casting parts, etc. to its subsidiaries.

3. The Tiangong AT800 of the subsidiary Hongxin Software is an AI training server based on an Intel processor and a Huawei Shengteng 910 chip. It has the characteristics of the strongest computing power density and high-speed network bandwidth.

4. The company's product innovation capabilities have been effectively enhanced. It launched the world's first smart TV equipped with an ARM flagship chip, launched the world's first artificial smart TV with voiceprint recognition function, released the world's first M Xiansheng series refrigerator equipped with water molecule activation fresh-keeping technology, and the Xiaoman waist cabinet air conditioner equipped with intelligent voice control and first-class energy efficiency technology became popular immediately after launch, successfully developed and launched a first-generation smart kitchen robot, etc.

Xingmin Zhitong (driverless driver+steel wheels+data elements+Huawei)

1. As the first listed steel wheel enterprise in China, the company focuses on R&D, production and sales of automobile steel wheels.

2. The subsidiary Yingtaist is a leading supplier of T-BOX in China, a participant in drafting standards for electric vehicle process information monitoring, and is a leader in the NEV T-BOX market, with a market share of nearly 40%; the smart rearview mirror products of the subsidiary 95 Smart Driving already have video surveillance and face recognition functions, which can be refined and deepened according to application scenarios; signed a strategic cooperation agreement with Spreadcom Communications to establish a vehicle networking business ecosystem.

3. According to the 2021 Annual Report: As one of the leading enterprises in automotive wireless and integrated products in China, the company is positioned as a high-accuracy data collection product and professional data collection, analysis and management software, and also provides complete solutions for large-scale vehicle information system construction and integrated testing.

4. The intelligent vehicle-mounted 5GTBOX terminal equipped with the Huawei 5G module developed by the subsidiary Wuhan Yingtest has recently been mass-produced on new BAIC New Energy models.

Science Innovation Source (Liquid Cooled Server+Huawei+Vehicle Thermal Management)

1. The company's main business is polymer materials business and thermal management system business.

2. Interaction on September 11: The company is currently the main supplier of waterproof sealing materials for Huawei communication base station antenna feeder systems. The main supply products include high-performance special rubber adhesive tape and its supporting waterproof sealing products such as PVC insulating tape and cold shrink sleeves.

3. The company disclosed in its 2022 annual report that the special cooling module for the data center server currently developed by the company can meet the cooling efficiency of high-power semiconductor chips in high-computing power scenarios. The project has completed sample trial production and has passed verification.

4. The company first entered the field of heat dissipating liquid cold plate products for 5G base stations in 2019. Currently, the company has flow field and flow channel design, fluid dynamic simulation and experimental capabilities. The professional fields cover the development of various heat transfer components such as expansion liquid cold plates for communication 5G base stations, wire tube condensers/blowout liquid cold plates for home appliances, and expansion liquid cold plates for new energy vehicles and energy storage systems, and their processing technology, process technology and product applications.

Gao Hong Shares (Starflash+Driverless Driver+Data Center+Proposed Transfer of Shares)

1. On September 11, the company announced that it intends to transfer shares such as Datang Integrated Communications and CITIC Technology, and that it also intends to acquire a controlling interest in Guotang Automobile.

2. The company's main business is enterprise informatization business, information service business, and terminal sales business. The company's main products include Internet marketing, artificial intelligence products, IDC, mobile information, mobile media, vehicle networking, trusted cloud computing, intelligent manufacturing, industry/enterprise informatization services, IT products, etc.

3. Gaohong Co., Ltd. has carried out research and standardization in Starflash technology, but Starflash technology is mainly aimed at application scenarios such as active noise reduction and surround view in vehicles, and does not fall into the category of C-V2X technology.

4. The C-V2X series products and solutions provided by the company are important enabling technologies for high-level driverless driving.

5. IDC's business, a joint venture with Equinix, the world's leading data center operator, has entered the actual operation stage. Currently, it operates 3 data centers and is participating in the construction of 1 data center; it has successfully obtained CDN and cloud licenses, is expanding the CDN business and cloud business, and is trying to enter the MSP business.

Institutions focus on trading individual stocks:

Huaying Technology:It went up and down today. It recorded 7 boards in 9 days, with a turnover of 1,696 billion yuan and a turnover rate of 20.46%. According to Dragon Tiger Ranking data, the Shenzhen Stock Connect special seat bought 206.583 million yuan and sold 22.743 million yuan, and the 2 institutions made a net purchase of 72,2195 million yuan.

Philingcos:Today, it rose 8.55%, with a turnover of 1,174 million yuan and a turnover rate of 50.92%. According to data from the Dragon Tiger List, 2 institutions bought 7.034 million yuan, and 1 agency sold 236.031 million yuan.

Mingpu Optomagnetism:It went up and down today, with a turnover of 821 million yuan and a turnover rate of 20.67%. According to Dragon Tiger Ranking data, the 2 institutions made a net purchase of 29.13.4 million yuan.

Xingmin Zhitong:It went up and down today, with a turnover of 937 million yuan and a turnover rate of 21.51%. According to data from the Dragon Tiger List, 1 institution made a net purchase of 2,0205,500 yuan.

Xinhua Insurance:Today, it fell 7.75%, with a turnover of 1,550 million yuan and a turnover rate of 1.91%. According to Dragon Tiger List data, the Shanghai Stock Connect special seat bought 218 million yuan and sold 112 million yuan, 1 institution bought 29.845 million yuan in net purchases, and 4 institutions sold 335 million yuan.

Fullerton:Today, it rose 17.76%, with a turnover of 1,565 billion yuan and a turnover rate of 75.77%. According to Dragon Tiger Ranking data, Shenzhen Stock Connect bought 34.4037 million yuan and sold 10.8817 million yuan, while the 2 institutions sold 53.8679 million yuan in net sales.

Demex:Today, it rose 13.67%, with a turnover of 1,465 billion yuan and a turnover rate of 55.08%. According to Dragon Tiger Ranking data, 2 institutions had net purchases of 6.317,800 yuan, and 3 institutions had net sales of 59,2681 million yuan.

Annie's shares:Today, it rose 0.46%, with a turnover of 1,267 million yuan and a turnover rate of 26.60%. According to Dragon Tiger List data, 1 agency bought 17.921,100 yuan, and 2 institutions sold 56.08893 million yuan.

Ronglian Technology:Today's increase was 0.23%, with a turnover of 2.176 billion yuan and a turnover rate of 39.79%. According to Dragon Tiger ranking data, the net sales of special seats on Shenzhen Stock Connect was 374.241 million yuan.

Optoelectronics:It fell to a halt today, with a turnover of 2,023 billion yuan and a turnover rate of 19.58%. According to Dragon Tiger ranking data, the Shenzhen Stock Connect special seat was purchased for 61.106 million yuan and sold for 96.5813 million yuan.

In the Dragon Tiger list, there are 3 individual stocks involving exclusive seats on the Shanghai Stock Connect.Xinhua InsuranceThe Shanghai Stock Connect had the largest net purchase amount for a special seat, with a net purchase of 106 million yuan.

In the Dragon Tiger list, there are 6 individual stocks involving exclusive seats on Shenzhen Stock Connect.Ronglian TechnologyThe Shenzhen Stock Connect special seat had the largest net sales volume, with a net sale of 374.241 million yuan.

Trends in volatile capital operations:

Zhongguancun, Beijing: Net purchases of Huaying Technology RMB 34.067 million, Annie shares RMB 16.1751 million, Optoelectronics RMB 17.97769 million, Mingpu Optoelectronics RMB 33.579,900, net sales of Guangxin Materials RMB 29.8354 million

Guangdong gang: net purchase of Changshan Pharmaceutical was 277.14,200 yuan, net sale of Xingmin Zhitong was 10.1391 million yuan

Shangtang Road: Net sales of Ronglian Technology RMB 45.165,800, net purchase of Science Innovation Resources RMB 31.0828 million

Chen Xiaoqun: Net sales of Optoelectronics was 18.4888 million yuan, Xinlun New Materials was 2,2922 million yuan

Pink Kudzu: Net purchase of Changshan Pharmaceutical was 22.7683 million yuan

New player: net purchase of Sichuan Changhong 88.3019 million yuan

Southern Jiangsu Bang: net purchase of Sichuan Changhong 30,027 million yuan

Chengdu gang: Sichuan Changhong net sales of 44,815,900 yuan

Little Crocodile: Net purchase of Fillingos RMB 21.933,800