[hot spot focus]

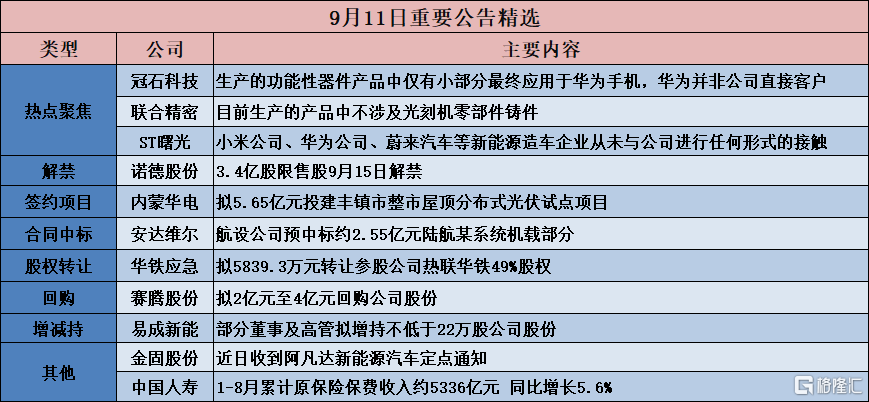

Joint Precision (001268.SZ): castings of lithography machine parts are not involved in the products currently produced.

United Precision (001268.SZ) announced abnormal fluctuations in stock trading, recent lithography machine-related concepts speculation is relatively hot, the company's current products do not involve lithography machine parts castings, the company reminds the majority of investors to guard against concept speculation and pay attention to investment risks.

4Lianban Guanshi Technology (605588.SH): only a small part of the functional devices are finally used in Huawei mobile phones. Huawei is not a direct customer of the company.

Guanshi Technology (605588.SH) announced that the company's shares rose by the daily limit for four consecutive trading days, and the closing price rose 46.44%. After excluding the overall factors of the market and the plate, the stock price fluctuated greatly. As far as the hot concept of recent market attention is concerned, the company's direct customers are mainly display panel manufacturers such as Beijing Oriental, Foxconn, Huaxing Optoelectronics, Rainbow Optoelectronics and so on. Only a small portion of the company's functional device products are eventually used in Huawei mobile phones. Huawei is not a direct customer of the company. This part of the business income accounts for about 1% of the company's operating income, which accounts for about 1% of the company's operating income, which has no significant impact on the company's performance.

ST dawning (600303.SH): new energy car manufacturers such as XIAOMI, Huawei and NIO Inc. have never had any form of contact with the company.

ST dawning (600303.SH) issued a stock trading risk alert announcement, XIAOMI, Huawei, NIO Inc. and other new energy car manufacturers have never had any form of contact with the company, have not signed any agreement with the company, and have not communicated with the company any equity transfer related matters; Ganfeng Lithium company has only business cooperation with the company. The relevant market rumors are completely false information.

[contract project]

Inner Mongolia Huadian (600863.SH): plan to invest 565 million yuan to build the roof distributed photovoltaic pilot project in Fengzhen city.

Inner Mongolia Huadian (600863.SH) announced that the company plans to invest in the construction of Fengzhen city-wide roof distributed photovoltaic pilot project. Fengzhen city-wide roof distributed photovoltaic pilot project is located in Fengzhen City, Inner Mongolia Autonomous region, with a total installed capacity of 108.903MW. This project plans to use some industrial and commercial, party and government organs and other public buildings in Fengzhen city, as well as the building roof of Inner Mongolia Fengdian Energy Generation Co., Ltd., to install photovoltaic modules. The power generation adopts the mode of "self-generation and self-use, surplus electricity surfing to the Internet". The total investment of the project is expected to be 565.3284 million yuan, and the project capital accounts for 30% of the total investment, and the rest of the funds will be solved through financing. According to the preliminary calculation, the financial internal rate of return of the project capital is 7.49%, and the investment payback period is 13.56 years, which has good profitability. The company will allocate capital to Fengchuan New Energy in accordance with the 89% shareholding ratio and the progress of the project.

Longgao Co., Ltd. (605086.SH): plan to carry out the project of mechanical and electric workshop in concentrator

Longgao (605086.SH) announced that in order to further improve the existing machine production process and enhance the automation level of the company's concentrator, the company plans to implement the project of the concentrator's mechanical and electrical workshop to upgrade and transform the concentrator's wood electric mill. Investment amount: the total investment in construction with its own funds is estimated to be 11.7057 million yuan.

[contract won the bid]

Yongfu Co., Ltd (300712.SZ): won the bid for 778 million yuan household photovoltaic power station project

Yongfu Co., Ltd. (300712.SZ) announced that on the same day, the company received the EPC general contract project for the first phase of household distributed photovoltaic power generation in Quanzhou area of Huaneng Fujian Luoyuan Electric Power Technology Company and the "bid winning notice" of the EPC general contracting project for the first phase of household distributed photovoltaic power generation in Zhangzhou area of Huaneng Fujian Power Technology Co., Ltd., the company is the winning bidder of the above two projects, and the total winning amount is 778 million yuan. It accounts for 912.23% of the company's business income of 85.318 million yuan for household photovoltaic power station products and services in 2022.

Andaville (300719.SZ): the aviation company has won the bid of about 255 million yuan for the airborne part of a certain system of land and aviation.

300719.SZ announced that on September 11, 2023, the military procurement network released the "announcement of the results of winning the bid (transaction) for the airborne part of a certain system of land and aviation". Beijing Andaville Aviation equipment Co., Ltd., a wholly owned subsidiary of Beijing Andaville Technology Co., Ltd. (referred to as "Aviation equipment Co., Ltd."), is the supplier of the project pre-winning bid (transaction), with a winning amount of about 255 million yuan.

National Monitoring Technology (600562.SH): the subsidiary has won the bid of 380 million yuan to bid for the procurement project.

National monitor technology (600562.SH) announced that the company received notice from Nanjing Enruit Industrial Co., Ltd. (hereinafter referred to as Enruitte), a wholly-owned subsidiary, that Enruitte's bid for "Nanjing-Maanshan (suburb) Railway (Nanjing Section) Project and (Mashan Section) Industrial signal system Purchasing Project" issued a public announcement of the bid evaluation results. Enruitte was the first candidate for the project. The results were publicized on the China International bidding Network (), and the publicity period is from September 11, 2023 to September 14, 2023.The tenderer of the Nanjing-Maanshan (suburb) railway (Nanjing section) project and (Maanshan section) project signal system procurement project is Nanjing Metro Construction Co., Ltd., with a total length of 54.23 km. Full-function operation is planned by the end of December 2025. Enritte's bid for the project is RMB 380 million. At present, the publicity period is not over, Enrette has not yet received the notice of winning the bid, and the project is still uncertain about winning the bid and signing the contract.

Taiji Industry (600667.SH): subsidiary National Day Science and Technology signed a total of 1.748 billion yuan of construction project general contract

Taiji Industry (600667.SH) announced that recently, the company received a notice from its subsidiary National Day Science and Technology that National Day Science and Technology and Shenghong Kinetics completed the formal signing of the "Construction Project General contract" for the first, second and third bidding sections of the project, with a total contract amount of about 1.748 billion yuan (including tax) for the three bidding sections.

[Equity acquisition]

Gao Hong shares (000851.SZ): it is proposed to transfer no less than 35.4 million shares of Datang Fusion at a price of not less than 5.75 yuan per share.

Gao Hong shares (000851.SZ) announced that the company intends to transfer the shares of Datang Fusion Communications Co., Ltd. (hereinafter referred to as "Datang Fusion" or "the subject matter of the transaction") at a price of not less than 5.75 yuan per share, and that the number of the transferred shares is not less than 35.4 million shares, and authorizes the management and the counterparty to conduct commercial negotiations at a price of not less than 5.75 yuan per share and sign relevant agreements. This transaction is to be carried out by agreement first, the transfer price is not less than 5.75 yuan per share, the counterparty is not clear, the transaction contract has not yet been signed, and there is no performance arrangement. After the completion of this equity transfer, the scope of the company's consolidated statements will be changed, and Datang fusion will no longer be included in the scope of the company's consolidated statements.

Sany heavy Energy (688349.SH): 100% equity of 11 subsidiaries involved in the operation and management of distributed photovoltaic power stations will be transferred to Sany heavy Industry for 78.8874 million yuan.

Sany heavy Energy (688349.SH) announced that, based on the needs of strategic development, in order to better focus on the main business, reduce related party transactions, in the retention of self-use photovoltaic power plants The company plans to include 11 wholly-owned subsidiaries involved in the operation and management of distributed photovoltaic power stations, Sany Solar Energy Co., Ltd., Changde Taisheng Electric Power Development Co., Ltd., Loudi Taisheng New Energy Co., Ltd., Loudi Zhongsheng New Energy Co., Ltd., Shaoyang Zhongsheng New Energy Co., Ltd., Changsha Zhongsheng New Energy Co., Ltd., Yiyang Zhongsheng New Energy Co., Ltd., Changshu Sansheng New Energy Co., Ltd. 100% equity of Anren Dayuan New Energy Development Co., Ltd., Huzhou Taisheng New Energy Co., Ltd., and Shanghai Kaifengxin Energy Technology Co., Ltd. were transferred to Sany heavy Industry. The total transfer price is RMB 78.887401 million. After the completion of this transaction, the company will no longer hold shares in the above 11 wholly-owned subsidiaries and will no longer include them in the scope of the company's consolidated statements.

Shandong Gold Mining (600547.SH): plans to transfer 100% equity of Shanjin Futures held by Shanjin Capital to the company free of charge

Shandong Gold Mining (600547.SH) announced that the 100% stake in Shanjin Futures Co., Ltd. held by Shanjin Capital Management Co., Ltd. would be transferred to the company free of charge.

China Railway Emergency (603300.SH): it is proposed to transfer 49% of the shares of the participating company, Hot Union China Railway, for 58.393 million yuan.

China Railway Emergency (603300.SH) announced that it plans to transfer 49% of its shareholding company Hangzhou Reilian Huatie Construction Service Co., Ltd. (referred to as "Hot Lian Huatie") to Hangzhou Reilian Group Co., Ltd., at a transfer price of 58.393 million yuan. This transaction does not involve changes in the scope of the company's consolidated statements.

[lifting the ban]

Wansheng Intelligence (300882.SZ): 147 million restricted shares lifted on September 13th

Wansheng Intelligence (300882.SZ) announced that the restricted shares in the company's listing are some of the shares issued before the initial public offering, and the company has a total of 6 shareholders to lift the restrictions. The number of shares released this time is 147 million shares, accounting for 71.8204% of the company's total share capital so far. The listing and circulation date of the shares to be lifted will be Wednesday, September 13, 2023.

600110.SH shares: 340 million restricted shares lifted on September 15th

Nord shares (600110.SH) announced that the company's shares in circulation a total of 340 million shares. The listing and circulation date of the stock is September 15, 2023.

Huaxiang shares (603112.SH): 271 million restricted shares listed and circulated on September 18th

Huaxiang shares (603112.SH) announced that the company lifted the restrictions and listed the number of restricted shares in circulation is 271 million shares, accounting for 62.02% of the company's total share capital, will be listed on September 18, 2023.

[buyback]

Kodak Manufacturing (600499.SH): to buy back 20 million-30 million shares of the company

600499.SH announced that the number of shares to be repurchased is not less than 20 million shares and not more than 30 million shares, and the repurchase price does not exceed RMB 15 per share for the implementation of employee stock ownership plans and / or equity incentives.

Jiangfeng Electronics (300666.SZ): plans to buy back 50 million yuan-80 million yuan of company shares

Jiangfeng Electronics (300666.SZ) announced the announcement on the share repurchase plan of the company, the total amount of funds used for the repurchase this time is not less than 50 million yuan (inclusive) and not more than 80 million yuan (inclusive), and the specific amount of the repurchased shares shall be subject to the actual repurchase amount at the completion of the repurchase implementation. The source of funds is the company's own funds. The repurchase price does not exceed RMB 85 per share.

688381.SH: plan to spend 100 million to 200 million yuan to buy back the company's shares

688381.SH announced that the company intends to use the repurchased shares for employee stock ownership plans or equity incentives at an appropriate time in the future, the total capital of the shares to be repurchased is not less than 100 million yuan (including 100 million yuan, the same below), no more than 200 million yuan (including 200 million yuan, the same below); the price of the repurchased shares is not more than 41.68 yuan per share (inclusive).

Sateng shares (603283.SH): it is proposed to buy back the company's shares from 200 million to 400 million yuan.

603283.SH announced that the company intends to buy back the company's shares with no less than 200 million yuan and no more than 400 million yuan, and the repurchase price does not exceed 60.58 yuan per share. The repurchased shares are intended to be used for equity incentives or employee stock ownership plans.

[increase or decrease holdings]

Shanghai Pharmaceutical (601607.SH): controlling shareholders increase their holdings of 100000 H shares

Shanghai Pharmaceutical (601607.SH) announced that on September 11, 2023, the company received notice from the controlling shareholder SIIC Group that it had increased its holdings in H shares by 100000 shares, accounting for about 0.003% of the company's total share capital, through its wholly-owned subsidiary SIIC International Investment Co., Ltd.After this increase, Shanghai Real Group holds 1344456237 shares of the company (including 1125817837 A shares and 218638400 H shares), accounting for 36.304% of the company's total share capital.

Yi Chengxineng (300080.SZ): some directors and senior executives plan to increase their holdings of no less than 220000 shares of the company

Mr. Wang Anle, Chairman, Mr. Wang Shaofeng, Vice President, Mr. Yang Guoxin, Chief engineer Mr. Zhou Yunhui, Mr. Yang Fan, Chief Financial Officer, Mr. Song Hongwei, Deputy Secretary of the Party Committee, Secretary of the discipline Inspection Commission and Chairman of the Trade Union, Mr. Lan Xiaolong and Mr. Yang Guangjie, Vice President, Mr. Chang Xinghua, Vice President and Secretary of the Board of Directors, Mr. Cui Qiang, Vice President, Mr. Lan Xiaolong and Mr. Yang Guangjie, Vice President Mr. Lan Xiaolong and Mr. Yang Guangjie, Mr. A total of 10 people plan to increase their holdings of the company's shares through the Shenzhen Stock Exchange system with their own funds within six months from September 12, 2023, with a total increase of not less than 220000 shares (of which: Mr. Wang Anle and Mr. Wang Shaofeng each increase their holdings by not less than 30000 shares, and the remaining 8 people each increase their holdings by not less than 20000 shares).

[other]

Jingu Co., Ltd. (002488.SZ): recently received the fixed-point notice of Avatar New Energy vehicle.

Jingu shares (002488.SZ) announced that the company recently received three fixed-point notices from a well-known new energy vehicle main engine factory (due to confidentiality requirements, unable to disclose its name, referred to as "customer"), the company will act as a customer's supplier to develop Avatar low-carbon wheel products for its three new energy vehicles, and the company will complete product development and delivery according to customer requirements.

China Life Insurance Company Limited (601628.SH): from January to August, the cumulative original insurance premium income was about 533.6 billion yuan, an increase of 5.6% over the same period last year.

China Life Insurance Company Limited (601628.SH) announced that during the period from January 1, 2023 to August 31, 2023, the company's cumulative original insurance premium income was about 533.6 billion yuan, an increase of 5.6% over the same period last year.