Gelonghui September 7?Energy stocks,Coal stocks continue to be activeTongyuan Oil is up more than 5%.Mountain coal international rose 3%, Lu'an Huaneng, Shaanxi coal industry, Shanxi coal industry and other stocks rose.

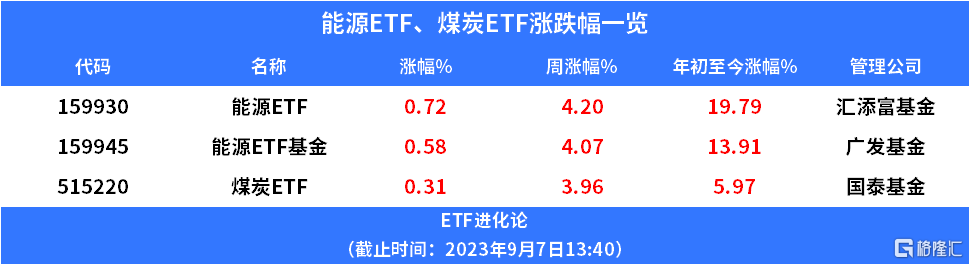

Cathay Pacific Fund Coal ETF, Huitianfu Fund Energy ETF and Guangfa Energy ETF Fund rose, up more than 4 per cent this week.

Saudi Arabia, the leader of the OPEC, extended unilateral production cuts for another three months to support fragile global markets. Recently, the state-run Saudi news agency said in a statement that Saudi Arabia will continue to cut production by 1 million barrels a day until December. The move will keep Saudi production at about 9 million barrels a day, the lowest level in years. As demand rises to record highs, the global crude oil market is tightening and oil prices have returned to their summer rally. Saudi Arabia's actions exceeded market expectations. Saudi Arabia cut production further in July on the basis of an agreement with OPEC+ allies to cut production. Since most of its allies have suffered production losses due to underinvestment and operational disruptions, Saudi Arabia has largely chosen to act alone to support prices.

Imports of major commodities such as iron ore, crude oil, coal, natural gas and soybeans increased and fell, according to data released by the General Administration of Customs today. In the first eight months, China imported 776 million tons of iron ore, up 7.4%, the average import price (the same below) 783.6 yuan per ton, down 3.6%; crude oil 379 million tons, up 14.7%, 4005.7 yuan per ton, down 16.8%; coal 306 million tons, up 82%, 812.5 yuan per ton, down 20.8%; natural gas 77.707 million tons, up 9.4%, 3762.1 yuan per ton, down 3.3% Soybeans 71.654 million tons, up 17.9%, 4288.6 yuan per ton, down 1.5%; oil products 30.55 million tons, up 100.1%, 3977.4 yuan per ton, down 25.5%. In the same period, imports of mechanical and electrical products totaled 4.09 trillion yuan, down 9.9 percent.

Statistics from the General Administration of Customs show that in August 2023, China imported 44.333 million tons of coal and lignite, an increase of 50.5 percent over the same period last year. From January to August, China imported 305.513 million tons of coal and lignite, up 82 percent from the same period last year.

Cinda Securities believes that the coal sector is the representative of the industry with high dividends and high dividends, with a cash dividend ratio of nearly 50% and a dividend yield of 7.08% in 2022. In the current risk-free interest rate downward stage, the investment performance-to-price ratio of the coal sector is becoming more and more prominent. In recent years, the profitability of the coal industry has greatly improved, with abundant cash flow and strong dividend capacity; at the same time, the growth rate of capital expenditure in the industry has slowed down and there are fewer projects under construction, creating favorable conditions for high dividends.

Societe Generale Securities said that with the continued strength of economic policies, downstream demand is expected to be marginal improved, imported coal year-on-year high growth is difficult to maintain long-term, producing area safety supervision and other factors form certain marginal constraints on supply, coal supply and demand in the future return to a tight balance pattern, is expected to provide support for medium-and long-term coal prices. Coal plate after the current round of coal price pressure test, the bottom of the performance is basically determined, superimposed the current valuation is still low, the plate has a strong margin of safety. At the same time, the leading coal companies with high dividends and high ROE are expected to continue to inject confidence into the market, plate returns and valuation may be repaired, the current configuration value is highlighted. It is recommended to pay attention to the leading stocks with high dividend margin and certain upward potential.

GF Securities Co., LTD. pointed out that coal prices are expected to be generally stable in the second half of the year due to the increase in seasonal demand and the lack of room for further growth on the supply side. In the expectation of improved supply and demand, the dividend yield of the coal sector is still at a high level, and the improvement of industry valuation is worth looking forward to.

The trend of domestic supply reduction remained unchanged against the backdrop of persistently low coal prices, with raw coal production rising only 0.1 per cent year-on-year in July, according to open source securities. The recent rise in international coal prices is strong, the advantage of imported coal is weakened, and the subsequent import volume is expected to decrease. In addition, the stable growth policy exceeds expectations, and coal, as an upstream resource, is bound to be driven by downstream demand.