[hot spot focus]

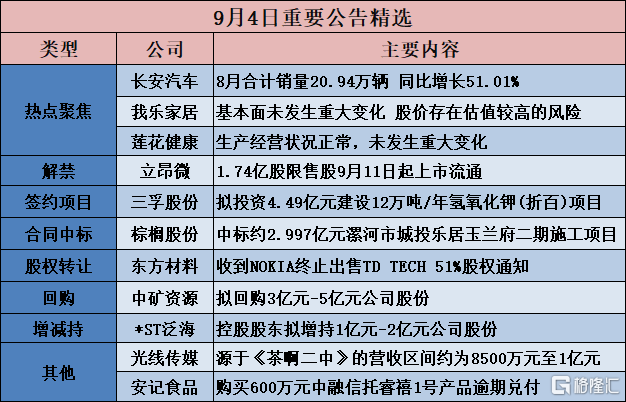

Chang'an Automobile (000625.SZ): total sales of 209400 vehicles in August increased by 51.01% from a year earlier.

Changan Automobile (000625.SZ) announced that it sold 209376 vehicles in August, up 51.01% from January to August. From January to August, Changan automobile sales were 1632800, up 11.43% from the same period last year; independent brand sales were 1360596, up 17.56% from the same period last year; independent passenger car sales were 1035035, up 25.32% from the same period last year; and overseas sales of independent brands were 154,527, an increase of 19.48%.Independent brand new energy sold 40122 vehicles in August, up 123.55% from January to August, an increase of 102.44% over the same period last year.

603326.SH: there is no significant change in fundamentals. Stock prices are at risk of higher valuations.

603326.SH announced that the company's stock closed by the limit for six consecutive trading days, with a cumulative deviation of 73.34% for the six consecutive trading days from August 28 to September 4, 2023. The company's share price rose much higher than the industry average in the short term, and there is a risk of a higher valuation when there is no major change in the company's fundamentals.

Lotus Health (600186.SH): the production and operation of the company is normal and no major changes have taken place.

Lotus Health (600186.SH) announced that the company's stock price rose by a cumulative deviation of 20% during the three consecutive trading days of August 31, September 1 and September 4, 2023, which belongs to the abnormal fluctuation of stock trading according to the relevant regulations of the Shanghai Stock Exchange. According to the company's self-examination, the production and operation of the company is normal and no major changes have taken place.

[contract project]

Sanfu Xinke (688359.SH): signed a 243 million yuan equipment sale contract and strategic cooperation framework agreement with Jiayuan Technology

Sanfu Xinke (688359.SH) announced that the general manager's office meeting was held on September 4, 2023 to examine and approve the "motion on signing the Strategic Cooperation Framework Agreement" with Jiayuan Technology, and signed the "Strategic Cooperation Framework Agreement" and "equipment Sale contract" with Jiayuan Technology on the same day.In order to establish a strategic cooperative relationship in the composite copper foil industry chain, we should give full play to the synergy between the two sides in the fields of research and development, production and sales, and realize the combination of the upper and lower reaches of the industrial chain, and hope that through strategic cooperation, quickly promote the application of new technologies, new equipment and new materials in lithium-electric composite current collectors, and provide integrated solutions for the safety, cost reduction and efficiency of lithium batteries. Finally, to achieve the rapid landing of the composite fluid collector industry, the company and Jiayuan Science and Technology signed the "Strategic Cooperation Framework Agreement".

In addition, Jiayuan Science and Technology plans to purchase special equipment from the company, and after friendly negotiation between the two sides, signed the "equipment Sale contract", the contract amount is RMB 243 million (including tax), and the subject matter of the contract is "one-step all-wet composite copper foil plating equipment". It is purchased by Jiayuan Technology in batches, and the remaining equipment starts to be delivered after the trial production and acceptance of the first equipment is qualified.

Sanfu Co., Ltd. (603938.SH): it is planned to invest 449 million yuan to build a 120000 t / a potassium hydroxide project.

Sanfu Co., Ltd. (603938.SH) announced that the company currently has a potassium hydroxide production capacity of 56000 tons / year, and hydrogen chloride, a by-product of potassium hydroxide production system, is used as the raw material for trichlorosilicon production. With the continuous extension of the company's industrial chain, the company's demand for hydrogen chloride is gradually increasing. In order to improve the company's circular economy chain and enhance the competitiveness of products, the company decided to invest 120000 tons / year potassium hydroxide (100%) project, with a total investment of 449 million yuan.

[contract won the bid]

Tianyuan Environmental Protection (301127.SZ): winning the concession of municipal solid waste incineration power generation project in Hezhang County

Tianyuan Environmental Protection (301127.SZ) announced that it recently received a "bid winning notice" from Guoxin International Engineering Consulting Group Co., Ltd., confirming that the company has become one of the winning bidders of the "Hezhang County municipal solid waste incineration power generation project concession public tender (second)". The amount of winning bid: the service charge for domestic waste disposal is 75.80 yuan per ton, and the estimated total investment of the project is 385082100.00 yuan.

Tianyuan Environmental Protection (301127.SZ): sign 140 million yuan daily operation contract

Tianyuan Environmental Protection (301127.SZ) announced that recently, the company and Tianjin Municipal Engineering Design and Research Institute Co., Ltd. as a consortium, and Kunming Dongchuan Industrial Investment and Development Co., Ltd. signed the "Yunnan Dongchuan Industrial Park Phase II supporting sewage treatment plant and pipe network reconstruction and expansion project design, procurement, construction general contract (EPC) contract" It is tentatively estimated that the contract price is RMB 140.25 million.

Tianyuan Environmental Protection (301127.SZ): winning bid Zhengzhou (West) Environmental Protection Energy Project leachate and tobacco washing wastewater treatment equipment procurement and installation construction

Tianyuan Environmental Protection (301127.SZ) announced that it recently received a "bid winning notice" from Jianjing Investment Consulting Co., Ltd., confirming that the company became the winning bidder of the project of "purchase and installation of complete sets of equipment for leachate and tobacco washing wastewater treatment in Zhengzhou (western) environmental protection energy project", with a winning bid amount of 92806127.59 yuan.

Palm shares (002431.SZ): about 299.7 million yuan won the bid for the second phase construction project of Yulanfu in Chengtuleju, Luohe City.

Palm shares (002431.SZ) announced that the company recently received a "bid winning notice" from Luohe Ronghui Industrial Co., Ltd., confirming that the company is the winning bidder for the second phase of the construction project in Yulanfu, Luohe City. The winning price is about 299.7 million yuan.

China Energy Construction (601868.SH): its enterprise won the first bid for the infrastructure project of Saade Abdullah New Town in Kuwait.

China Energy Construction (601868.SH) announced that its subsidiary China Gezhouba Group Co., Ltd. (hereinafter referred to as Gezhouba shares) received a "bid winning notice" issued by the Kuwaiti Housing Welfare Department. Gezhouba shares won the first bid for the infrastructure project of Saade Abdullah Metro in Kuwait. The total amount of the winning contract is about 345230883.658 KWD, equivalent to about 7.998 billion RMB (the exchange rate is calculated at KWD 1 = 23.1679 RMB, subject to the actual occurrence).

Golden Crown Electric (688517.SH): won the bid 20.9886 million yuan ring network cabinet-environmentally friendly gas, low voltage cable branch box products

Golden Guan Electric (688517.SH) announced that recently, the e-commerce platform of the State Grid Co., Ltd. released the announcement of the winning candidates recommended by the State Grid Fujian Electric Power Co., Ltd. in 2023 for the procurement of the first distribution network agreement inventory. The company won the bid ring cabinet-environmentally friendly gas, low-voltage cable branch box products, a total of two bid packages, a total of 20.9886 million yuan.

Huitong Group (603176.SH): won the bid 294 million yuan construction project

Huitong Group (603176.SH) announced that the company received a "bid winning notice" from the tenderer Anguo State-controlled warehousing Service Co., Ltd., and the company became the winning bidder for the first phase of the international strategic reserve and processing comprehensive construction project of traditional Chinese medicine of the Anguo Finance Bureau, with a winning bid amount of 294 million yuan.

Ningbo Construction Engineering (601789.SH): the consortium signed a 454 million yuan contract for the construction of Xingci Avenue Expressway (Xinpu Interchange-Binhai Avenue) of Shenyang Expressway.

Ningbo Construction Engineering (601789.SH) announced that the consortium formed by Ningbo Municipal Engineering Construction Group Co., Ltd. (hereinafter referred to as "Municipal Group") and Zhejiang Xinwan Municipal Engineering Construction Co., Ltd. recently signed a "Xingci Avenue Expressway (Shenyang Expressway Xinpu Interchange-Binhai Avenue) Project Construction contract" with Ningbo Hangzhou Bay New area Haiping Development and Construction Co., Ltd., at a contract price of 454 million yuan.

[Equity acquisition]

Oriental Materials (603110.SH): received a notice from NOKIA to terminate the sale of 51% of its stake in TD TECH

Oriental Materials (603110.SH) announced that on April 7, 2023, the company held the 10th meeting of the Fifth session of the Board of Directors and the eighth meeting of the Fifth session of the Supervisory Board, and examined and passed the "proposal on the signing of the Equity transfer Agreement" and other related motions, and proposed to issue shares to specific targets to raise funds to acquire the 51% equity of TECH HOLDING limited held by Nokia Solutions and Networks GmbH&Co.KG. And signed "AGREEMENT FOR THE SALE AND PURCHASE OF SHARES IN TD TECH HOLDING LIMITED" with the other party of the transaction. Recently, the company received a "Notice of Termination of the SPA" from the other side of the transaction, which unilaterally asked to terminate the "equity transfer agreement", and this transaction may be terminated.

Beijing Investment Development (600683.SH): to be listed to transfer 43.08% of the partnership share of the cornerstone fund

Beijing Investment Development (600683.SH) announced that the company plans to transfer its 43.08% partnership share of Beijing Cornerstone Venture Capital Fund (Limited Partnership) (hereinafter referred to as "Cornerstone Fund") through the Beijing Equity Trading Center. According to the "Beijing Cornerstone Venture Capital Fund (Limited Partnership) 43.08% Partnership share Project Asset Evaluation report" issued by Beijing Tonghua Asset Evaluation Co., Ltd. (Zhonghua Review (2023) No. 041407), this transaction is listed for the first time at a price not lower than 84.4218 million yuan. The above-mentioned evaluation has completed the filing procedures for the evaluation of state-owned assets. After the completion of this transaction, the company will no longer hold the share of the cornerstone fund.

[lifting the ban]

Mingyang Intelligence (601615.SH): 148 million restricted shares lifted on Sept. 8

Mingyang Intelligence (601615.SH) announced that the company listed a total of 148 million shares in circulation. The listing and circulation date of the stock is September 8, 2023.

Jiahua shares (603182.SH): 51.9387 million restricted shares lifted on September 11th

Jiahua shares (603182.SH) announced that the restricted shares in circulation are part of the company's initial public offering, involving a total of 42 shareholders, a total of 51.9387 million shares, accounting for 31.56% of the company's total share capital. The lock-up period of the above shareholders is 12 months from the date of listing of the shares, and this portion of the shares with limited conditions of sale will be listed on September 11, 2023 (since 9 September 2023 is a non-trading day, it will be postponed to the next trading day).

Hyatt Care (605009.SH): 103 million restricted shares have been in circulation since September 11.

605009.SH announced that the number of restricted shares in circulation is 103 million shares, accounting for 66.20% of the company's total share capital, and will be listed and circulated from September 11, 2023.

Lionwei (605358.SH): 174 million restricted shares have been in circulation since September 11th.

605358.SH announced that the restricted shares in circulation are the remaining restricted shares in the company's initial public offering for a period of 36 months, including four shareholders such as Wang Minwen. The above-mentioned shareholders hold a total of 174 million restricted shares in circulation, accounting for 25.76% of the company's total share capital, and will be listed and circulated from September 11, 2023.

[buyback]

China Mineral Resources (002738.SZ): plans to buy back 300 million-500 million yuan of company shares

China Mineral Resources (002738.SZ) announced that it intends to use its own funds to buy back some of its issued RMB common shares (A shares) through centralized bidding, and to use the repurchased shares for employee stock ownership plans or equity incentives at an appropriate time in the future. The total amount of funds to be used to buy back shares shall not be less than 300 million yuan (inclusive) and not more than 500 million yuan (inclusive). The repurchase price shall not exceed RMB 60 per share (inclusive). The implementation period of the repurchase of shares shall be within 12 months from the date of consideration and approval of the repurchase plan by the board of directors of the company.

301239.SZ: plan to spend 50 million-60 million yuan to buy back the company's shares

301239.SZ announced that the company intends to use its own funds to buy back some of the company's RMB common A shares through centralized bidding transactions, with a total repurchase capital of no less than 50 million yuan and no more than 60 million yuan (including capital). The repurchase price shall not exceed RMB 151.74 per share.

Jingsheng Mechanical and Electrical (300316.SZ): plan to spend 60 million-100 million yuan to buy back the company's shares

Jingsheng Mechanical and Electrical (300316.SZ) announced the announcement on the share repurchase plan of the company, the total amount of funds used for the repurchase is not less than 60 million yuan (including capital) and not more than 100 million yuan (including capital), the specific amount of repurchase shares shall be subject to the actual repurchase amount at the completion of the repurchase implementation. The source of funds is the company's own funds. The repurchase price does not exceed RMB 80 per share.

Yongchuang Intelligence (603901.SH): plans to spend 20 million to 40 million yuan to buy back shares

Yongchuang Intelligence (603901.SH) announced that the shares repurchased by the company are intended to be used for the implementation of employee stock ownership plans or / and equity incentive plans. The total amount of the shares to be repurchased shall not be less than RMB 20 million and shall not exceed RMB 40 million; the price of the shares to be repurchased shall not exceed RMB 16 per share (inclusive).

[increase or decrease holdings]

* ST 000046.SZ: the controlling shareholder intends to increase its shareholding in the company by 100 million to 200 million yuan

* ST Oceanwide (000046.SZ) announced that its controlling shareholder, China Oceanwide Holdings Group Co., Ltd. (hereinafter referred to as "China Oceanwide"), plans to increase its stake in the company by concentrated bidding in the secondary market within four months from September 5, 2023 (including September 5, 2023), with a planned increase of RMB 100 million to RMB 200 million.

Pingping Coal shares (601666.SH): some senior managers of the controlling shareholder intend to increase their holdings by a total of 100000 shares to 200000 shares

601666.SH announced that the company's controlling shareholder, Mr. Li Mao, chairman of the senior management of China Ping Coal Shenma Holdings Group Co., Ltd., Mr. Cai Zhigang, secretary of the discipline Inspection Commission, and Mr. Liu Xinye, deputy general manager, Mr. Jiang Junfu, a total of four people plan to increase their shares in the company through the Shanghai Stock Exchange system with their own funds within six months from September 4, 2023. In total, the number of shares increased by not less than 100000 shares and not more than 200000 shares (of which, Mr. Li Mao and Mr. Jiang Junfu each increased their holdings by not less than 30000 shares, and Mr. Cai Zhigang and Mr. Liu Xinye each increased their holdings by not less than 20000 shares).

[other]

Light Media (300251.SZ): as of September 3, the operating income from "Cha'a No.2 Middle School" ranges from about 85 million yuan to 100 million yuan.

Light Media (300251.SZ) announced that the film "Tea er Zhong" sponsored and distributed by its subsidiary has been released on Chinese mainland since July 14, 2023. As of 24:00 on September 3, 2023, the film had been released in Chinese mainland for 52 days, with cumulative box office receipts of about 379 million yuan, more than 50 percent of the company's audited consolidated financial statements in its most recent fiscal year, according to the State Film Resources Office.As of September 3, 2023, the company's revenue from the film ranges from 85 million yuan to 100 million yuan. At present, the film is still in theaters, and the box office receipts in Chinese mainland region are subject to the statements officially confirmed by cinemas in Chinese mainland region; at the same time, the film's copyright sales in Chinese mainland region and overseas distribution revenue have not yet been finally settled. There may be differences between the operating income such as the box office revenue of the film and the actual identifiable operating income of the company (including, but not limited to, the revenue and other income calculated on the basis of the recognized box office revenue and the corresponding sharing method after the film is shown in the cinema).

Anji Food (603696.SH): overdue payment of 6 million yuan of Zhongrong Trust Ruixi No. 1 product

603696.SH announced that on March 1, 2023, the company used idle funds of 6 million yuan to buy Ruixi No. 1 product from March 1, 2023 to September 1, 2023. As of the date of disclosure of this announcement, Ruixi No. 1 product has expired and the company has not yet received the principal and investment income of this product.