Harbour Equine Holdings Limited (HKG:8377) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 52% share price drop in the last twelve months.

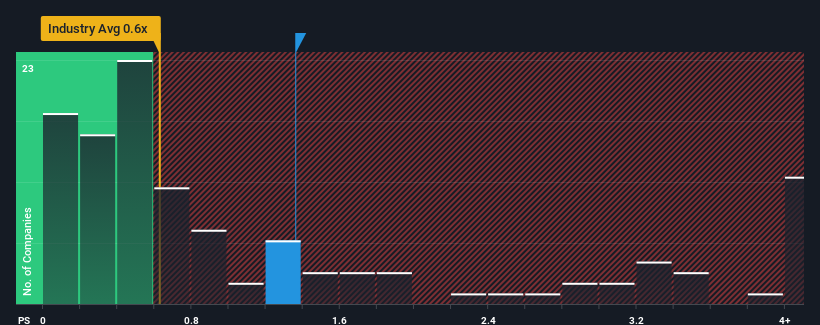

Since its price has surged higher, when almost half of the companies in Hong Kong's Luxury industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Harbour Equine Holdings as a stock probably not worth researching with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Harbour Equine Holdings

How Harbour Equine Holdings Has Been Performing

Revenue has risen firmly for Harbour Equine Holdings recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Harbour Equine Holdings will help you shine a light on its historical performance.How Is Harbour Equine Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Harbour Equine Holdings would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 7.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 75% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Harbour Equine Holdings' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Harbour Equine Holdings' P/S?

Harbour Equine Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Harbour Equine Holdings maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Harbour Equine Holdings (at least 3 which don't sit too well with us), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Harbour Equine Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.