To sum up the beauty industry this year, the word “differentiation” is most appropriate.

On August 29, Perilla handed over a semi-annual report that had surpassed market expectations, and the stock price surged more than 8% the next day.

This certainly sends a positive signal to the market: high-quality beauty brands can still maintain strong growth in the midst of changes.

However, the market also needs to clearly see that the days when marketing and big promotions could stimulate sales are over.

When consumption returns to rationality, domestic beauty makers must also show some “real skills.”

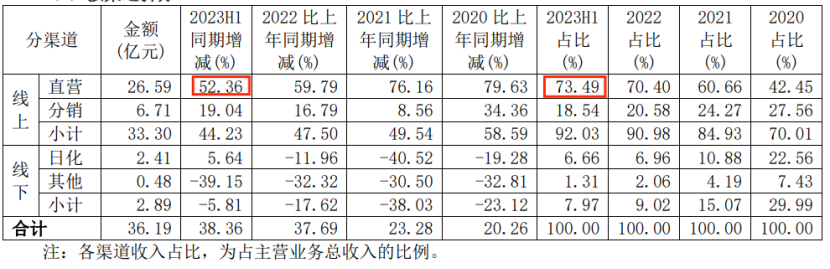

Direct sales account for a high proportion - lower costs, more manageable prices

Looking at a single quarter, Perea's revenue and net profit grew rapidly in the second quarter.

Q2 revenue was 2.05 billion yuan, up 46.22% year on year, and realized net profit of 291 million yuan to mother, up 110.41% year on year (excluding the impact of 55 million yuan of feather sunscreen, up 50.6% year on year).

Historical data shows that the company's profit has increased year-on-year for 13 consecutive quarters.

The net interest rate for Q2 rose to 14.53%, the highest since listing except 3Q22.

The increase in profitability is mainly due to the increase in the proportion of direct online sales, which skips distributors and retailers, and effectively controls the costs brought about by the middle link.

As of the first half of 2023, direct management accounted for 73.49%, an increase of 52.36% over the same period last year.

(Image source: Perea Semi-Annual Report)

Compared with the price control capabilities of major domestic/international brands, Perea's direct sales account for a relatively high share, the price of the big promotion is also relatively manageable, and the price management ability is outstanding.

Furthermore, continuous version upgrades and iterations of core products have also increased customer unit prices, which has led to an increase in overall gross margin.

According to financial reports, Perea's gross margin for the second quarter reached 70.9%, an increase of 2.3 percentage points over the previous year.

Compared to extensive marketing, domestic beauty products at this stage require intensive cultivation

In terms of costs, the 23H1 Perilla sales expense ratio was 43.56%, up 1.03 percentage points year on year; the Q2 sales expense ratio was 43.83%, up 1.15 percentage points year on year.

In the beauty industry at this stage, products are advertising-oriented, and beauty brands need to seize the minds of users. Marketing promotion, especially in the new product launch stage, is particularly critical.

The only difference between this year and previous years is that compared to previous years, it relies more on discount promotions and extensive marketing with crazy delivery. This year, the industry as a whole is facing weakening dividends, and refined operation and input-output ratios have become more important.

In other words, to spend money wisely, brands need to focus their budgets on the points that best highlight differentiation.

Perea also mentioned during the conference call, “In the Internet age, information is synchronized faster, and new things are needed to form a reason to buy. Cosmetics are becoming more and more like an Internet brand, and new sales points need to continue to be formed.”

(Insight Research Homemade Maps)

Looking at the sales expenses of key enterprises, 2020-2022 is the fastest growing period for the industry, and it is also a stage of rapid growth for the industry as a whole.

Sales expenses of most companies have shown signs of slowing down this year, and Perea continues to increase investment.

Specifically, Perea launched two anti-aging series of essences, Ruby and Dual Anti-Aging, in 2020, and strengthened its “anti-aging” positioning by superimposing anti-aging ingredients and relying on social platforms in subsequent versions to enhance product targeting.

For example, the 3.0 version of Dual Anti-Aging Serum, which was launched in April of this year, claims to use the exclusive active ingredient Nox-Age to strengthen the anti-aging mind, while improving the pump head design, improving the splash problem that consumers have always complained about.

The upgraded Dual Antibody Essence 3.0 and Ruby Essence 2.0 were quickly recognized by consumers and quickly released. The sales volume of Dual Antibody 3.0 exceeded one million during the 618 shopping festival.

(Image source: Minsheng Securities)

Now, if you search for the word “anti-aging” on Xiaohongshu, you can see that Perea also has a place among many famous international brands.

In 2022, these two series have begun to take shape; after the launch of the 3.0 edition of Dual Antimicrobial Essence in 2023, it accounted for 34% of the company's total sales.

Ruby Essence 3.0 will also be launched in the second half of this year, and its market response will directly reflect whether Perea can continue to differentiate itself from other brands on the anti-aging circuit.

However, it is worth noting that among major products, the Yuanli series has always had a relatively weak presence, and sales volume is far less than that of the “Dual Antibody” and “Ruby” series. Genki Essence 2.0 sold only 300,000 in the 618 promotion, far behind Dual Resistance Essence 3.0.

It's only been 2 years since the launch of the Morning C and Evening A Group, and the growth rate has begun to slow down. The main thing is that it is already quite popular in the online market, and the sinking market will be a new growth point worth exploring.

However, looking at it today, Perea's strategy of using large single products to drive growth is still a success.

One of the major contributions to this is that the brand positioning is clear, and the development and marketing of new products have accurately stepped on consumers' “pain points”, making the investment of marketing resources and expenses more accurate and efficient.

One step closer to the dream of an international group

Today, when the bubble in the beauty industry has faded, the market pays more attention to the refined operation strategies of enterprises and the construction of product and brand strength, rather than relying on promotions and live streaming to gain short-term popularity.

This places higher demands on corporate management capabilities, but it also brings new investment opportunities to companies with good cash flow.

For example, Perea's direct sales model continues to increase in proportion, making the cash flow situation excellent.

As of the first half of 2023, Perea's net cash flow from operating activities reached $1,111 billion.

(Data source: Choice)

Referring to the development path of overseas brands, when a single brand reaches a large scale, there is no need for too much capital investment in the short term, and the cash flow is healthy.

However, considering the upper limit of growth space, it is necessary to improve the efficiency of capital utilization and find new growth points, such as continuing the life cycle of successful products and building more brands.

This is in line with Perea's development path.

In 2019, Perea successively acquired Caitang and the Spanish brand San Gelan; in 2021, it also acquired the Japanese nursing brand Off&Relax, and has formed a stable matrix of three major brands for skin care, makeup, and care.

Each brand is deeply involved in its own field and has achieved encouraging growth during the reporting period.

2023H1 Perea's revenue was 2,892 million yuan, yoy +35.86%, accounting for 79.87%; Chaitang's revenue was 414 million yuan, yoy +78.65%, accounting for 11.45%; OR revenue was 97 million yuan, yoy +94.17%; Yuefti's revenue was 132 million yuan, yoy +64.80%.

What can be seen is that through single product expansion and brand acquisitions, Pereyar is successfully transforming from a single brand to a multi-brand matrix, which undoubtedly brings it one step closer to the dream of an international group.