Consumers will never stop chasing beauty.

On August 29, Winona's parent Beatney (300957.SZ) released financial reports for the first half of 2023, showing that current operating income and net profit for the period were 2,368 million yuan and 450 million yuan respectively, up 15.52% and 13.91% year-on-year respectively.

However, this growth rate has slowed down from the first half of 2022. In the first half of last year, the year-on-year growth rates of Bethany's income and net profit from her mother reached 45.19% and 49.06%, respectively.

This is related to the fact that Bethenny's first-quarter results were dragged down by the pandemic.

In the first quarter of 2023, Bethany's revenue and net profit to her mother were 863 million yuan and 158 million yuan respectively, up 6.78% and 8.41% respectively, down 52.54 percentage points and 77.33 percentage points from the same period in 2022.

However, Bethany's performance for the second quarter of this year has improved. Current revenue and net profit to parent were 1,505 million yuan and 292 million yuan respectively, up 74.39% and 84.81% from the previous month, respectively.

On August 29, Bettany's intermarket increase had reached 4.18%.

Specifically, skincare products, mainly Winona, are still Bethenny's dominant business, but the growth rate is not as fast as before. The first half of 2023 generated revenue of 2,050 billion yuan, an increase of 12.13% over the previous year, and a decrease of 33.27 percentage points from the first half of 2022.

In contrast, medical devices generated 278 million yuan in revenue during the same period, and the year-on-year growth rate was still as high as 45.92%.

Under a high base, Winona's slowdown in growth also seems to be an inevitable outcome.

Finding the next point of growth is Bethany's goal.

Bettany is replicating Winona's style of play—cutting into a segmented racetrack for skin problems. In 2023, Bethenny launched the acne brand “Bevertin”, mainlyacneSkin consumers provide skincare products.

Currently, Bevertin is on sale, but sales data has not yet been disclosed. Whether it will finally be recognized by consumers still needs further observation.

From the channel side, the continued increase in revenue from the Douyin platform is an important driving force to boost Bethany's performance.

Revenue from Jinkyo in the first half of 2023 was 265 million yuan, an increase of 32.47% over the previous year; in contrast, from those including Taobao and TmallAliThe platform's revenue showed a downward trend. In the first half of 2023, it only achieved revenue of 789 million yuan, a year-on-year decline of 3.41%.

The growth rate of the jitter platform is faster thanAliThis is the current state of revenue growth for many companies. Even the health food company Tomson Beijian (300146.SH), the main brand of “Tomson Beijian”, saw a year-on-year increase of over 100% in Douyin's sales in the first half of 2023, reversing the decline in online channel changes over the years in one fell swoop.

But the cost is rising selling costs.

In the first half of this year, Bettany's sales expenses had broken through the 1 billion yuan mark, reaching 1,097 billion yuan, an increase of 17.80% over the previous year, accounting for 46.33% of revenue.

“This is mainly due to the fact that during the reporting period, as the company's sales scale increased, the company continued to increase investment in marketing personnel expenses and warehousing and logistics.” Bettany said, “During the reporting period, the increase in brand image promotion and sales expenses basically matched the increase in sales scale.”

With the arrival of shopping festivals such as Double Eleven in the second half of the year, the market continues to pay attention to whether Bethany can continue to achieve further growth.

Furthermore, TradeWind01 (ID: TradeWind01) noticed that there is suspected to be a unit error in the records of revenue for various products in Bethany's 2023 semi-annual report.

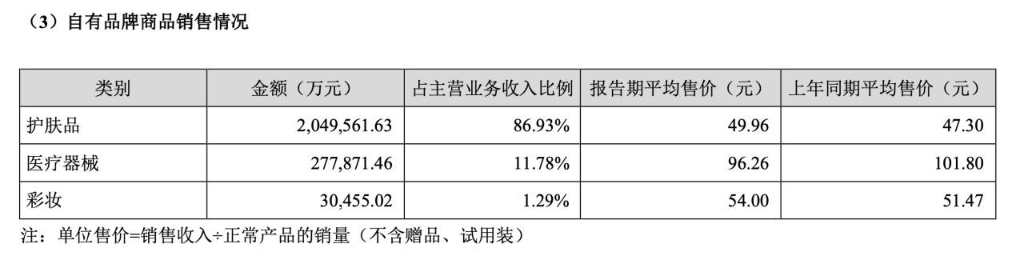

On page 18 of the 2023 Interim Report, Bethany recorded the sales of her own brand's products. The unit of amount was 10,000 yuan. Revenue from skincare products, medical devices, and makeup was recorded as “2049,561.63,” “277,871.46,” and “30,455.02,” respectively. After being converted into units of 100 million yuan, the revenue of these three business segments reached 20.496 billion yuan, 2,779 billion yuan, and 305 million yuan, respectively.

Obviously, there is a big discrepancy between this and the revenue of various products previously recorded by Bethany.

It is worth mentioning that if you change the unit of amount to “1,000 yuan,” you will find that the data is recorded correctly, that is, revenue from skincare products, medical devices, and makeup is 2,050 million yuan, 278 million yuan, and 30 million yuan.

TradeWind01 (ID: TradeWind01) called Bethany's securities department on this issue to verify whether the data was wrong. The caller said it would promptly provide feedback and verification with relevant personnel.