On the evening of Monday, Aug. 28, Chinese cheese giant Mioco Lando announced its first-half results.

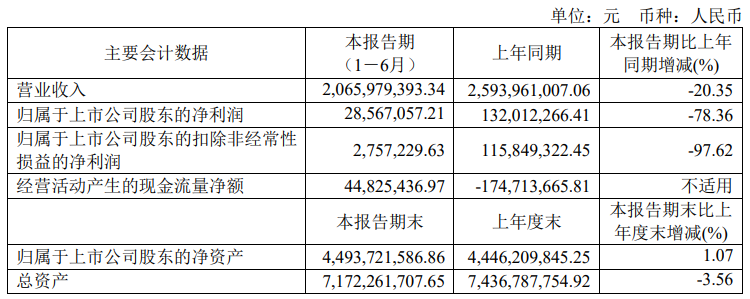

According to the financial report, in the first half of this year, the operating income of Miao Ke Landuo was 2.066 billion yuan, down 20.35% from the same period last year; the net profit was 28.567 million yuan, down 78.36% from the same period last year; and the net profit after deducting it was 2.7572 million yuan, down 97.62% from the same period last year.

As of the first half of the year, the company's net assets were 4.494 billion yuan, an increase of 1.07% compared with the end of last year, and its total assets were US $7.172 billion, down 3.56% from the end of last year.

More specifically, the company's revenue in the second quarter was 1.043 billion yuan, an increase of 20 million yuan over the first quarter and a decrease of 13.66% compared with the same period last year; the net profit of returning to the mother was 4.3648 million yuan, down 92.56% from the same period last year; and the net loss after deduction was 3.1116 million yuan, compared with 47.0841 million yuan in the second quarter of last year.

The company said in its financial report:

In the first half of 2023, domestic consumer demand showed a trend of recovery, but the overall recovery rate is still slow. The company actively promotes various measures, and its operating income in the second quarter shows signs of improvement compared with the first quarter, but due to the impact of the macro environment, the company's cheese business income and overall operating income have declined compared with the same period last year.

While the revenue from the cheese business declined, the cost of major raw materials increased compared with the same period last year (including the impact of the depreciation of the RMB exchange rate on import costs), resulting in a decline in the gross profit margin of the cheese business, a decrease in current foreign exchange lock income and an increase in net interest expenses over the same period last year, resulting in a decline in the company's net profit belonging to the shareholders of the parent company.

In the first half of 2023, the company's cheese business market share still ranks first in the industry. In the future, the company will continue to focus on cheese business, continue to maintain a first-mover advantage, pay close attention to market changes, and seize the opportunity of market recovery. Further consolidate the leading position of cheese category.

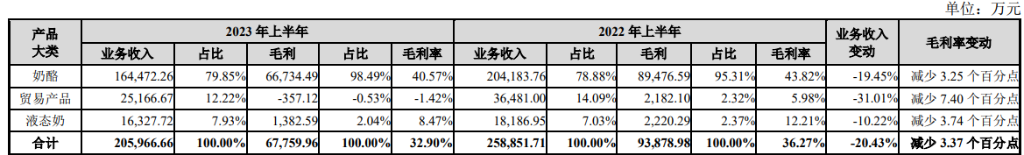

From the perspective of the company's business structure, cheese business remained the company's main business in the first half of this year, accounting for nearly 80% of revenue, 19.45% of revenue from the same period last year, and a gross profit margin of 40.57%, a decrease of 3.25 percentage points compared with the same period last year. The proportion of revenue from trading products was 12.22%, which was significantly lower than that of last year, while business income dropped sharply by more than 30%. The business posted a gross loss of 3.5717 million yuan, compared with a gross profit of nearly 22 million yuan in the same period last year. The share of revenue from the liquid milk business rose to nearly 8 per cent, but revenue fell by more than 10 per cent from a year earlier, with a gross profit margin of 8.47 per cent, down 3.74 percentage points from a year earlier.

Further breaking up the branch's core business cheese business, the ready-to-eat nutrition series contributed nearly 2/3 of the business income and nearly 85% of the gross profit, and the gross profit margin was also higher than that of the same period last year; the income contributed by the family table series accounted for more than 10%, which was lower than the same period last year, the gross profit was less than 8%, and the gross profit margin decreased by 5.59%. The catering industry series contributed nearly 1/4 of revenue and nearly 8 per cent of gross profit from the cheese business, while gross profit margin fell 3.64 percentage points to 13.38 per cent.

In addition, relevant data show that retail growth in China's cheese market has declined for three consecutive years and slowed to 8.9% in 2022. Affected by the sharp drop in the heat of children's cheese bars, the growth rate of cheese category was-30% in the first half of this year.

Miocolando's shares have fallen more than 40% so far this year.