Unfortunately for some shareholders, the Blink Charging Co. (NASDAQ:BLNK) share price has dived 32% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 80% loss during that time.

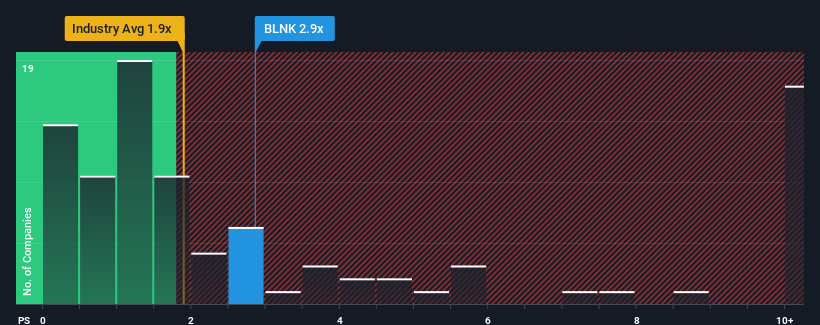

In spite of the heavy fall in price, when almost half of the companies in the United States' Electrical industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider Blink Charging as a stock probably not worth researching with its 2.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Blink Charging

How Has Blink Charging Performed Recently?

With revenue growth that's superior to most other companies of late, Blink Charging has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

With revenue growth that's superior to most other companies of late, Blink Charging has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Revenue Growth Forecasted For Blink Charging?

The only time you'd be truly comfortable seeing a P/S as high as Blink Charging's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 165%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 40% per annum during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 64% per annum growth forecast for the broader industry.

In light of this, it's alarming that Blink Charging's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Blink Charging's P/S

Despite the recent share price weakness, Blink Charging's P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Blink Charging trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 5 warning signs for Blink Charging that you should be aware of.

If these risks are making you reconsider your opinion on Blink Charging, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.