F8 Enterprises (Holdings) Group Limited (HKG:8347) shareholders have had their patience rewarded with a 55% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.6% in the last twelve months.

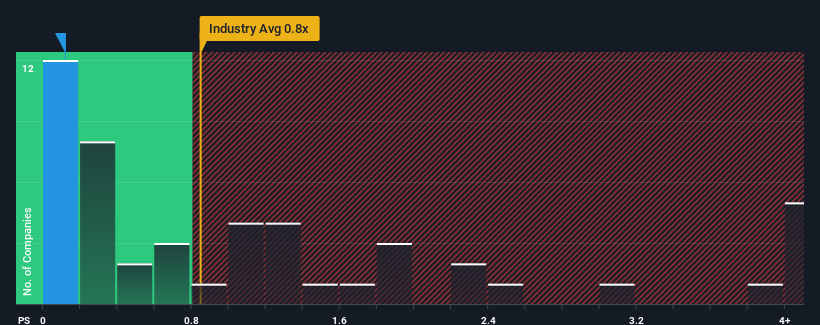

Although its price has surged higher, given about half the companies operating in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider F8 Enterprises (Holdings) Group as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for F8 Enterprises (Holdings) Group

How Has F8 Enterprises (Holdings) Group Performed Recently?

For instance, F8 Enterprises (Holdings) Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on F8 Enterprises (Holdings) Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as F8 Enterprises (Holdings) Group's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 17% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 4.9% either.

In light of this, the fact F8 Enterprises (Holdings) Group's P/S sits below the majority of other companies is unanticipated but certainly not shocking. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet, despite the industry heading down in unison. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

The Bottom Line On F8 Enterprises (Holdings) Group's P/S

F8 Enterprises (Holdings) Group's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Upon examining F8 Enterprises (Holdings) Group, we found that its recent revenue decline over the past three-year is affecting its P/S ratio more than we initially expected, even though the wider industry is also expected to experience a decline in revenue. There could be some further unobserved threats to revenue preventing the P/S ratio from keeping up with the industry average. One major risk is whether the company can maintain its 'middle of the road' medium-termrevenue growth under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for F8 Enterprises (Holdings) Group (of which 3 are a bit unpleasant!) you should know about.

If you're unsure about the strength of F8 Enterprises (Holdings) Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.