In the first half of this year, Sunshine Power's profit growth rate nearly quadrupled, killing its photovoltaic peers. In a context where the market once thought there was excess photovoltaic production capacity and the inverter competition pattern was worsening, why can solar power still buck the trend and grow?

01 Single-quarter profit reached a record high, and Sunshine Power's performance shocked the photovoltaic industry

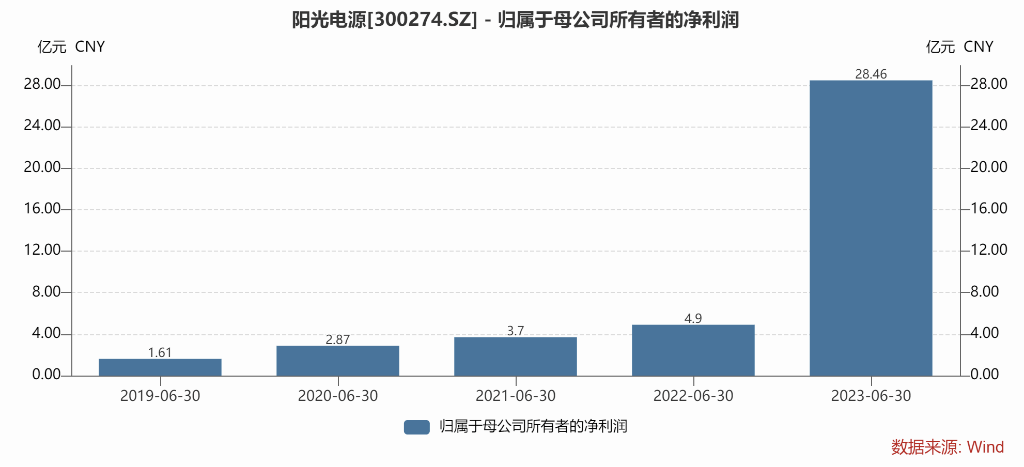

On the evening of August 24, Sunshine Power announced its semi-annual report for 2023. Among them, revenue for the first half of the year was 28.62 billion yuan, up 133% year on year; net profit for the first half of the year was 4.35 billion yuan, up 384% year on year; net profit for the Q2 quarter was 2.85 billion yuan, up 89% from the previous year, which is more than the total profit for the past four years. The growth rate of revenue and profit this season has undoubtedly thrown a shock bomb on the industry.

The company said, “The increase in revenue and operating costs is mainly due to the increase in photovoltaic inverters, energy storage business, and new energy investment business.” In other words, at the industry level, the global optical storage industry had strong demand in the first half of the year, bringing room for growth in the company's business.

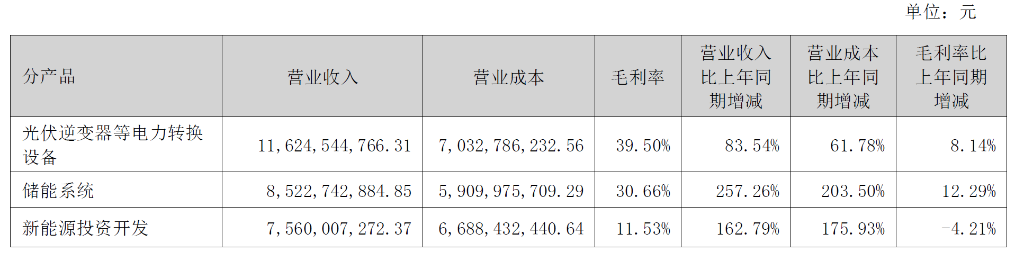

Compared to the increase in revenue scale, Sunshine Power's profit growth rate this season has exceeded expectations. According to the product gross profit margin announced by the company, the increase in profit mainly comes from energy storage systems and photovoltaic inverters, especially the energy storage business. While revenue increased 257.26% year on year, gross margin also increased 12.29%; while photovoltaic inverters were not inferior, gross margin increased 8.14% year on year.

In a market environment where photovoltaic inverters are acknowledged to be fully competitive, Sunshine Power can also buck the trend and increase gross profit margin. On the one hand, because Sunshine Power's overseas business accounts for 54%, overseas gross margin is higher than domestic.

On the other hand, it is because the company itself is more advanced in terms of scale effect, brand effect, and channel development. Although inverters do not account for a high proportion of the cost of photovoltaics, quality is very important. Therefore, customers are willing to pay a higher premium for brand quality.

In the energy storage business, the main profit contribution is from overseas. Domestic component prices were high last year, and many large storage projects were postponed until this year, so demand is strong and orders are sufficient this year. On the overseas side, both large savings and household savings achieved rapid growth in the first half of the year. In particular, Sunshine Power was more recognized overseas, and it did not have as much internal volume as at home. Some high-end customers prefer to pay high premiums.

02 Performance is surging with peers, and inverters are still the star track for photovoltaics

As we all know, there is excess production capacity in all aspects of photovoltaics, and competition is becoming more and more intense. Even the inverter circuit, which was once regarded as the “crown” business model, is no exception.

According to some market opinions, the inverter competition pattern has worsened; there are also opinions that inverters are still a good business, at least compared to other aspects of photovoltaics.

In order to explore the current earning capacity of inverters, Insight Research has compiled statistics on the photovoltaic industry up to now. The top two profit growth rates have been reported by mainstream companies. The main business is inverters.

Last year's stars, Ujing Technology for high-purity quartz crucibles, and Jingke Energy, the leader in TopCon components, were all left behind by inverter companies.

Competition for inverters has intensified, but in the first half of this year, inverters were still more profitable.

(Insight into intellectual research and cartography)

It is undeniable that it is difficult for the household storage market to experience a surge like during the European energy crisis last year, but for global leaders such as Sunshine Power, with the support of scale effects, brand advantages, and channel advantages, the leading advantage is even more obvious in high-end consumer markets such as the US and Australia that value quality.

In terms of large savings, although domestic markets do not have a high degree of international marketization, and for the time being, domestic savings are not profitable, the profit model will definitely be optimized as the degree of standardization increases.

Overcapacity in all aspects of photovoltaics is inevitable. However, companies with a high share of overseas business, such as Sunshine Power, may be profitable for a longer period of time by taking advantage of their differentiation.