If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of BOC International (China) CO., LTD (SHSE:601696) have had an unfortunate run in the last three years. So they might be feeling emotional about the 61% share price collapse, in that time. The last week also saw the share price slip down another 9.4%.

After losing 9.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for BOC International (China)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, BOC International (China) actually saw its earnings per share (EPS) improve by 2.2% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. Looking to other metrics might better explain the share price change.

With a rather small yield of just 0.3% we doubt that the stock's share price is based on its dividend. With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

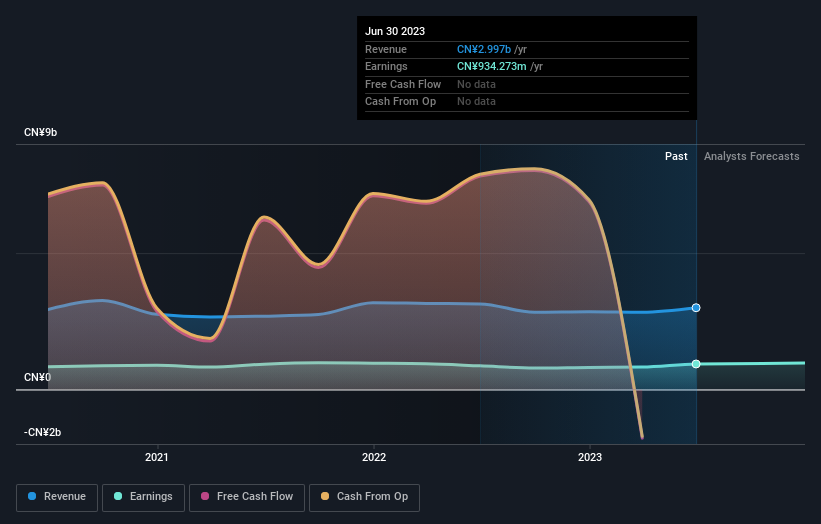

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling BOC International (China) stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We can sympathize with BOC International (China) about their 8.6% loss for the year ( including dividends), but the silver lining is that the broader market return was worse, at around -9.8%. The one-year return is also not as bad as the 17% per annum loss investors have suffered over the last three years. It could well be that the business has begun to stabilize, though the recent returns are hardly impressive. Is BOC International (China) cheap compared to other companies? These 3 valuation measures might help you decide.

Of course BOC International (China) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.