Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Renrenle Commercial Group Co.,Ltd. (SZSE:002336) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Renrenle Commercial GroupLtd

How Much Debt Does Renrenle Commercial GroupLtd Carry?

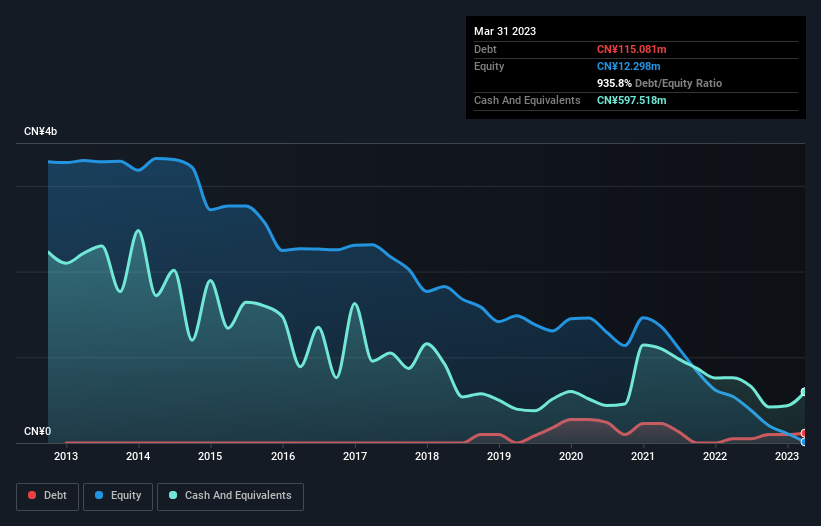

As you can see below, at the end of March 2023, Renrenle Commercial GroupLtd had CN¥115.1m of debt, up from CN¥50.0m a year ago. Click the image for more detail. But it also has CN¥597.5m in cash to offset that, meaning it has CN¥482.4m net cash.

How Strong Is Renrenle Commercial GroupLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Renrenle Commercial GroupLtd had liabilities of CN¥2.75b due within 12 months and liabilities of CN¥1.92b due beyond that. Offsetting this, it had CN¥597.5m in cash and CN¥59.0m in receivables that were due within 12 months. So it has liabilities totalling CN¥4.01b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Renrenle Commercial GroupLtd is worth CN¥6.76b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, Renrenle Commercial GroupLtd also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Renrenle Commercial GroupLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Renrenle Commercial GroupLtd had a loss before interest and tax, and actually shrunk its revenue by 21%, to CN¥3.7b. To be frank that doesn't bode well.

So How Risky Is Renrenle Commercial GroupLtd?

Although Renrenle Commercial GroupLtd had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CN¥351m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Renrenle Commercial GroupLtd .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.