The intense AI boom continues unabated, and the stock price of the “dominant” Nvidia continues to take off, but this trend faces a critical test next week — “how did Nvidia perform in the second quarter”.

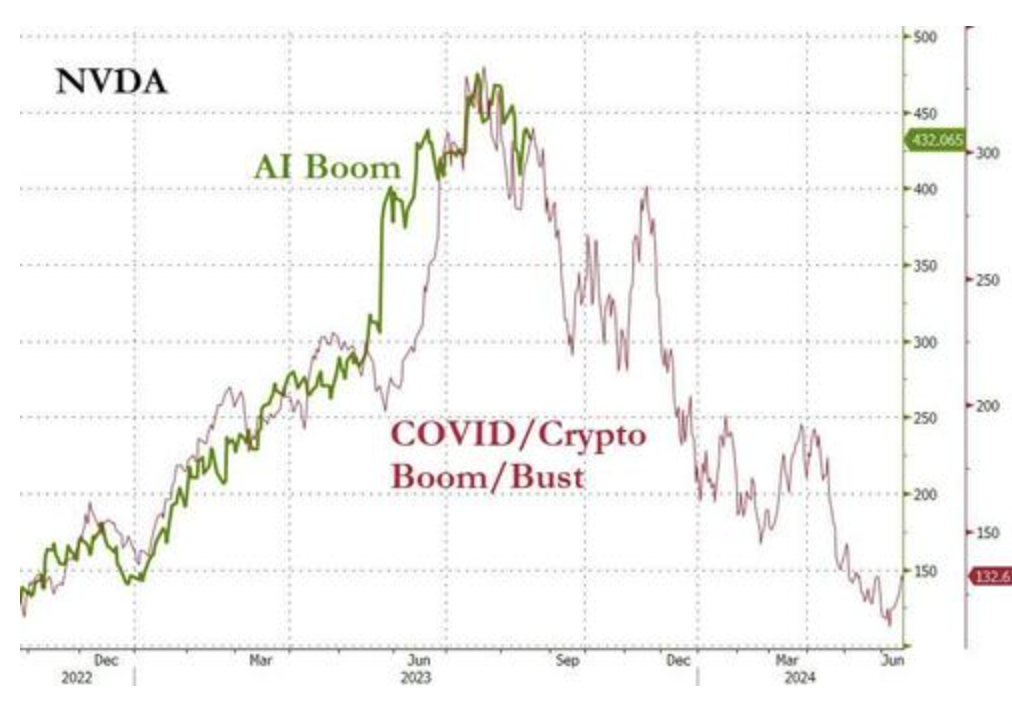

This week, Nvidia's stock price rose 2.80%, with a cumulative increase of 198% year-to-date. As of the close of last Friday, it was 432 US dollars per share. The rise is fearsome.

Next Wednesday, Nvidia will announce its second-quarter earnings report after the US stock market. This will be the “biggest test” facing this round of AI frenzy.

Currently, analysts have high expectations for Nvidia's earnings report, but if the company fails to achieve its goals, it could seriously hinder the AI boom and have an impact on tech giants from Microsoft and Google to Meta and AMD.

Demand explosion analysts have high hopes

Currently, technology companies large and small are looking for ways to get Nvidia chips. It is said that orders are scheduled for 2024, and large companies, from Musk to Saudi Arabia, are trying to get as many Nvidia chips as possible.

This explosion in demand is the reason why Nvidia's second-quarter performance guidelines announced during the last earnings call exceeded expectations. At the time, analysts expected revenue to be 7.2 billion US dollars.However, Nvidia said it will achieve revenue of about 11 billion US dollars this quarter, an increase of 64% over the same period last year. Wall Street analysts now expect to achieve this target next week.

Wall Street is also forecasting earnings of $2.07 per share, up 306% year over year.Nvidia is used to huge numbers, but they have high expectations for next week's report.

Forrester analyst Glenn O'Donnell explained:

What Nvidia announces in its upcoming financial report will be a barometer of the entire artificial intelligence hype. Since demand is so high, Nvidia's performance will be excellent, which means Nvidia can obtain higher profit margins than before.

Wall Street actively sings multiple hedge funds to get on the bus

A number of Wall Street players have expressed their bullish views on the semiconductor giant.

Rosenblatt Securities analyst Hans Mosesmann raised his target price to an astonishing $800, which meant that its stock price was 80% higher than its current price. Mosesmann stated:

There's no doubt that Nvidia is speeding on the artificial intelligence highway, leaving its rivals behind. With unrivalled advantages in compilers, libraries, and software tools, Nvidia can overcome hardware specification challenges and drive recurring software revenue streams.

Additionally, Wells Fargo raised Nvidia's target share price from $450 to $500. Baird analyst Tristan Gerra raised the stock price target from $475 to $570.

Similarly, Morgan Stanley also expressed the same optimistic view. “Shifting a large amount of spending to artificial intelligence Nvidia is still our first choice”; UBS also raised Nvidia's target price. “The company is simply king; a wave of capital and new financing tools are chasing new artificial intelligence software and specialized cloud infrastructure.”

Some large hedge funds have also invested in Nvidia. Even after the stock price soared, funds such as Lone Pine, Third Point, Viking, and D1 Capital first took a stake in the artificial intelligence company in the second quarter.

A few funds didn't get on Nvidia's “fast track” until the second quarter. Among the new hedge fund holders in the second quarter, there is no shortage of well-known funds, including Lone Pine Capital and Third Point. The former currently holds a share of Nvidia accounts for 2.5% of its $11 billion publicly traded stock portfolio, while the latter holds Nvidia's share for 3% of its $6.8 billion publicly traded stock portfolio.

Hidden worries: supply can't keep up, competition is fierce

However, there are still hidden concerns behind the optimism.

As demand surged further, Nvidia experienced a supply shortage, and it was simply unable to supply as many chips as customers wanted. SMIC, Nvidia's preferred supplier of chips, is already overstretched to meet Nvidia's order needs. According to UBS Group analyst Timothy Arcuri,The surge in demand has delayed the delivery cycle of Nvidia's critical H100 chip by six to nine months.

In addition to supply not being able to keep up with the problem, Nvidia also has to face fierce competition in the semiconductor industry. Although Nvidia has built a leading edge by relying on early investments in artificial intelligence, there is no absolute security in the industry landscape. Intel is a reminder that no industry leader is secure.