Sunworks, Inc. (NASDAQ:SUNW) Not Doing Enough For Some Investors As Its Shares Slump 41%

Sunworks, Inc. (NASDAQ:SUNW) Not Doing Enough For Some Investors As Its Shares Slump 41%

Sunworks, Inc. (NASDAQ:SUNW) shareholders won't be pleased to see that the share price has had a very rough month, dropping 41% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

Sunworks, Inc. 納斯達克股票代碼:SUNW)的股東們不會很高興看到股價經歷了非常艱難的月份,下跌了41%,抵消了前一時期的積極表現。對於股東來說,最近的下跌結束了災難性的十二個月,在此期間,股東虧損了74%。

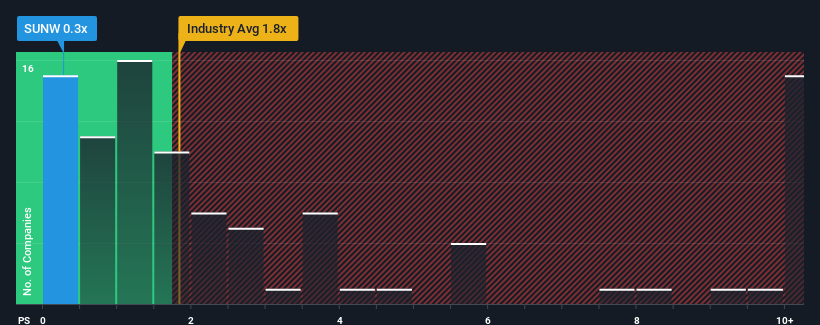

After such a large drop in price, Sunworks may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

考慮到美國電氣行業將近一半的公司的市盈率大於1.8倍,甚至市盈率高於5倍,在價格大幅下跌之後,Sunworks目前可能正在發出買入信號,其市盈率(或 “市盈率”)爲0.3倍。儘管如此,我們需要更深入地挖掘,以確定降低市盈率是否有合理的基礎。

View our latest analysis for Sunworks

查看我們對 Sunworks 的最新分析

How Has Sunworks Performed Recently?

Sunworks 最近的表現如何?

Recent revenue growth for Sunworks has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Sunworks最近的收入增長與該行業一致。也許市場預計未來的收入表現將下滑,這使市盈率受到抑制。如果你喜歡這家公司,你會希望情況並非如此,這樣你就可以在股票失寵的時候買入一些股票。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

關於低市盈率,收入增長指標告訴我們什麼?

Sunworks' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Sunworks的市盈率對於一家預計增長有限、重要的是表現不如行業的公司來說是典型的。

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. Pleasingly, revenue has also lifted 209% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

回顧過去,去年該公司的收入增長了28%。令人高興的是,由於過去12個月的增長,總收入也比三年前增長了209%。因此,股東們肯定會歡迎這些中期收入增長率。

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 18% over the next year. That's shaping up to be materially lower than the 22% growth forecast for the broader industry.

轉向未來,報道該公司的雙重分析師的估計表明,明年的收入將增長18%。這將大大低於整個行業22%的增長預期。

With this information, we can see why Sunworks is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

有了這些信息,我們可以明白爲什麼Sunworks的市盈率低於該行業。看來大多數投資者預計未來的增長將有限,只願意爲該股支付較低的金額。

What We Can Learn From Sunworks' P/S?

我們可以從 Sunworks 的 P/S 中學到什麼?

The southerly movements of Sunworks' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Sunworks股票的向南走勢意味着其市盈率現在處於相當低的水平。通常,我們傾向於將價格與銷售比率的使用限制在確定市場對公司整體健康狀況的看法上。

We've established that Sunworks maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

我們已經確定,Sunworks維持其低市盈率,原因是其預期的增長低於整個行業,正如預期的那樣。股東對公司收入前景的悲觀情緒似乎是市盈率低迷的主要原因。在這種情況下,很難看到股價在不久的將來會強勁上漲。

It is also worth noting that we have found 5 warning signs for Sunworks (1 is significant!) that you need to take into consideration.

還值得注意的是,我們已經發現 Sunworks 的 5 個警告標誌 (1 很重要!)這是你需要考慮的。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果過去盈利增長穩健的公司是你的選擇,你可能希望看到這個 免費的 彙集了其他盈利增長強勁且市盈率低的公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 取得聯繫 直接和我們在一起。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。