Arowana, once known as “rapeseed,” seems to be in a profit situation. Net profit for the first half of the year fell 51.13% year on year, and net profit after deducting non-net profit fell 99.40% year on year.

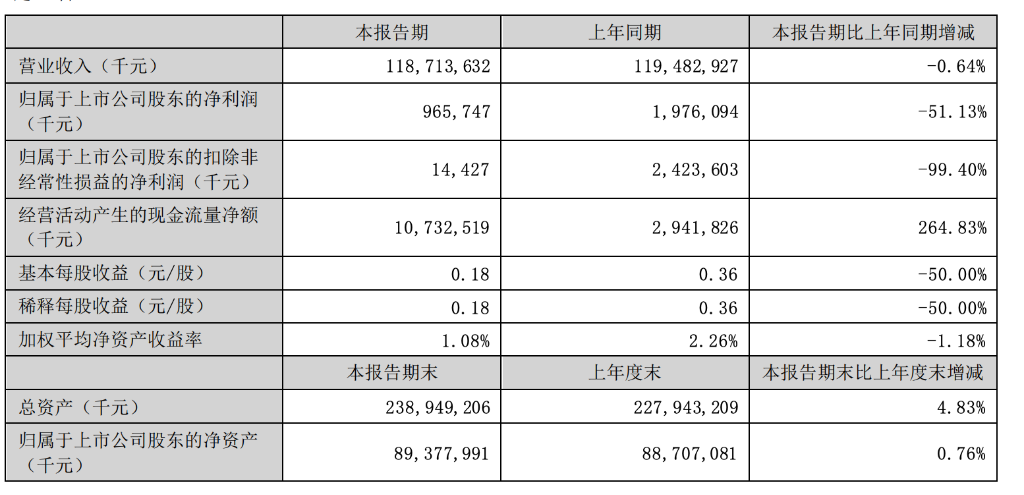

On the afternoon of August 11, Arowana announced its 2023 semi-annual report. As of June 30, Arowana's revenue was 118.714 billion yuan, down 0.64% year on year; net profit attributable to shareholders of listed companies was 966 million yuan, down 51.13% year on year; net profit attributable to shareholders of listed companies deducted non-recurring profit and loss was 144.27 million yuan, down 99.40% year on year; basic earnings per share of 0.18 yuan, a sharp drop of 50% from 0.36 yuan in the same period last year.

Arowana's net profit for the first quarter of this year was 854 million yuan, while Arowana's net profit for the second quarter was only 112 million yuan, down 87% from the previous quarter.

It is worth mentioning that since its listing, the overall profitability of arowana has declined.From 2020 to the first quarter of 2023, arowana's gross margins were 11.01%, 8.18%, 5.68%, and 5.13%, respectively, with a total decrease of 5.88 percentage points over the four reporting periods; net interest rates were 3.37%, 1.98%, 1.21%, and 1.25%, respectively, with a total decrease of 2.12 percentage points over the four reporting periods.

However, the gross margin of arowana in the first half of this year was 4.15%, a further decline from 5.13% in the first quarter of this year; the net interest rate was only 0.67%, so the downward trend is obvious.

Looking at it by business,Revenue from kitchen food products was 73.525 billion yuan, down 3.43% year on year; Revenue from feed ingredients and oil technology products was 44.464 billion yuan, up 4.70% year on year; revenue from other products was 725 million yuan, down 17.45% year on year.

Arowana pointed out in the report that operating income declined slightly compared to the same period last year, mainly due to the influence of price factors:

With the gradual recovery of the domestic economy, sales of the company's kitchen food, feed ingredients, and oil technology products have increased compared to the same period last year, but the price of the products has declined somewhat as the prices of major raw materials such as soybeans, soybean oil, and palm oil have fallen.

Regarding the sharp decline in profit margins, Arowana pointed out in its earnings report:

Prices of wheat, flour and by-products declined overall in the first half of the year, and the company's performance declined due to consumption of high-priced wheat stocks in the early period. On the other hand, with the increase in eating out, the sales volume of retail channel products, mainly household consumption, decreased year-on-year, but the decline in raw material costs led to a year-on-year increase in gross margin and profit of retail channel products.

Overall, the increase in retail channel product profits did not fully offset the impact of the decline in food and beverage channel product profits, resulting in a year-on-year decline in kitchen food profits.

Net profit after deduction fell 70.94% year over year.

By the close of trading on August 11, Arowana's stock price was 41.2 yuan, with a total market capitalization of 223.4 billion yuan. The stock price had fallen back to the level of October 2020.Compared with the previous all-time high of 145.36 yuan, the stock price dropped by more than 70%, and the market capitalization evaporated by 560 billion yuan.

Arowana's profit woes

At the beginning of its listing, arowana was regarded by the outside world as “rapeseed.” However, in 2021, the second year after listing, there was a phenomenon where revenue and profit did not increase, and the company's gross margin and net interest rate data continued to decline, which was slightly inferior to other food and beverage leaders.

In that year, the company achieved revenue of 226.2 billion dollars, an increase of 16.06% over the previous year, and achieved attributable net profit of 18.5 billion yuan, a decrease of 31.15% over the previous year.

In 2022, Arowana achieved revenue of 257.5 billion yuan, an increase of 13.82% over the previous year; it achieved net profit attributable to 3,011 billion yuan, a year-on-year decrease of 27.12%.

In the first quarter of 2023, Arowana achieved revenue of 61.04 billion yuan, an increase of 7.97% over the previous year, and realized attributable net profit of 854.1 million yuan, an increase of 645.99% over the previous year. However, the company's deduction of non-net profit was only 240.4 million, down 70.94% year on year. Analysts believe that this data shows that the company's main business is sluggish.

Some investors once asked about arowana's “increase in revenue without increasing profit,” and the company replied that it was related to factors such as the macro environment and agricultural product prices.

In recent years, Arowana has been developing new businesses, including high-margin products such as cosmetics, condiments, and prepared dishes.

In July, Arowana said on an interactive platform that the company's central kitchen projects in Hangzhou, Chongqing, Zhoukou, and Xi'an have been put into operation. Currently, production capacity is climbing, and no specific data on the production and sales volume of central kitchen products has been disclosed. The central kitchen is a very important new business segment of the company, and the company's existing business will basically play a role in the central kitchen. The company has a series of cost advantages in production, marketing, distribution, etc., and the product quality is of high quality, which I believe will bring good benefits.

Since the business has just started and the company's current rice and noodle oil business base is large, it is expected to account for a very small share of revenue in the short term.