The CHK Oil Limited (HKG:632) share price has fared very poorly over the last month, falling by a substantial 29%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

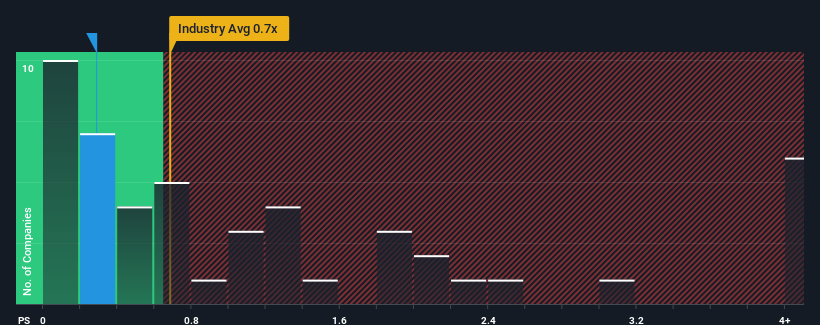

Although its price has dipped substantially, there still wouldn't be many who think CHK Oil's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Oil and Gas industry is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for CHK Oil

What Does CHK Oil's Recent Performance Look Like?

For instance, CHK Oil's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for CHK Oil, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, CHK Oil would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 77% decrease to the company's top line. Still, the latest three year period has seen an excellent 102% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to shrink 5.7% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, we find it intriguing that CHK Oil's P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does CHK Oil's P/S Mean For Investors?

CHK Oil's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As mentioned previously, CHK Oil currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Having said that, be aware CHK Oil is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of CHK Oil's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.