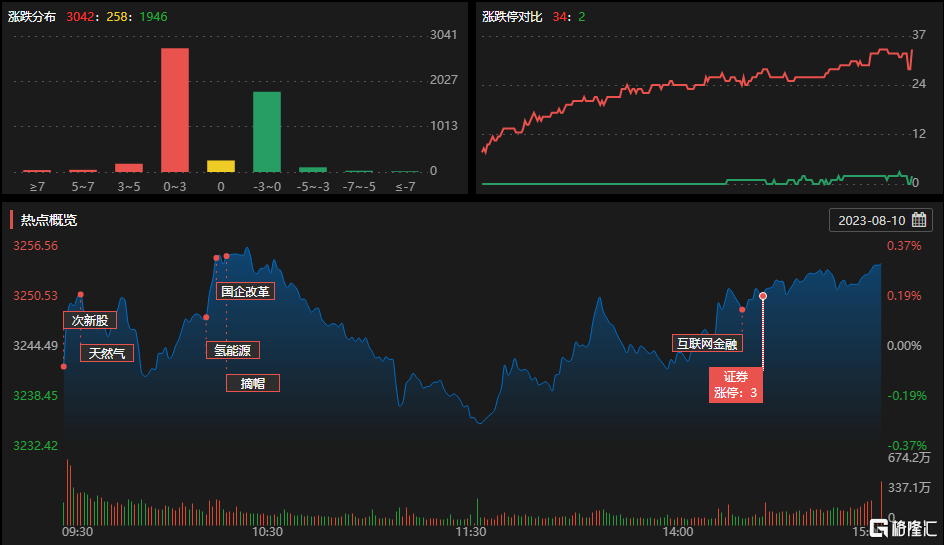

Today, 24 shares rose by the daily limit and 7 shares fried the board, with a closure rate of 77%. On the whole, stocks rose more than fell less, and more than 2900 stocks in the two markets rose. The turnover on the Shanghai and Shenzhen stock markets today was 694.2 billion, a decrease of 42.4 billion compared with the previous trading day, and the transaction volume fell below 700 billion.

In terms of high-level stocks, Hengyin Science and Technology 5 connected boards, Keyuan Pharmaceutical, Saili Medical 3 connected boards, Royal Silver shares 2 connected boards, first Securities 13 days 6 boards, dry Landscape Garden, Chinese Capital Industries 3 days 2 boards, Whitton, Renxin New Materials, pioneering Electric, Shouhua Gas 20CM first Board.

Let's take a look at today's Dragon and Tiger list:

Today, the top three daily net purchases on the Dragon and Tiger list are China Merchants Nanyou, Pacific Ocean and Blue Arrow Electronics, which are 175 million yuan, 138 million yuan and 94.8452 million yuan respectively.

Dragon and Tiger list net sales three days ago for the first Securities, Cinda Securities, Jingyeda, respectively-103 million yuan,-60.618 million yuan,-47.3735 million yuan.

Among the stocks involved in institutional seats on the Dragon and Tiger list, the top three net purchases on that day were Pacific, China Merchants Nanyou and Keyuan Pharmaceutical, which were 151 million yuan, 102 million yuan and 53.2368 million yuan respectively.

Among the stocks involved in institutional seats on the Dragon and Tiger list, the top three net sales on that day were Whitton, Blue Arrow Electronics and Royal Silver shares, which were-58.9188 million yuan,-39.8877 million yuan and-22.6119 million yuan respectively.

Some of the stock topics on the list:

Pacific (Securities + Internet Finance)

1. Late at night on August 3, the securities industry "targeted reserve reduction" landed. China Clearing plans to reduce the contribution ratio to an average of about 13% from October this year, exceeding the original expectation of 15%.

2. The company's main business is securities underwriting and listing recommendation, securities self-trading, securities agency trading and other business. The main services are securities brokerage business, credit business, asset management business, investment banking business, securities investment business, securities research business, private investment fund business, alternative investment business. 3. The announcement on May 10, 1919 revealed that Internet financial business continues to take the online business platform as the starting point to promote business transformation.

China Merchants Nanyou (Shipping + crude Oil Transportation + State-owned Enterprise Reform)

1. The company is mainly engaged in fuel supply and chemical trade business, domestic and foreign trade oil products, chemicals and gas transportation business. In terms of crude oil transportation, the company is mainly engaged in domestic coastal crude oil transportation and supplemented by a small amount of foreign trade transportation.

2. In the aspect of refined oil transportation, the company is mainly engaged in foreign trade transportation, and its main operating areas include Northeast Asia, Singapore and Australia, as well as the Middle East and East Africa; in addition, the company's foreign trade refined oil business is also slightly involved in the United States, the Mediterranean and the Baltic Sea. Chemicals and gas transport operating areas for the domestic coastal, far East and Southeast Asian routes.

3. The company is a state-owned enterprise. The ultimate controller of the company is the State-owned assets Supervision and Administration Commission of the State Council.

Tiandi online (virtual digital human + virtual IP+ advertising marketing + digital collection)

1. The company's main business is to provide Internet advertising and enterprise-level SaaS marketing services. The company provides Internet advertising and enterprise-level SaaS marketing services, including online advertising marketing services and enterprise-level SaaS sales and promotion services.

2. Tiandi online is committed to providing customers with digital image production, digital image operation, digital idol service, digital content planning and production, social platform operation and other services.

3. From the release of the first virtual IP Yuanqi, to reaching a strategic cooperation with UME Studios to create "Meta-Universe Cinema", and then to joining the Meta-Universe Industry Committee to become a member of the standing Committee of the Committee, Tiandi online's continuous increase in virtual digital content business fully demonstrates the company's strategic layout and determination for this part of the business.

4. Qiyuan Tiandi, a wholly-owned subsidiary of Tiandi online, officially signed an agreement with Shanghai Zhongyuan Network Co., Ltd., becoming iQIYI, Inc. 's first official digital collection business partner.

Institutions focus on trading individual stocks:

Pacific: trading volume 9.214 billion yuan, turnover 29.22%, Shanghai Stock Connect dedicated seats sold for 89.0679 million yuan, an agency dedicated seats net bought 151 million yuan.

McCall: the daily limit is 20.00%, the turnover is 416 million yuan and the amplitude is 13.78%. The net purchase of the organization is 17.6054 million yuan, and the total net purchase of seats in the business department is 15.973 million yuan.

N Blue Arrow Electronics: up more than 200%. After-hours data show that the second securities business department of Oriental Fortune Securities Co., Ltd. in Lhasa Tuanjie Road bought 42, 140000 yuan and sold 8, 30000 yuan, while the four institutions sold 39.88 million yuan.

Tiandi online: trading limit, the turnover rate is 24.1%, and the turnover is 751 million yuan. The three institutions bought 7.196 million yuan and sold 26.5627 million yuan at the same time, making a total net purchase of 19.3668 million yuan.

Whitton: 20CM rose by the daily limit, with a turnover rate of 64.07% and a turnover of 1.051 billion yuan. According to the data of the Dragon and Tiger list, four organizations ranked first, second, third and five seats, buying 24.0443 million yuan and selling 82.9631 million yuan at the same time, with a total net sale of 58.9188 million yuan.

In the Dragon and Tiger list, there are 4 stocks involved in the Shanghai Stock Connect dedicated seats, with the largest net purchase of the Shanghai Stock Connect dedicated seats of China Merchants Nanyou, with a net purchase of 25.5577 million yuan.

In the list of dragons and tigers, there are 3 stocks related to the special seats of Shenzhen Stock Exchange, and the net purchase of the seats of Shenzhen Stock Exchange of Oriental Garden is the largest, with a net purchase of 8.8168 million yuan.

Hot money operation trend:

Chapter leader: a net purchase of 56.89 million yuan for Tiandi online

Shinichi: a net purchase of 215 million yuan from the Pacific and 9.223 million yuan from Renxin

Chen Xiaoqun: net purchase of Keyuan Pharmaceutical 19.01 million yuan, innovative new materials 3.996 million yuan

Fang Xinxia: net purchase of Cinda Securities 36.39 million yuan; net sale of pioneering securities-24.15 million yuan

Ningbo Jiefang Nan: net purchase of dry Landscape Garden 5.43 million yuan