The Science and Technology Innovation Board 100 Index will be released on August 7,Four fund companies, including Bosch, Penghua, Cathay Pacific, and Yinhua, have already obtained the first batch of authorizations for the Sci-Tech Innovation 100 ETF. It is expected that related product reports will also advance soon, and investors are expected to use the Sci-Tech Innovation 100 ETF to participate in the Sci-Tech Innovation Board investment in the near future.

In terms of market capitalization, the market capitalization of the Science and Innovation 100 Index companies is mainly concentrated below 20 billion yuan, accounting for 81%, while companies with market capitalization of 10-20 billion yuan account for 52%.

In terms of industry division, the industries that account for more than 10% are pharmaceuticals (29%), electronics (23%), machinery (16%), and computers (10%) in that order. Judging from the rise and fall rates, in the year-to-date range, 40 have only risen and 60 have declined. Of these, 21 have increased more than 20%. The top ten increases are Wealth Trends, Weijie Chuangxin, Hongsoft Technology, Tuojing Technology, Yuncong Technology, Information Technology, Xinke Mobile, Xinyichang, Xinyichang.

In terms of growth, the growth rate of the revenue and net profit of Sci-Innovation 100 in 2022 was higher than the Sci-Tech Innovation Board as a whole, lower than the Sci-Innovation 50, and the ROE and R&D expenses ratio higher than the Sci-Tech Innovation 50 and the Science and Technology Innovation Board as a whole.

Looking at fund holdings, according to the 2023 fund semi-annual report holding data, the market value of public fund holdings on the Science and Technology Innovation Board was 288.063 billion yuan, accounting for 9.4% of the total market value of public fund holdings, up 17.782 billion yuan from Q1 2023, an increase of 6.6% for the quarter. The top ten fund holdings by market value were Jinshan Office, SMIC, Zhongwei, Tianhe Solar, Communications Holdings, Lanqi Technology, Cambrian-U, Jingke Energy, Tuojing Technology, and Central Control Technology. Increase holdings in the electronics, computer, pharmaceutical and mechanical equipment industries, and reduce holdings in the new electricity industry and military industry.

By industry, publicly held science and technology innovation board companies are mainly concentrated in electronics, computers, power equipment, pharmaceuticals, biology, machinery and equipment industries. The industry with the highest market capitalization of holdings is the electronics industry, accounting for 47.77% of total holdings, up 8.88% from the previous quarter; the second is computers, with a market value of 46.744 billion yuan, accounting for 16.23% of the total market value of holdings, up 0.52% from the previous quarter; followed by the power equipment and new energy industry, with a market value of 371.01 billion yuan 12.88 of total market value of holdings %, a decrease of 473% from the previous quarter; holdings of pharmaceuticals, biology, machinery and equipment increased, accounting for 8.27% and 8.13%, respectively; national defense and military holdings were reduced, accounting for 3.83% of holdings.

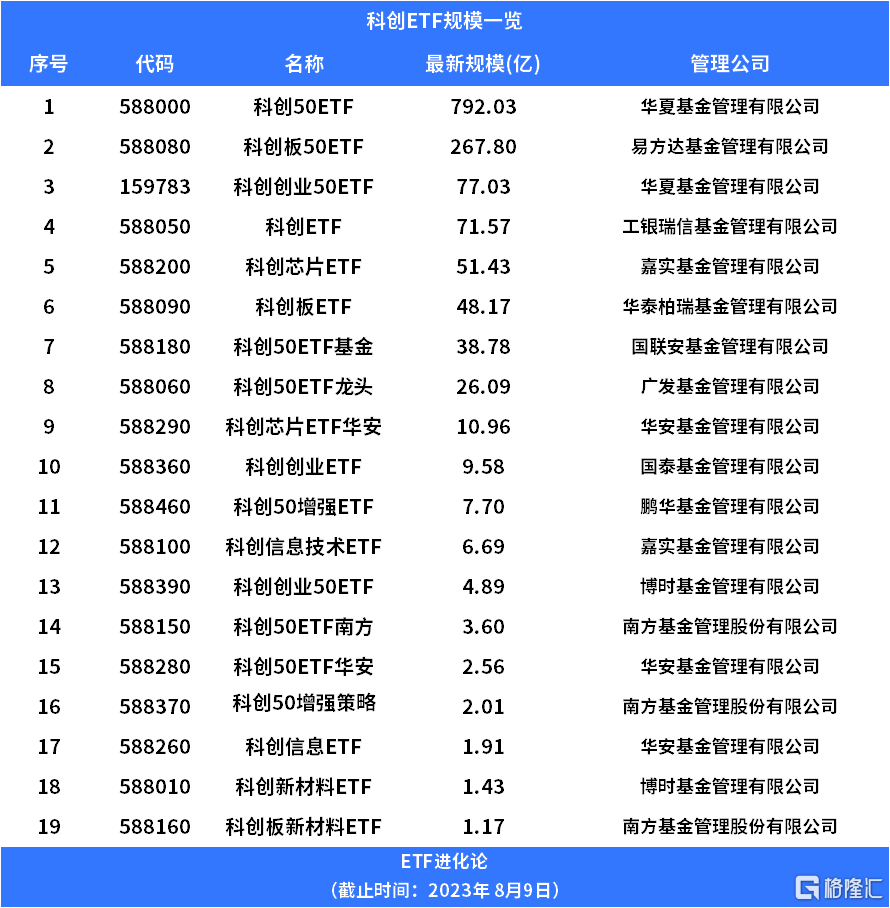

As of August 7, there were 30 ETFs tracking science and innovation themed indices, with a total scale exceeding 150 billion yuan. Among them, the Huaxia Sci-Tech Innovation 50 ETF reached 79.2 billion yuan, ranking first. The scale of the 50 ETFs on the Yi Fangda Science and Technology Innovation Board also reached 26.7 billion yuan. Including these two ETFs, there are 8 science and innovation-themed ETFs with a scale of over 2 billion yuan.

Galaxy Securities believes that with the gradual recovery of the economy, the downstream boom continues to pick up. Combined with the advancement of AIGC, digital economy, and innovation policies, and the continuous opening and implementation of application scenarios, the valuation of the Science and Technology Innovation Board is expected to bottom out and the allocation value of high-quality individual stocks is gradually showing. We can focus on computer software and hardware investment opportunities under AIGC, Innovation, and the digital economy circuit, as well as the semiconductor sector under anticipated restoration of inventories, and high-end manufacturing sectors with a clear pattern of competitive stock markets. Investment opportunities.