Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Pacific Century Regional Developments Limited (SGX:P15) shareholders over the last year, as the share price declined 29%. That falls noticeably short of the market decline of around 1.8%. However, the longer term returns haven't been so bad, with the stock down 3.2% in the last three years. Unfortunately the share price momentum is still quite negative, with prices down 15% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since Pacific Century Regional Developments has shed S$132m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Pacific Century Regional Developments

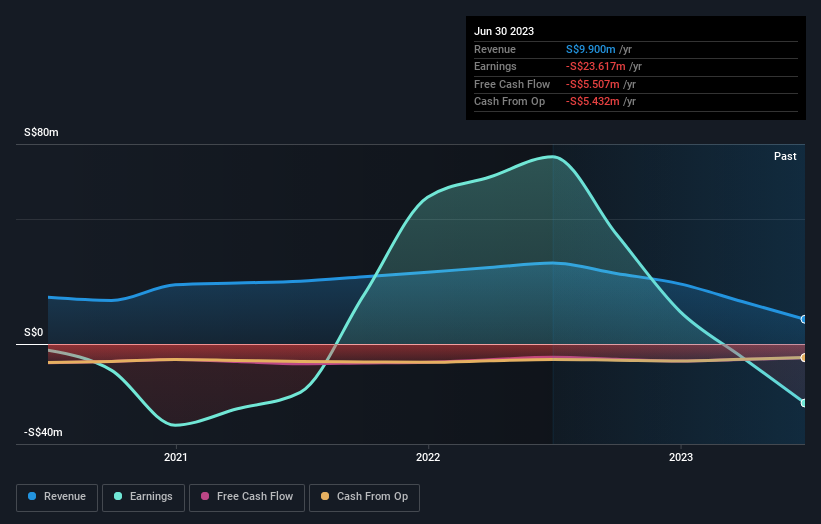

Pacific Century Regional Developments wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Pacific Century Regional Developments' revenue didn't grow at all in the last year. In fact, it fell 69%. If you think that's a particularly bad result, you're statistically on the money Meanwhile, the share price dropped by 29%. It's always work digging deeper, but we'd probably need to see a strong balance sheet and bottom line improvements to get interested in this one.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 1.8% in the last year, Pacific Century Regional Developments shareholders lost 28% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 12%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Pacific Century Regional Developments you should be aware of.

But note: Pacific Century Regional Developments may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.