[performance focus]

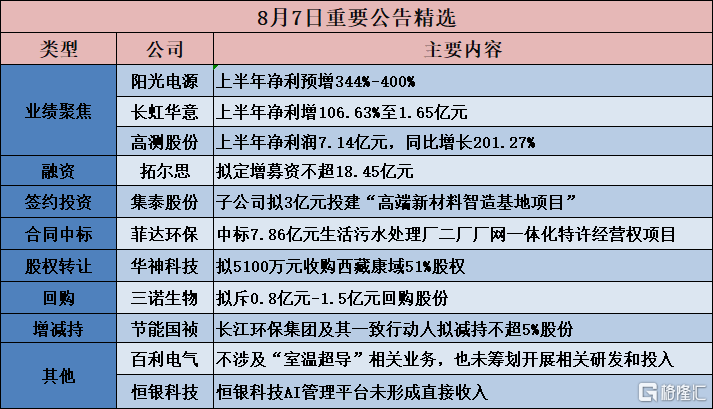

Sunshine Power supply (300274.SZ): net profit increased by 344% in the first half of the year. 400% revenue from core products such as photovoltaic inverters and energy storage systems increased significantly compared with the same period last year.

Sunshine Power (300274.SZ) issued a half-year performance forecast for 2023, with operating income of 26 billion yuan to 30 billion yuan during the reporting period, an increase of 112% over the same period last year. Net profit belonging to shareholders of listed companies was 4 billion yuan to 4.5 billion yuan, up 344% 400% over the same period last year. Net profit after deducting non-recurring profits and losses was 3.9 billion yuan to 4.4 billion yuan, an increase of 390% over the same period last year.

During the reporting period, the global new energy market maintained rapid growth, the company continued to increase R & D and innovation, persisted in in-depth development, continued to promote the strategy of full coverage of market-tasting products, gave full play to the advantages of the global marketing service network, and the brand influence continued to expand. Market leadership has been further enhanced, and revenue from core products such as photovoltaic inverters and energy storage systems has increased significantly compared with the same period last year. At the same time, benefiting from the improvement of lean operation capacity, the decline of sea freight and the increase in exchange earnings, the company's net profit belonging to shareholders of listed companies increased significantly during the reporting period.

Shanxi Coking Coal (000983.SZ): net profit in the first half of the year decreased by 29.43% to 4.517 billion yuan

Shanxi Coking Coal (000983.SZ) released its semi-annual report for 2023, with operating income of 27.56 billion yuan during the reporting period, down 15.70% from the same period last year; net profit belonging to shareholders of listed companies was 4.517 billion yuan, down 29.43% from the same period last year; net profit belonging to shareholders of listed companies after deducting non-recurring profits and losses was 4.547 billion yuan, down 19.85% from the same period last year; and basic earnings per share was 0.8425 yuan.

China Test Navigation (300627.SZ): net profit in the first half was 176 million yuan, up 30.33% from the same period last year.

China Test Navigation (300627.SZ) released a semi-annual report that operating income was 1.208 billion yuan, an increase of 30.09% over the same period last year, and net profit was 176 million yuan, an increase of 30.33% over the same period last year, deducting non-net profit of 157 million yuan, an increase of 67.57% over the same period last year, and basic earnings per share of 0.3293 yuan.

South Micro Medicine (688029.SH): first-half net profit of 264 million yuan, an increase of 111.69% over the same period last year

South Micromedicine (688029.SH) released its half-yearly report for 2023, with operating revenue of 1.147 billion yuan during the reporting period, an increase of 19.46 percent over the same period last year. The net profit belonging to shareholders of listed companies was 264 million yuan, an increase of 111.69 percent over the same period last year. The net profit after deducting non-recurring gains and losses belonging to shareholders of listed companies was 259 million yuan, an increase of 116.87% over the same period last year. Basic earnings per share is 1.4070 yuan.

688181.SH: net profit fell 57.94% to 53.6978 million yuan in the first half of the year

688181.SH released its semi-annual report for 2023, with operating income of 408 million yuan for the reporting period, down 21.57% from the same period last year; net profit belonging to shareholders of listed companies was 53.6978 million yuan, down 57.94% from the same period last year; net profit belonging to shareholders of listed companies after deducting non-recurring profits and losses was 45.159 million yuan, down 60.22% from the same period last year; and basic earnings per share was 0.40 yuan.

688002.SH: net profit in the first half was 257 million yuan, up 129.03% from the same period last year.

Ruichuang Weinar (688002.SH) released its semi-annual report of 2023, with operating income of 1.784 billion yuan during the reporting period, an increase of 64.16% over the same period last year. The net profit belonging to shareholders of listed companies was 257 million yuan, an increase of 129.03% over the same period last year. The net profit after deducting non-recurring gains and losses belonging to shareholders of listed companies was 230 million yuan, an increase of 131.20% over the same period last year. Basic earnings per share is 0.5764 yuan. Business revenue increased by 64.16% over the same period last year, mainly due to the substantial increase in revenue from the two main businesses, infrared thermal imaging and microwave radio frequency, during the reporting period.

Changhong Huayi (000404.SZ): net profit in the first half increased by 106.63% to 165 million yuan

Changhong Huayi (000404.SZ) released its semi-annual report for 2023, with operating income of 7.737 billion yuan for the reporting period, an increase of 7.66% over the same period last year; net profit belonging to shareholders of listed companies was 165 million yuan, up 106.63% over the same period last year; net profit belonging to shareholders of listed companies excluding non-recurring profits and losses was 176 million yuan, up 159.21% from the same period last year; and basic earnings per share was 0.2368 yuan.

002233.SZ: net profit increased by 178.03% to 486 million yuan in the first half of the year

002233.SZ released its semi-annual report for 2023, with operating income of 2.871 billion yuan for the reporting period, an increase of 10.72% over the same period last year. Net profit belonging to shareholders of listed companies was 486 million yuan, up 178.03% over the same period last year. Net profit belonging to shareholders of listed companies excluding non-recurring profits and losses was 389 million yuan, up 89.65% over the same period last year; and basic earnings per share was 0.42 yuan.

High Test Co., Ltd. (688556.SH): first-half net profit of 714 million yuan, up 201.27% from the same period last year

688556.SH released its semi-annual report for 2023, with operating income of 2.521 billion yuan during the reporting period, an increase of 88.80% over the same period last year. The net profit belonging to shareholders of listed companies was 714 million yuan, an increase of 201.27% over the same period last year. The net profit after deducting non-recurring gains and losses belonging to shareholders of listed companies was 692 million yuan, an increase of 197.40% over the same period last year. Basic earnings per share is 2.23 yuan.

Jiuzhitang (000989.SZ): first-half net profit fell 33.55% to 245 million yuan

000989.SZ released its semi-annual report for 2023, with operating income of 1.819 billion yuan for the reporting period, down 3.72% from the same period last year; net profit belonging to shareholders of listed companies was 245 million yuan, down 33.55% from the same period last year; net profit belonging to shareholders of listed companies after deducting non-recurring profits and losses was 236 million yuan, up 77.40% from the same period last year; and basic earnings per share was 0.28603 yuan.

[contract project]

Jitai Co., Ltd. (002909.SZ): the subsidiary plans to invest 300 million yuan to build the "High-end New material Intelligence Base Project".

Jitai shares (002909.SZ) announced that Conghua Zhaoshun, a wholly owned subsidiary of the company, plans to invest in the construction of a "high-end new material intelligent base project" in Conghua District, Guangzhou City, with an investment of about 300 million yuan. The purpose of this overseas investment is to further improve the company's business layout and meet the emerging rubber markets in the field of new energy vehicles and power batteries and LED drive power supply, which is conducive to the long-term and stable development of the company.

[Win the contract]

China Keyun Network (002306.SZ): the holding subsidiary signed the construction contract of 281 million yuan for the mechanical and electrical general contract project.

002306.SZ announced that the holding subsidiary, Zhongke Gaoyou, signed the "Mechanical and Electrical General contract Project Construction contract" with Hubei Sanjiang Aerospace Construction Engineering Co., Ltd. Sanjiang Aerospace Building will be responsible for the construction of the first phase of Zhongke Gaoyou high-efficiency battery project and supporting projects, with a contract price of 281 million yuan.

Azure Dragon Pipe Industry (002457.SZ): pre-winning bid 227 million yuan procurement of steel-plastic composite pipes and fittings for multi-diversion projects in Lhasa

Azure Dragon Pipe Industry (002457.SZ) announced that the Department of Water Resources of Tibet Autonomous region issued a "notice of winning candidates" for the procurement of steel-plastic composite pipes and pipe fittings for multi-diversion projects in Lhasa. Ningxia Azure Dragon Steel-plastic Composite Pipe Co., Ltd., the holding subsidiary of Ningxia Azure Dragon Pipe Group Co., Ltd., was named the first winning candidate in the procurement and evaluation activities of steel-plastic composite pipes and pipe fittings for multi-diversion projects in Lhasa. It is estimated that the winning bid amount is 227473391.00 yuan, accounting for 8.84% of the company's audited total revenue in 2022.

Feida Environmental Protection (600526.SH): the consortium won the bid of 786 million yuan for the second plant and network integrated franchise project of the domestic sewage treatment plant.

Feida Environmental Protection (600526.SH) announced that recently, the consortium of subsidiary Ziguang Environmental Protection and China Shipping Construction won the bid for the second plant-network integrated franchise project of the domestic sewage treatment plant in Nankang District, Ganzhou City, and signed a relevant contract with the City Administration of Nankang District of Ganzhou City. The winning contract amount is 786 million yuan, and the implementation time is 30 years from the date of signing the franchise contract (including 2 years of construction period). The place of performance shall be designated by the Urban Administration of Nankang District, Ganzhou City.

Yutong heavy Industry (600817.SH): won the bid of 264 million yuan in the second section of the franchise project of the integration of sanitation construction and service in the upper district.

Yutong heavy Industry (600817.SH) announced that its subsidiary, Aolan Environmental Technology Co., Ltd., received a bid winning notice on August 4, 2023, and Aolan won the second section of the block sanitation construction and service integrated franchise project, with a total amount of 264 million yuan.

[equity transfer]

Rongqi Technology (301360.SZ): is planning to acquire 60% stake in Ningde Zhongneng

Rongqi Technology (301360.SZ) announced that it is planning to buy 60% of Ningde Zhongneng Electronic equipment Co., Ltd. (hereinafter referred to as "Ningde Zhongneng" or "target company") by paying cash (hereinafter referred to as "this transaction"). After the completion of this transaction, the company will realize the holding of Ningde Zhongneng. According to the preliminary study and calculation, this transaction is expected to constitute a major asset restructuring as stipulated in the measures for the Management of Major Asset reorganization of listed companies.

Kehua data (002335.SZ): plans to acquire the remaining 33% stake in Beijing Science and Technology Public for 111 million yuan

Kehua data (002335.SZ) announced that the company ("Party B") held the fourth meeting of the Ninth Board of Directors on August 7, 2023, and examined and passed the "Bill on the acquisition of Minority shareholders in the Company's controlling subsidiary". Based on the company's overall strategic plan, the company agreed to sign the "Equity transfer Agreement" with Sun Jiafeng ("Party A" for short). Buy its 33% stake in Beijing Kehua Zhongsheng Cloud Computing Technology Co., Ltd. (referred to as "Beijing Kezhong" or "target company") for 110.8 million yuan. After the completion of this equity transfer, the company will directly hold a 100% stake in Beijing Kezhong.

Huashen Technology (000790.SZ): plans to acquire 51% stake in Tibet Kangyu with 51 million yuan

Huashen Technology (000790.SZ) announced that the company and Tibet Wanan Pharmaceutical Information Consulting Co., Ltd. signed the "Chengdu Huashen Science and Technology Group Co., Ltd. and Tibet Wanan Pharmaceutical Information Consulting Co., Ltd., Li Jingkui, Li Zhenghong, Wang Gang about the equity transfer agreement of Tibet Kangyu Pharmaceutical Co., Ltd." The company bought 51% of Tibet Kangyu Pharmaceutical Co., Ltd. (referred to as "Tibet Kangyu") held by Tibet Wanan for 51 million yuan. After the completion of this transaction, Tibet Kangyu will become a holding subsidiary of the company and will be included in the scope of the company's consolidated statements.

[financing]

000068.SZ: plans to raise no more than 846 million yuan from the controlling shareholder

000068.SZ announced that the total amount of funds to be raised by issuing shares to specific targets will not exceed 846 million yuan, and the net amount will be used to repay interest-bearing loans after deducting the issuance costs. The target of this issue is a total of one specific investor in Shenzhen Huarongtai Asset Management Co., Ltd., which meets the requirement of no more than 35 issuing objects stipulated by the China Securities Regulatory Commission and other securities regulatory authorities. Huarongtai will subscribe for all the shares in this issue in cash. Huarongtai has signed a share subscription agreement with the company with effective conditions. Huarongtai is the controlling shareholder of the company, and this issue of shares to a specific object constitutes a related party transaction. After this issue, the controlling shareholder and the actual controller of the company will not change.

Aviation Asia Technology (688510.SH): to issue convertible bonds to raise no more than 500 million yuan

Aviation Asia Technology (688510.SH) announced the plan to issue convertible corporate bonds to unspecified objects, the total amount of funds raised by this issue of convertible bonds (including issuance costs) does not exceed 500 million yuan (including 500 million yuan). After deducting the issuance costs, the net raised funds will be used for the aero-engine key parts production line phase II construction project and 80 million yuan to supplement liquidity.

300229.SZ: it is proposed to raise no more than 1.845 billion yuan for the research and development of large model of Tuotian industry and the industrialization project of AIGC application.

300229.SZ announced that the total amount of funds to be raised from a specific target will not exceed 1.845 billion yuan, and the net funds raised after deducting the issuance costs will be used for the research and development of large models of the Toutian industry and the industrialization of AIGC applications.

[buyback]

SanNuoBio (300298.SZ): plan to spend 80 million-150 million yuan to buy back shares

300298.SZ announced that it intends to use its own funds to buy back some of the company's public shares through centralized bidding: the total amount of the proposed repurchase funds is not less than 80 million yuan and not more than 150 million yuan (including capital). The price range of the shares to be repurchased shall not exceed RMB 35.00 per share (inclusive).

New Huadu (002264.SZ): the buyback cost 51 million yuan to buy back 1.16% of the shares

New Huadu (002264.SZ) announced that the company actually repurchased shares from June 26, 2023 to August 4, 2023 ("during the buyback implementation period"). Through the buyback special securities account, it accumulated 8.3359 million shares of the company's shares through centralized bidding, accounting for 1.16% of the company's current total share capital of 719922983 shares. the highest transaction price is 6.38 yuan per share, and the lowest transaction price is 5.81 yuan per share. The cumulative total amount paid is 51 million yuan (including transaction fees). As of August 4, 2023, the amount of repurchase funds has reached the maximum limit, and the company's share buyback program has been fully implemented.

[increase or decrease holdings]

Guangwei compound material (300699.SZ): Xinyi Partnership intends to reduce its stake in no more than 4.649%.

Guang Wei compound Materials (300699.SZ) announced that shareholders Beijing Xinyi Investment Center (Limited Partnership) (referred to as "Xinyi Partnership") plans to reduce their holdings in the company by means of centralized bidding and bulk trading. During the reduction period, within six months after the three trading days from the date of the announcement, the total number of shares reduced shall not exceed 38651936 shares (that is, no more than 4.6493% of the total share capital of the company, up to 100% of the shares held by the partnership). If the company has any changes in shares during the proposed reduction period, such as the transfer of shares and the transfer of capital accumulation fund to increase share capital, the number of shares to be reduced shall be adjusted accordingly.

Guomao shares (603915.SH): real controllers Xu Bin and Shen Huiping plan to reduce their holdings by no more than 3.57%.

Guomao shares (603915.SH) announced that Mr. Xu Bin and Ms. Shen Huiping, the real controllers of the company, intend to reduce their holdings in no more than 23.6434 million shares and no more than 3.57% of the total share capital of the company. Among them, Mr. Xu Bin intends to reduce no more than 15.75 million shares of the company, the proportion of reduction shall not exceed 2.38% of the total share capital of the company, and Ms. Shen Huiping plans to reduce the shares of the company not more than 7.8934 million shares, and the proportion of reduction shall not exceed 1.19% of the total share capital of the company. The way of reducing the holdings of the above shareholders is centralized bidding trading and bulk trading.

Energy-saving Guozhen (300388.SZ): Changjiang Environmental Protection Group and its actors plan to reduce their shareholdings by no more than 5%.

Energy-saving Guozhen (300388.SZ) announced that Changjiang Environmental Protection Group and its concerted actor, three Gorges Capital (a total of 73040457 shares), plan to reduce their holdings of no more than 34046063 shares of Energy-saving Guozhen in the form of centralized bidding, block trading or exchange-traded open index securities investment fund (ETF) within six months after 15 trading days from the date of the announcement. It accounts for 5% of the total share capital of the company.

[other]

Golden Crown shares (300510.SZ): received a transaction notice of about 236 million yuan for energy storage projects.

Golden Crown Co., Ltd. (300510.SZ) announced that the company recently received a "transaction notice" from Xuchang Xuji material Co., Ltd., confirming that the company has become the trader of the energy storage battery and ancillary equipment procurement project (serial number: JTXY230598) package W01 (package name: battery and ancillary equipment), the transaction price is 235.74 million yuan (including tax price).

Bailey Electric (600468.SH): does not involve "room temperature superconductor" related business, nor does it plan to carry out related R & D and investment

Bailey Electric (600468.SH) issued an announcement of abnormal volatility in stock trading, and the company paid attention to the hot concept of "room temperature superconductivity". The company's main business is transmission and distribution and control equipment, wires and cables and pumps. The company is not involved in "room temperature superconductivity" related business, nor does it plan to carry out related R & D and investment. Beijing Yingna Superconducting Technology Co., Ltd., a subsidiary of the company, is engaged in the R & D and production of bismuth high temperature superconducting wires, which has nothing to do with "room temperature superconductivity". In 2022, Beijing Yingna Superconducting Technology Co., Ltd. had an operating income of 715900 yuan and a net profit of-4.0226 million yuan. At present, the income mainly comes from the sales of wire and teaching aids, the amount of income is small, in a state of loss, will not have a significant impact on the performance of the company.

National Cable Inspection (301289.SZ): the HTS cable involved in HTS cable testing operates at-196C, which has nothing to do with the concept of room temperature superconductivity.

National Cable Inspection (301289.SZ) announced serious abnormal fluctuations in stock trading announcement, the company's main business is to provide wire and cable and optical fiber cable inspection and other professional and technical services, wire and cable related to the national economy and people's livelihood in many aspects of application, high temperature superconducting cable testing is one of the company can provide testing areas, does not have a significant impact on the company's business. The high temperature superconducting cable involved in the detection of high temperature superconducting cable runs at-196 degrees, which has nothing to do with the concept of superconductivity at room temperature. At present, the company does not have the technology related to the concept of room temperature superconductivity and does not generate revenue.

Hengyin Technology (603106.SH): Hengyin Technology AI management platform has not formed direct income.

Hengyin Technology (603106.SH) announced that the recent market on Hengyin Technology AI management platform is more concerned. Hengyin Technology AI management platform is to provide customers with interactive communication, business management, question consultation, service guide and other services of the technical capability platform, has not formed a direct income.