The expectations of the wind power cable market are becoming more and more chaotic. Poor performance markets will feel that there is a problem with the industry's prosperity, and if the performance is good, they also have to worry about future order delays.

How do you view the performance of wind power cable companies?

01 Dongfang Cable's net profit increased 18%. The Q2 single quarter was the same as when it was rushed to install in '21, but the market was not satisfied

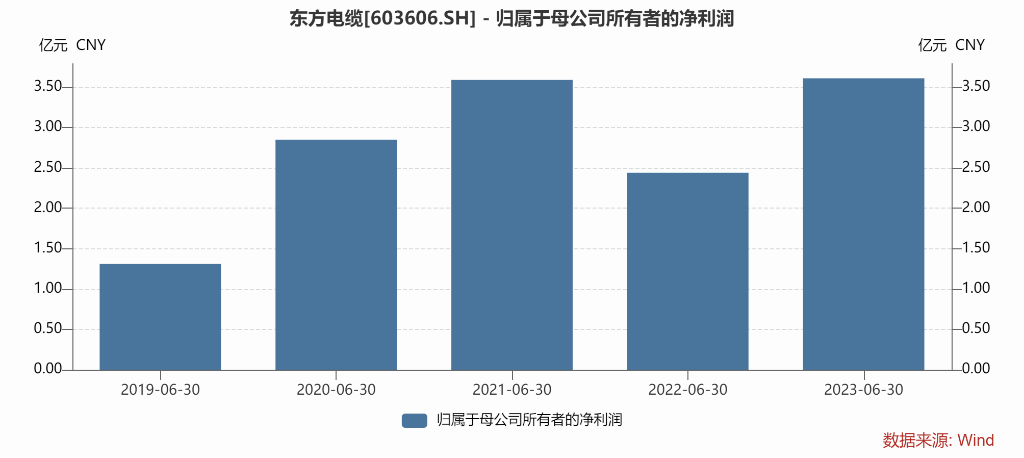

On August 4, Dongfang Cable released its semi-annual performance report. Revenue for the first half of 2023 was about 3.688 billion yuan, a decrease of 4.44% over the previous year; net profit from the parent company was about 617 million yuan, an increase of 18.08% over the previous year.

Net profit for the Q2 quarter was 361 million yuan, an increase of 47.95% over the previous year, a significant increase over the previous year, but the reason for the high growth rate is that last year's base was too low. However, the profit for the Q2 single quarter is also on par with the 2021 rush year, so this season's performance is not that bad.

By business, submarine cable systems and offshore engineering achieved revenue of 1,862 billion yuan in the first half of the year, up 1.39% year on year; land cable revenue was 1,822 billion yuan, down 9.89% year on year.

By business, submarine cable systems and offshore engineering achieved revenue of 1,862 billion yuan in the first half of the year, up 1.39% year on year; land cable revenue was 1,822 billion yuan, down 9.89% year on year.

Therefore, the decline in revenue over the past six months was mainly dragged down by land cables, and the increase in net profit was mainly brought about by the increase in revenue from high-end submarine cable products.

Specifically, the gross margin of land cables is basically 10%, and submarine cables are as high as 40%.

Beta that cannot be circumvented, the overall construction of the Haifeng industry was slow in the first half of the year.

The overall Haifeng construction rate slowed in the first half of this year. There was a Spring Festival holiday in the first quarter, which is already a traditional low season for the industry, so the market is looking forward more to the second quarter, but in reality, the construction process in the second quarter did not meet the market's original expectations.

As far as Dongfang Cable itself is concerned, progress has also slowed. incorporationIn the first half of the year, the Qingzhou 1 and 2 500Kv AC submarine cables were delivered, as well as some overseas projects. However, the Qingzhou 5 and 7 projects and the Guangdong Sailing Stone Project 1 and 2 all lagged behind due to factors such as waterways, which caused market confidence to suffer. Therefore, the company's poor performance. The above is the main reason the market is worried.

02 Year after year, the market has run out of patience, but Donggang Cable is still a leader in the industry

However, project delays are also a cliché topic; how much patience can the market actually give?

Last year, due to the impact of the epidemic, the delivery period for the Qingzhou 4 project was delayed until 2023. At that time, the market was already greatly shocked.

The market is more concerned about whether the delivery time of the company's next projects will also be extended.

By '23, some high-voltage submarine cable projects were still progressing slowly, further undermining the market's expectations for submarine cables. Coupled with orders of only 8 billion dollars at the end of July, the market's concerns about the company's future performance have deepened even further.

But the market's fears may have gone too far.Delayed delivery will affect current profit, but the order is still there and can still be fulfilled. Also, judging from order quality, this year's performance is still supported by major orders. For example, the Qatar Oil and Gas Company's NFXP umbilical cord cable project won the bid this year; the Baltica 2 offshore wind power project's 66kV submarine cable 350 million yuan order; and the signed Inch Cape offshore wind power project 220 kV 3 x 2000 mm2 delivered a preliminary cable supply engineering agreement.

From an industry perspective, differentiated competition for submarine cables still exists, and the industry has yet to enter the Red Sea stage. The threshold for high-voltage submarine cables is high, and homogenized competition has not yet emerged. As a company that makes pure cables, the market can still look forward to Dongfang Cable.