Text | Sina Finance Yuan Yiming

Why are so many brands of women's clothing these days getting smaller and smaller? Moreover, this style of a hot girl is still quite popular?

Consumers have a very different view of this change: one side believes that diverse styles and aesthetics should be respected; the other side argues that this style of attire creates anxiety about body shape.

Opinions aside, some manufacturers have indeed tasted the sweetness of “more and smaller” women's clothing; Uniqlo is one of them.

In the past few years, traditional tailoring, looseness, and comfort have always been the signature of Uniqlo apparel's success, but in the past two years, its development in Greater China has hit a wall one after another, and there has been a cliff-style decline in net profit growth. Now that Uniqlo has given up the gold display area to a “section for hot girls who look like children's clothes,” its performance has actually picked up.

So, can Uniqlo, whose overall performance is under pressure, rely on the Hot Girls series to turn the tables? Can it actually be equated with body anxiety, and who can control wealth if they master the essence of hot girls?

Women's clothing is getting smaller and smaller; does Uniqlo taste “sweet”?

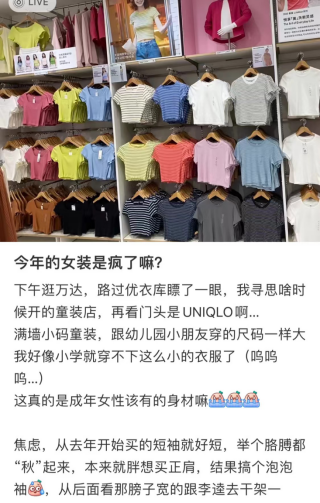

Recently, the Uniqlo Spice Girls series has been getting a lot of attention. If you open Xiaohongshu, you can see that quite a few people share their tips on how to wear the Hot Girls series, and there are also quite a few people complaining about the aesthetic anxiety brought about by the Hot Girls series. “I love it, I love it”, “Is this for kids?” “Hot girls, I can't do it”, “It's the same size as kindergarten kids wear”.

Do the right thing at the right time. The launch of the Hot Girls series in 2023 can be said that Uniqlo has mastered the traffic password. You need to know that Uniqlo's development in China has not been good in recent years.

In fiscal year 2022, the financial report of Express Sales Group, the parent company of Uniqlo, showed that annual revenue in Greater China was 27.3 billion yuan, a slight increase of 1.2% over the previous year, but the share of available revenue fell from 25% to 23.4%. According to FY2023's interim results, Uniqlo's Greater China region recorded revenue of about RMB 16.6 billion, a slight increase of 4.6% over the previous year. However, the revenue share fell further to 21.9%.

Furthermore, from an overall perspective, Uniqlo's overall development has also entered a “slow era”. As of the mid-fiscal year 2023, Uniqlo achieved total revenue of about 75.8 billion yuan, an increase of 20.4% over the previous year; achieved net profit of more than 7.9 billion yuan, an increase of 4.5% over the same period last year. The net profit growth rate showed a cliff-style decline compared to 38.7% in the same period last year.

However, the importance of the Chinese market to Uniqlo is self-evident. After all, in terms of business, the Greater China region accounts for nearly 25% of the Express Sales Group. Judging from the number of stores, Uniqlo has opened more than 1,000 stores in China, while it has a total of 3,592 stores worldwide. Nearly one-third of its stores are in China.

Tadashi Yanai, chairman of Express Sales Group, also announced three years ago that it would open 3000 stores in China. Meanwhile, in 2023, Uniqlo changed its voice and said it would continue to open new stores in China at a rate of 80 to 100 stores per year.

Jiang Han, a senior researcher at the Pangu think tank, believes that Uniqlo's business in the Chinese market has indeed encountered some challenges. This is related to factors such as intense market competition, unclear brand positioning, and insufficient product innovation. Furthermore, Uniqlo's sales channels in China are mainly shopping malls, but with the rapid development of e-commerce, consumer shopping habits have changed, which may also have an impact on Uniqlo's business.

Hot Girl Style, on the other hand, gave Uniqlo a “sweet taste.” Financial data showed that in the third quarter, net sales of the same store in mainland China increased by more than 40%, higher than expected.

Previously, Uniqlo's representative products were co-branded T-shirts, which also had a loose fit and were naturally comfortable. However, the biggest display stand now has a scaled-down version of women's clothing. These women's clothes are dubbed kindergarten sizes, and almost all of them are bright yellow, green, and pink with high saturation. They fit the current dopamine aesthetic, and are eyeing thin people's wallets.

According to Jiang Han, Uniqlo's main promotion is to replace the original big T-shirts with the Hot Girl style, probably to attract a younger target audience. Hot girl style pays more attention to fashion and sense of design, and is more suitable for the aesthetics and needs of young people. In addition, this style can also help differentiate Uniqlo from other brands and enhance its brand image.

Facilitating body anxiety, has clothing become the “original sin”?

Regarding “women's clothing is getting smaller and smaller,” many people complained that they used to be able to wear size S clothes, but now they can only wear size M. In the first episode of “It's a Good Friend's Weekend,” female celebrities Ouyang Nana, Jin Jing, and Yang Ying went shopping. As a result, all three of them found that they couldn't wear them when they tried on their pants.

Actor Zhang Xinyu also wrote an article saying that he really likes a brand of clothing, but he can't even wear his family's big size.

The fan effect has further fueled women's anger over women's clothing being made less and less angry. Some people bluntly say that it is the store that creates anxiety about their figure. “China Women's Daily” also commented that making smaller women's clothing essentially promotes slimness to the ultimate aesthetic, “shrinks” the freedom to dress that is supposed to be diverse, and it is an invisible kind of “body bullying” against girls.

However, Jiang Han believes that not all women's clothing brands are driving anxiety. Demand and supply in the womenswear market are affected by many factors, including fashion trends, consumer demand, production costs, etc. Some brands may launch smaller clothing sizes to meet market demand, but this isn't necessarily a deliberate source of anxiety.

“The pursuit of the small-size trend is indeed related to the BM style in the early days. Some brands may use this trend to market their products, but that's not the only reason. Additionally, social media also played a role in this trend, as influencers on social media often wear small-sized clothing, which could have an impact on their fans.”

From the perspective of the supply chain, Taobao store merchants have publicly stated that the sales volume of small-sized clothing is indeed better. After launching a batch of new products, it can be clearly seen that the data on the number of visitors and additional purchases of Spice Girl style clothing is better. Overall, S-size clothing also sells faster than size L.

However, from a brand's point of view, after visiting Uniqlo in person, you can see that almost all of the discounted items are plus size women's clothing size L or above, and there are almost no discounts for those under size M. “This shows to some extent that plus size clothing really doesn't sell well, and Uniqlo has to quickly clear its inventory through discounts.”

Meanwhile, internet practitioner Chen Di (pseudonym) also said that there are many styles of small-sized women's clothing, and many of them don't go oversized. On the other hand, “girls really don't like to buy clothes when they're fat. The range of options is smaller than when they're thin, so they buy less frequently.”

Affected by this change, domestic fast fashion brands have now also experienced a “collective overhaul”. Previously, brands such as H&M ushered in a wave of store closures, but BrandyMelville, CHUU, BASEMENTFG, BETTERSAY, etc. have reaped a lot of weight despite the stigma of “driving anxiety” above their heads.

Earlier, it was reported in the media that under normal circumstances, the return rate of women's clothing on e-commerce platforms is around 40%, and most of the reasons for returns are that the fit is not slim and thin, but after the popularity of small-sized women's clothing, the size of the clothes became tighter, and there were fewer returns. Meanwhile, giants Zara, Gap, etc. have also “defected” on the current situation, allowing small-sized women's clothing to occupy half of the shelves.

Conclusion:

Admittedly, women's body anxiety should be changed. While the times are developing and progressing, diverse aesthetics should be respected, and voices from all aspects of the body that accept one's body, such as strength, weight, and beauty, should be seen. Even if they are defined as “ugly,” side breasts, obliques, and body worship are parts of a woman's physiology that should be accepted and seen.

However, there should be no opposite of “diversity.” The original “hot girl style” is also part of “diversity,” and petite women seeking clothing that suits them are not “demonized” demands. As one consumer said, although there are people who are not suitable for small-sized clothes, there are also other sizes to choose from, and objecting to body anxiety is not an excuse to prevent “thin people” from buying clothes.

According to Jiang Han, today's “women's clothing is getting smaller and smaller” is the result of KOLs exerting an effect, and it is also a cause and effect under the leverage of supply and demand. “Market demand is determined by supply, and we need to negotiate instead of worrying about our size due to size reduction.