[Performance Focus]

Yao Ming Kangde (603259.SH)'s net profit exceeded 5 billion dollars for the first time in half a year, further increasing the full-year adjusted non-IFRS gross profit growth rate and free cash flow guidelines

Yao Ming Kang (603259.SH) disclosed its semi-annual performance report. According to the report, the company's revenue in the first half of the year increased 6.3% year on year to 18.871 billion yuan. If major commercial order projects were excluded, revenue from large commercial orders increased 27.9% year on year. Adjusted non-IFRS net profit was $5.095 billion, up 18.5% year over year; free cash flow was revised year over year and increased strongly to $2,926 billion.

Meanwhile, Yao Ming Kangde updated its annual guidelines. In addition to maintaining a 5% to 7% increase in revenue, it raised adjusted non-IFRS gross profit growth for the whole year to 13% to 14% and free cash flow growth to 750% to 850%.

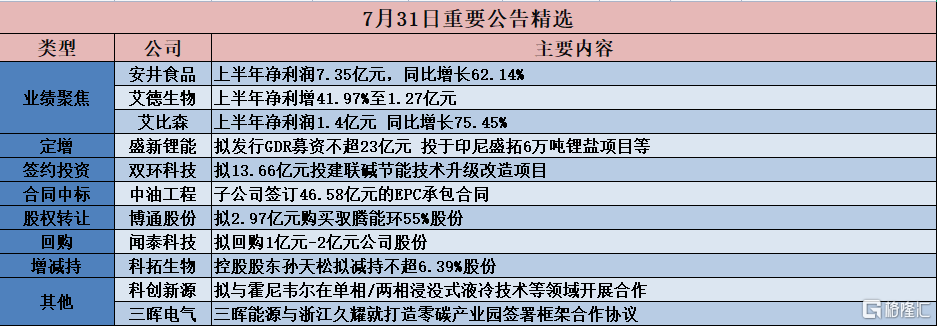

Yasui Foods (603345.SH): Net profit for the first half of the year was 735 million yuan, up 62.14% year on year

Yasui Foods (603345.SH) released its 2023 semi-annual report. Revenue for the reporting period was 6.894 billion yuan, an increase of 30.70% over the previous year. Net profit attributable to shareholders of listed companies was 735 million yuan, an increase of 62.14% over the previous year. Net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 695 million yuan, an increase of 82.65% over the previous year. The basic earnings per share were 2.51 yuan.

CLP Environmental (300172.SZ): Net profit in the first half of the year increased 11.64% to 81.0889 million yuan

CLP Environmental Protection (300172.SZ) released its 2023 semi-annual report. Revenue for the reporting period was 556 million yuan, down 10.97% year on year; net profit attributable to shareholders of listed companies was 81.0889 million yuan, up 11.64% year on year; net profit attributable to shareholders of listed companies was 598.398 million yuan, up 6.06% year on year; basic earnings per share were 0.1198 yuan.

Ed Biotech (300685.SZ): Net profit in the first half of the year increased by 41.97% to 127 million yuan

Ed Biotech (300685.SZ) released its 2023 semi-annual report. Revenue for the reporting period was 459 million yuan, up 16.87% year on year; net profit attributable to shareholders of listed companies was 127 million yuan, up 41.97% year on year; net profit attributable to shareholders of listed companies was 109 million yuan, up 42.64% year on year; basic earnings per share were 0.32 yuan.

Abison (300389.SZ): Net profit of 140 million yuan in the first half of the year increased 75.45% year-on-year

Abison (300389.SZ) released its semi-annual report, with operating income of 1.59 billion yuan, up 44.66% year on year, net profit of 140 million yuan, up 75.45% year on year, deducting non-net profit of 127 million yuan, up 121.79% year on year, and basic earnings per share of 0.3965 yuan.

[Contract project]

Shuanghuan Technology (000707SZ): Plans to invest 1,366 million yuan to build a Lianji energy saving technology upgrade project

Shuanghuan Technology (000707.SZ) announced that in order to achieve energy saving and consumption reduction, reduce production costs, and reduce safety and environmental hazards, the company plans to upgrade the 600,000-ton alkali monocalysis unit in the company's existing production line with an annual output of 600,000 tons. According to the “Feasibility Study Report on the Joint Alkali Energy-saving Technology Upgrading and Transformation Project of Hubei Shuanghuan Technology Co., Ltd.” issued by China Tianchen Engineering Co., Ltd., the total investment amount of this project is 13665.8378 million yuan. The estimated internal financial return on project capital is 8.36%, and the payback period is 9.99 years.

Fosu Technology (000973.SZ): The holding subsidiary plans to invest 808.813 million yuan to build a blown PE breathable film and its printed film production expansion project

Fosu Technology (000973.SZ) announced that in order to further expand PE breathable film production capacity and consolidate and enhance its market position, the holding subsidiary Foshan Huahan Health Materials Co., Ltd. plans to invest 88.8813 million yuan to build a blown PE breathable film and its printed film production expansion project. To support the development of Huahan Company, Foresu Technology plans to increase the capital of Huahan Company by 45 million yuan to meet part of Huahan's capital requirements for this project.

Hilti (002206.SZ): Plans to invest about 52 million US dollars to implement a high-performance tire curtain cloth project with an annual output of 18,000 tons in Vietnam and expansion of production base in Vietnam

Hailide (002206.SZ) announced that the company held the 12th meeting of the 8th board of directors on July 31, 2023. The meeting deliberated and passed the “Proposal on Implementing a High-Performance Tire Curtain Cloth Project with an Annual Output of 18,000 Tons in Vietnam and Expansion of the Vietnam Production Base”. The company plans to implement the Vietnam (Phase I) project with an annual output of 18,000 tons of high-performance tire curtain cloth. At the same time, the project is an expansion project of the company's Vietnam production base, which plans to build a new twisting workshop, weaving workshop, warehouse, etc. (structure) with a construction area of 56 square meters, purchase twisting machines and looms Production equipment such as glue dispensers, and related supporting equipment, warehouses, glue and water treatment, power conversion and distribution, cooling, heating, etc. form a construction scale of 18,000 tons of high-performance tire curtain cloth in Vietnam (Phase I) with an annual output of 18,000 tons. The total investment of the project is about 52 million US dollars.

Shanghai RYX (002252.SZ): Plans to invest about 1.6 billion yuan to expand the company's Fengxian production base

Shanghai Raix (002252.SZ) announced that based on the long-term development business plan of Shanghai Laishi Blood Products Co., Ltd., combined with the increase in slurry collection volume and the growing trend of market demand, the company plans to raise its own capital to invest in expanding the company's Fengxian production base (“investment project”) in order to meet the company's continuous development needs and increase the future production capacity and storage capacity of the company's Fengxian plant. The estimated total investment amount for this investment project is approximately RMB 1.6 billion.

Shinnichi Co., Ltd. (603787.SH): Plans to establish Sun Company's production base in Southeast Asia for 300 million yuan

Shinnichi Co., Ltd. (603787.SH) announced that the company plans to set up a subsidiary in Singapore and then use the subsidiary as an investor to set up Sun Company in Southeast Asia to build a production base. The total investment of the project is 300 million yuan, and the construction period is 18 months. After the project is fully delivered, it will achieve an additional production capacity of 1 million electric two-wheelers per year. The implementation of the project will help speed up the company's international market layout, support the company to expand the Southeast Asian market, reduce production costs, and enhance the company's profitability.

Guoke Military (688543.SH): Subsidiary company Aerospace Jingwei plans to invest 810 million yuan in the “Solid Rocket Engine Manufacturing Emergency Capacity Building Project”

Guoke Military (688543.SH) announced that the company held the 20th meeting of the 2nd board of directors on July 31, 2023 to review and pass the “Proposal on the Subsidiary Company Aerospace Jingwei to invest in the “Solid Rocket Engine Manufacturing Emergency Capacity Building Project”. The project plans to build a new composite solid propellant production line, build 35 new buildings (43,173 square meters), and add 31 units (sets) of process equipment; the investment amount is 810 million yuan, of which construction investment is 650 million yuan, with working capital of 160 million yuan (the total final investment is subject to actual investment).

[[Contract won the bid]

Lingnan Co., Ltd. (002717.SZ): The consortium won the bid for the ecological restoration and slope remediation project of the Zhongkai Expressway Bridge side plot in Licun, Torch Development Zone, about RMB 86.1643 million

Lingnan Co., Ltd. (002717.SZ) announced that recently, Lingnan Ecological Cultural Tourism Co., Ltd. received the “Notice of Winning the Bid” from the tenderer Zhongshan Torch High-tech Industrial Development Zone Urban and Rural Construction Service Center, which determined that the consortium formed by the company and Zhongshan Public Works Co., Ltd. was the winner of the ecological restoration and slope remediation project of the Zhongkai Expressway Bridge side plot in Licun, Torch Development Zone. The winning bid price was about RMB 86.1643 million (the details are subject to the amount signed in the contract).

China Tianyuan (000035.SZ): Signed an 86.0598 million yuan rural environmental long-term management project contract in Hai'an High-tech Zone

China Tianjing (000035.SZ) announced that recently, the purchaser, the Jiangsu Hai'an High-tech Industrial Development Zone Management Committee (“Hai'an High-tech Zone Management Committee” or “Party A” for short) signed a “Hai'an High-tech Zone Rural Environment Long-Term Management Project Contract”). According to the contract agreement, the company will be responsible for the long-term management of the rural environment in 41 administrative villages (residences) and 7 old market areas under the Hai'an High-tech Zone, including road (bridge) cleaning, domestic waste collection and cleaning, and cleaning of domestic waste, and cleaning Transportation and disposal of designated garbage collection in residential areas, green maintenance, operation of perishable garbage dumps and surrounding areas Collection and transportation of perishable garbage, participation in village environmental remediation, etc. The total contract amount was RMB 86.0598 million.

Donghong Co., Ltd. (603856.SH): Received a bid notice of 119 million yuan

Donghong Co., Ltd. (603856.SH) announced that on July 18, 2023, the company disclosed the “Promissive Notice of Donghong Co., Ltd. on Project Pre-bid Announcement”. The company pre-won the bid for Shandong Company's Boxing Company's 2×1000MW external water supply pipeline material public tender project, and issued the “Donghong Co., Ltd. indicative notice on winning the project” on July 25, 2023, determining that the company was the winner of the project. The company recently received a bid notice from China Energy Group International Engineering Consulting Co., Ltd., which determined that the company was the successful bidder for the 001 bid section of the project, with a bid price of 119 million yuan.

Shenghui Integration (603163.SH): Signed a daily operating contract of 383 million yuan

Shenghui Integration (603163.SH) announced that the company signed a “contract” with a technology company and a construction company on July 31, 2023. Since signing a formal contract involved multiple parties to complete the internal approval process, it took a long time. In order to advance the progress of the project, the company had already obtained the customer's order before the contract was officially signed. According to the requirements of the accounting system, the company counted the above contract amount of 383 million yuan in current orders up to June 30, 2023, and disclosed the “Shenghui Integration Voluntary Disclosure Notice on Ongoing Orders” on July 13, 2023.

Pinggao Electric (600312.SH) won the bid for a national grid project of about 876 million yuan

Pinggao Electric (600312.SH) announced that recently, the e-commerce platform of the State Grid Co., Ltd. issued the “State Grid Co., Ltd. 2023 (Third Substation Equipment (Including Cable) Bidding Notice”, “State Grid Co., Ltd. 2023 49th Batch Procurement (Third Substation Equipment Single Source Procurement) Transaction Notice”, “State Grid Co., Ltd. added the ninth batch of procurement in 2023 (the first 35-110 kV equipment inventory agreement for transmission and transformation projects) Announcement” . The company, subsidiaries and joint ventures were the winning bidders for related projects. The total bid amount was about 876 million yuan, accounting for 9.45% of operating income in 2022.

CNPC Engineering (600339.SH): Subsidiary signs 4.658 billion yuan EPC contract

China Petroleum Engineering (600339.SH) announced that on July 28, 2023, our wholly-owned subsidiary Global Engineering Company and Guangxi Petrochemical signed a general contract for the engineering design, procurement and construction of the ethylene plant of CNPC Guangxi Petrochemical Refining and Upgrading Project, with a contract amount of RMB 4.658 billion.

Haibo Heavy Industries (300517.SZ): Signed an engineering contract for a 5G base station construction project of about 117 million yuan

Haibo Heavy Industries (300517.SZ) announced that recently, Haibo Heavy Engineering Technology Co., Ltd. (“Party B”) and Zhiguanjia (Beijing) Communications Engineering Co., Ltd. (“Zhiguanjia”, “Party A”) signed a “5G Base Station Construction Project Engineering Contract” with a contract amount of 117.39 million yuan.

[Equity Transfer]

Surveying and Mapping Co., Ltd. (300826.SZ): It plans to invest 50.16 million yuan in Nanjing Xinchuanhui to obtain 8.8265% of its shares

Surveying and Mapping Co., Ltd. (300826.SZ) announced that in order to implement the company's main business development strategy, Nanjing Surveying and Research Institute Co., Ltd. plans to invest 50.16 million yuan of its own capital in Nanjing Xinchuanhui Electronic Technology Co., Ltd. (“Nanjing Xinchuanhui” for short, the “target company”). After the transaction is completed, the company will hold 8.8265% of Nanjing Xinchuanhui's shares.

Broadcom Co., Ltd. (600455.SH): Plans to purchase 55% of Yuteng Energy Ring shares for 297 million yuan

Broadcom Co., Ltd. (600455.SH) announced that the company plans to issue shares and pay cash to purchase 55% of its shares in Yuteng Energy Ring from Yuteng Group, Chen Liqun, Borui Yongxin, Juli Yongcheng, and Wang Guoqing. After the transaction is completed, Yuteng Energy Ring will become a holding subsidiary of the listed company. At the same time, the company plans to raise supporting capital by issuing shares to no more than 35 eligible specific investors. The total amount of supporting capital raised this time did not exceed 188.595 million yuan. As determined through negotiation between the parties to the transaction, the overall transaction price of the underlying company was 540 million yuan, and the transaction price of the 55% shares of the underlying company was 297 million yuan, of which 108.505 million yuan was paid in cash and 188.595 million yuan in shares.

Mindray Healthcare (300760.SZ): Plans to acquire 75% of DiaSys Diagnostic Systems GmbH shares to improve overseas supply chain platforms

Mindray Medical (300760.SZ) announced that it intends to acquire Diasys Diagnostic Systems GmbH held by Gorka Holding GmbH in cash through its wholly-owned subsidiary Mindray Global (HK) Limited (“Hong Kong Global” for short) and Hong Kong Global's wholly-owned subsidiary Mindray Medical Netherlands B.V. (“Mindray Netherlands” for short) 75% of the shares of the “target company”) (hereinafter referred to as “this transaction”), the total purchase price is estimated to be around 115 million euros. The final transaction amount is subject to confirmation at the time of actual delivery. After the transaction is completed, the company will hold 75% of the shares in the underlying company, and the target company and its subsidiaries will be included in the scope of the company's consolidated statements.

After the delivery is completed, Mindray Netherlands and Gorka Holding GmbH will increase the capital of the target company by a total of 40 million euros according to their respective shareholding ratios, that is, Mindray Netherlands will invest 30 million euros and Gorka Holding GmbH will invest 10 million euros. The capital increase will be used to support the target company's future business development. The total value of these transactions is around 145 million euros.

[Fixed increase]

Shengxin Lithium Energy (002240.SZ): Proposed GDR to raise no more than 2.3 billion yuan to invest in Indonesia's Shengtuo 60,000 ton lithium salt project, etc.

Shengxin Lithium Energy (002240.SZ) announced that the total capital raised by the company for issuing the GDR will not exceed RMB 2.3 billion (or equivalent in foreign currency). The total net amount of capital raised after deducting issuance fees will be used for the following projects: Indonesia's Shengtuo 60,000 ton lithium salt project, SESA 2,500 ton technical improvement project, Shengjing Lithium's 20,000 ton lithium salt processing project, Shengxin Metal Phase I 5,000 ton lithium salt project, and supplementary working capital.

Mengcao Ecology (300355.SZ): Proposed to issue convertible bonds to raise no more than 837 million yuan for ecological restoration projects, etc.

Mengcao Ecology (300355.SZ) announced a plan to issue convertible corporate bonds to unspecified targets. The total amount of capital raised by the company's current issuance of convertible corporate bonds to unspecified targets (including issuance costs) does not exceed 837.04 million yuan. The net amount of capital raised after deducting issuance expenses is intended to be invested in ecological restoration projects, grass (seed) industry construction projects, supplementary working capital, etc.

Binjiang Group (002244.SZ): Proposes to publicly issue no more than 850 million yuan of corporate bonds

Binjiang Group (002244.SZ) announced the public issuance of corporate bonds (first instalment) for professional investors in 2023. The issuance scale of current bonds is not more than RMB 850 million (including 850 million yuan), each with a face value of RMB 100, the number issued is not more than 8.5 million, and the issue price is RMB 100 yuan/sheet.

[Repurchase]

Wentai Technology (600745.SH): Plans to buy back 100 million yuan to 200 million yuan of company shares

Wentai Technology (600745.SH) announced that the total capital to be repurchased is not less than 100 million yuan, no more than 200 million yuan, and the repurchase price is not more than 72 yuan/share. The shares repurchased will be used in employee stock ownership plans or equity incentive plans.

Hengrui Pharmaceutical (600276.SH): A total of 7.43887 million shares were bought back through centralized bidding at a cost of 339 million yuan

Hengrui Pharmaceutical (600276.SH) announced that as of July 31, 2023, the company had purchased a total of 7.43887 million shares through centralized bidding transactions, accounting for 0.12% of the company's total share capital. The highest transaction price was 47.01 yuan/share, the lowest price was 44.09 yuan/share, and the total amount already paid was 339 million yuan (excluding transaction fees).

Haier Smart Home (600690.SH): Spending a total of 713 million yuan to buy back 36.683 million shares

Haier Smart Home (600690.SH) announced that in July 2023, the company had repurchased a total of 5,820,700 A-shares through centralized bidding transactions, accounting for 0.062% of the company's total share capital. The highest purchase price was 23.35 yuan/share, the minimum price was 22.65 yuan/share, and the payment amount was 133,566,336.00 yuan; from the start date of implementation of this repurchase until July 31, 2023, the company had repurchased a total of 31,668,300 shares of the company's total share capital, accounting for a cumulative total of 31,668,300 shares of the company's total share capital purchase, accounting for 36% of the company's total share capital purchase. The highest price was 23.90 yuan/share, the lowest price was 21.20 yuan/share, the payment amount was 712,699,266.98 yuan, and the average purchase price was 22.51 yuan/share.

Hengyi Petrochemical (000703.SZ): A cumulative cost of 970 million yuan to repurchase 3.61% of shares

Hengyi Petrochemical (000703.SZ) announced that as of July 31, 2023, the company had purchased a total of 132,288,700 shares (phase 3) through a dedicated securities account through centralized bidding transactions, accounting for 3.61% of the company's total share capital. The highest transaction price was 8.09 yuan/share, the minimum transaction price was 6.37 yuan/share, and the total transaction amount was 971,529,365.21 yuan. This share repurchase complies with the requirements of relevant laws and regulations and complies with the requirements of the company's established repurchase plan.

[Increase or decrease holdings]

Fangzheng Securities (601901.SH): China Cinda plans to reduce its holdings by no more than 2.00% through centralized bidding

Fangzheng Securities (601901.SH) announced that due to the company's operating needs, China Cinda plans to reduce its holdings of the company's shares by no more than 165 million shares through centralized bidding within six months after 15 trading days from the date of publication of this announcement, that is, between August 23, 2023 and February 22, 2024, accounting for about 2.00% of the company's total share capital.

Cotuo Biotech (300858.SZ): Controlling shareholder Sun Tiansong plans to reduce his holdings by no more than 6.39%

Coto Biotech (300858.SZ) announced that Ms. Sun Tiansong, the controlling shareholder and actual controller, who holds 69,383,312 shares of the company's shares (26.3319% of the company's total share capital), plans to use centralized bidding, bulk transactions, and agreement transfers to reduce the total number of company shares by not more than 16,844,490 shares, or no more than 6.3927% of the company's total shares.

Western Test Test (301306.SZ): Honen Junyue, Honen Junchuan, and their co-actors plan to reduce their holdings by no more than 9% in total

Western Test Test (301306.SZ) announced that Ningbo Meishan Bonded Port Area Fengnian Junyue Investment Partnership (Limited Partnership) (“Fengnian Junyue”), Chengdu Sichuan Venture Capital Fengnian Junchuan Military Equity Investment Fund Partnership (Limited Partnership) (“Fengnian Junchuan”) and their co-actors Ningbo Meishan Free Trade Port Area Fengnianjun Investment Partnership (Limited Partnership) (limited partnership) (“Fengnian Junhe”) plans on the 15th day of disclosure of the transaction announcement The total reduction of the company's shares by no more than 2,532,000 shares through centralized bidding within the next 6 months (3% of the company's total share capital). The total shareholding of the company was reduced by no more than 5,064,000 shares (6% of the company's total share capital) through bulk transactions within 6 months after 3 trading days from the date of disclosure of the announcement.

Liding Optoelectronics (605118.SH): The 3 shareholders plan to reduce their holdings by no more than 5.87% in total

Liding Optoelectronics (605118.SH) announced that the Evidia partnership plans to reduce its holdings by no more than 16 million shares, with a reduction ratio of no more than 3.93% of the company's total share capital. Of these, holdings will be reduced by no more than 16 million shares through bulk transactions and no more than 232,800 shares through bidding transactions. Dingzhijie partnership plans to reduce its holdings by no more than 4.833 million shares through auction transactions, with a reduction ratio of no more than 1.19% of the company's total share capital. Xinliding Partnership plans to reduce its holdings by no more than 3.0742 million shares through auction transactions, with a reduction ratio of no more than 0.75% of the company's total share capital.

[Other]

Science Innovation Source (300731.SZ): Plans to cooperate with Honeywell in the fields of single-phase/two-phase immersion liquid cooling technology

Science Innovation Source (300731.SZ) announced that it has signed a “Memorandum of Cooperation” with Honeywell. Based on the company's willingness to cooperate with Honeywell, the company and Honeywell intend to carry out strategic cooperation in various fields to support the product development and business growth strategies of both parties. The two sides signed this Memorandum of Understanding through friendly negotiations with the aim of establishing long-term strategic business cooperation and in line with the principles of mutual benefit and win-win cooperation. According to this Memorandum of Understanding, the two parties agree to actively cooperate in the development and application of siphon cooling technology, board-to-plate liquid cooling technology, and single-phase/two-phase immersion liquid cooling technology for data center servers.

Sanhui Electric (002857.SZ): Sanhui Energy and Zhejiang Jiuyao signed a framework cooperation agreement to build a zero-carbon industrial park

Sanhui Electric (002857.SZ) announced that the company recently received that the holding subsidiary Shenzhen Sanhui Energy Technology Co., Ltd. (“Sanhui Energy”) and Zhejiang Jiuyao Enterprise Management Co., Ltd. (“Zhejiang Jiuyao”) signed the “Framework Cooperation Agreement on Building a Zero-Carbon Industrial Park” on July 31, 2023. The two sides built a comprehensive demonstration solution based on the principles of honesty, credit, equality and mutual benefit, resource sharing and complementary advantages to achieve the construction and digital transformation of Jiuyao Industrial Park's zero-carbon park construction and digital transformation.