The Hanvey Group Holdings Limited (HKG:8219) share price has softened a substantial 54% over the previous 30 days, handing back much of the gains the stock has made lately. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

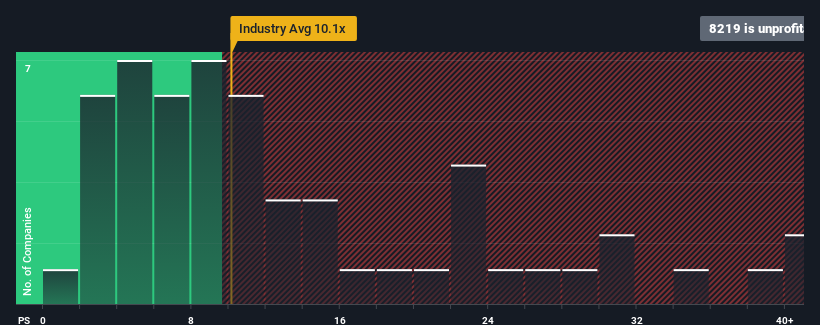

In spite of the heavy fall in price, Hanvey Group Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -4.7x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 21x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Hanvey Group Holdings' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Hanvey Group Holdings

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Hanvey Group Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 705% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Hanvey Group Holdings is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Hanvey Group Holdings' P/E?

Hanvey Group Holdings' P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hanvey Group Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Hanvey Group Holdings (3 make us uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of Hanvey Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.