To the annoyance of some shareholders, ShiFang Holding Limited (HKG:1831) shares are down a considerable 38% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 75% share price decline.

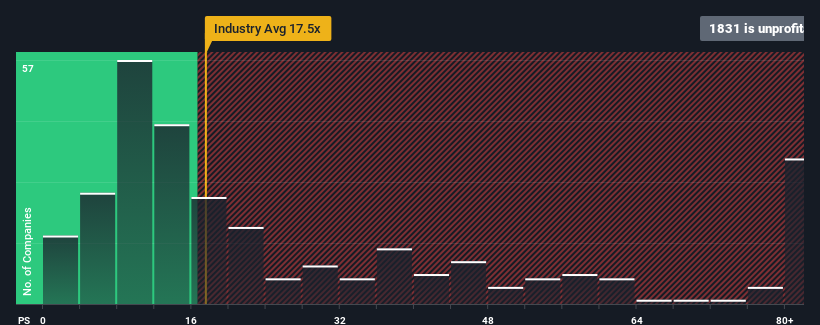

Although its price has dipped substantially, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider ShiFang Holding as a highly attractive investment with its -1x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for ShiFang Holding recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for ShiFang Holding

How Is ShiFang Holding's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as ShiFang Holding's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 18% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that ShiFang Holding's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On ShiFang Holding's P/E

Having almost fallen off a cliff, ShiFang Holding's share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of ShiFang Holding revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 4 warning signs for ShiFang Holding (2 are a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on ShiFang Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.