On July 26, speculation in the A-share computing power leasing sector declined collectively, and most individual stocks continued to decline throughout the day. Among them, Huijin shares, which once harvested 20CM yesterday, closed down 9.08%, Topway Information 8.26%, Capital Online closed down 6.6%, and concept leaders such as Century Huatong, Wave Information, and Yunsai Smart Connect all fell more than 4%.

As can be seen from the current day's decline list, in addition to the weakening market environment, the individual stocks that declined a lot were also related to the company's own recent events. For example, Capital Online recently announced a reduction in senior management holdings, which to a certain extent became a trigger for market sell-offs.

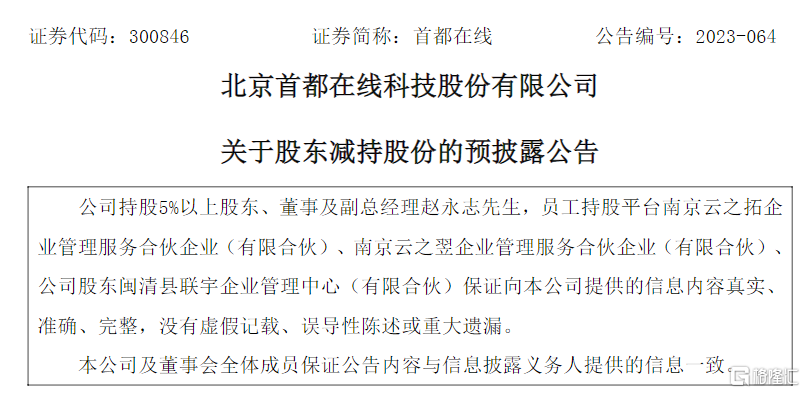

According to an announcement from Capital Online, director and deputy general manager Zhao Yongzhi, Nanjing Yunzhituo, Nanjing Yunzhiyi, and Minqing County Lianyu plan to reduce the company's shares by no more than 1.44% in total. Among them, Zhao Yongzhi, director and deputy general manager of 5.086% of the shares, plans to reduce the company's shares by no more than 2 million shares (accounting for about 0.4284% of the company's total share capital). After the holdings are reduced, their shareholding ratio to the company's total share capital will be less than 5%.

Since this year, earnings from the computing power leasing sector are expected to pick up in the computing power industry due to the explosion of the AI industry, but after related concept stocks have risen by quite a bit, shareholders and even executives have reduced their holdings and cashed out, which has brought a relatively bad impression to market investors and is more likely to be seen as a sign of lack of confidence in the future development of the enterprise or the prospects of the industry.

Looking back at Capital Online's business activities, performance, and frequent changes in the shareholder list in the past two years, investors are indeed quite puzzled.

According to the company profile, Capital Online is a global Internet data center service provider with international teams in China, the United States, India, Singapore, Germany and other countries to provide fast, secure, and stable industry solutions for AI artificial intelligence, metaverse, car networking, gaming, audio and video, e-commerce and other industries. It is a neutral cloud service provider that also provides two-wheel drive for IDC and cloud services.

Overall, the company's business card slots are in the very growing technology circuit industry. At the same time, it already has many experiences and advantages, and its business development model is also very clear. At the same time, it has advantages such as thousands of medium and large enterprise customers and many patents and software copyrights.

In the past two years, Capital Online has also responded positively to the country's digital transformation and development strategy, actively laid out data centers to promote the process of localization of computing power, and with the popularity of the AI industry this year, it also intends to increase the layout of high-performance computing power networks in emerging industries, provide high-performance, low-latency computing power networks and rendering solutions, mainly GPUs, and build a new engine for the company's second growth curve.

As a result, the company has also been labeled with a series of popular concepts in the market, such as AIGC, big data, cloud computing, chip concepts, edge computing, data security, and computing power leasing, and has received financial attention.

The company moved from the Third Board market to GEM listing on July 1, 2020. At the beginning of its listing, it was closed for 21 consecutive trading days. The issue price rose from 3.37 yuan to 43.63 yuan over a month, with a cumulative increase of nearly 12 times. However, the stock price then began to fluctuate and fall, falling back to around 10 yuan at the beginning of this year.

During this period, as the initial lifting of the ban period passed, there were frequent significant holdings reductions, including important shareholders and executives.

At the same time, although there is no doubt about the future growth of the business circuit where Capital Online is located, since the company went public in 2020, revenue and profit growth rates have been small or even on a downward trend.

In 2022, Capital Online's revenue was 1,223 million yuan, an increase of only 0.21% over the previous year, and net profit also experienced its first annual loss of nearly 200 million yuan. In the first quarter of 2023, the company's revenue was 271 million yuan, down 11.78% year on year, and net profit loss was 57 million yuan, down 257.47% year on year.

The massive reduction in holdings by shareholders and senior management, combined with a continuous decline in performance, both put tremendous pressure on the company's stock price.

Until the beginning of 2023, as the AIGC concept began to be very popular, Capital Online was also hyped up by the market for having a related concept. Stock prices began to rise again and doubled at one point.

Since July, Capital Online has frequently responded positively to investors' questions on the company's business development on interactive platforms.

On July 18, Capital Online responded to investors' questions saying that at present, the first phase of the Capital Online Hainan International Data and Computing Power Service Center project has successfully completed electricity transmission, and the project will be delivered soon. The scope of the first phase of construction includes a high computing power computer room, a standard computer room and 2 core computer rooms, with a total of 525 racks.

At the same time, in another question the next day, it was also revealed that the company's Wenchang Computing Power Center project is an important infrastructure for smart Hainan. In the future, it can provide a strong computing power foundation for smart cities, aerospace manufacturing, R&D, biomedicine, and ecology and environmental protection. At the same time, the company will rationally lay out GPU-centered application scenario services according to market demand.

From the content of the company's response, it can be seen that its business is showing a steady trend of progress. But I didn't expect that now the company has once again announced a reduction in the holdings of important shareholders and executives, which will once again trigger an uproar among market investors.