Will the bull market of US debt come? Bulls "anxiously wait" for the Federal Reserve

Source: Wall Street Zhou Xiaowen

Continued strong employment and sticky inflation could throw cold water on the bond market.

The Fed is due to hold a monetary policy meeting next week, and bond bulls are waiting for dove signals.

With the recent cooling of more-than-expected US inflation data, the market expects the Fed's interest rate hike cycle to be coming to an end and Treasuries strengthen.

Yields on policy-sensitive two-year Treasuries have fallen nearly 30 basis points since hitting this year's high on July 6, which is good news for bond bulls.

Fund managers are expanding their exposure to longer-term Treasuries, Bloomberg reported.Because they expect the Fed to remain unchanged and loosen policy next year after raising interest rates to their highest level since 2001.

However, continued strong labor market data could throw cold water on bond bulls.This suggests that the Fed may not end raising interest rates any time soon.

Gregory Faranello, head of US interest rate trading and strategy at AmeriVet Securities, said:

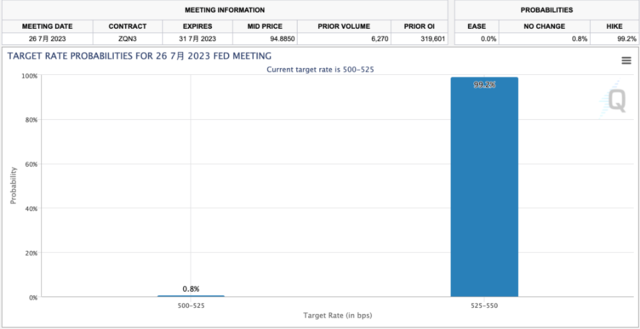

The Fed is now widely expected to raise interest rates by 25 basis points next week, and there is only a 1/3 chance of raising rates again later this year, down from 50% earlier this month.

But if the labour market stays strong and inflation stays stable over the next two months, these bond bulls are likely to be held up again-as happened in the first half of this year.

In January, bond bulls bet that the US recession failed and yields rose sharply; two-year Treasury yields fell below 4 per cent during the regional banking crisis in March, but soared again as risks eased.

George Catrambone, head of fixed income at DWS Americas, said:

"Old debt King": debt Bull is unlikely to come

In the face of the current market, Bill Gross, a legendary investor known as the "bond king" and former chief investment officer of PIMCO, agrees that while US bond yields may have peaked this year, a bond bull market is unlikely.

In his latest investment outlook on Friday, Gross predicted that as markets await Fed easing, the U. S. bond market will experience a sustained bear market and have a negative impact on U. S. stocks.

There are several reasons why he thinks US debt will not go bad:

- As the Federal Reserve shrinks its scheduleThe US government's soaring deficit has further added to the supply pressure on the bond market.This will keep the yield on 10-year Treasuries above 3.5 per cent for a long time.

- Historically, 10-year Treasury yields have been more than 140 basis points higher than the federal funds rate. Even if cooling inflation allows the fed to cut interest rates from 5% to 2.5%, the Fed's forecast of long-term neutral interest rates, the yield on 10-year Treasuries should be at 3.9%.If inflation rises, it could even push u.s. bond yields back above 4% over the next two years.

- The ECB has more work to do to curb inflation than the Fed, which will have an "upward pull" on US bond yields.

'The bond market will eventually have a bull market, but not now, 'Mr. Gross said.