Key Insights

- The considerable ownership by individual investors in CK Hutchison Holdings indicates that they collectively have a greater say in management and business strategy

- The top 25 shareholders own 44% of the company

- 29% of CK Hutchison Holdings is held by insiders

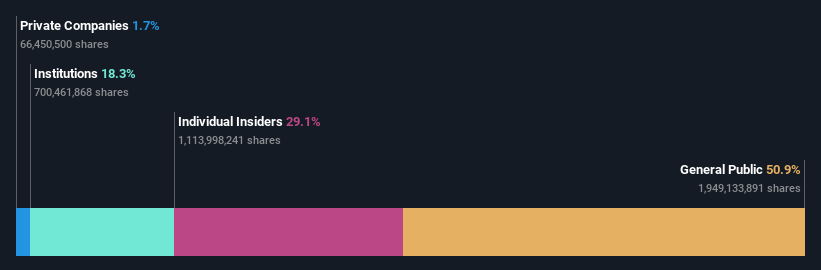

Every investor in CK Hutchison Holdings Limited (HKG:1) should be aware of the most powerful shareholder groups. We can see that individual investors own the lion's share in the company with 51% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

While individual investors were the group that benefitted the most from last week's HK$6.5b market cap gain, insiders too had a 29% share in those profits.

In the chart below, we zoom in on the different ownership groups of CK Hutchison Holdings.

View our latest analysis for CK Hutchison Holdings

What Does The Institutional Ownership Tell Us About CK Hutchison Holdings?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

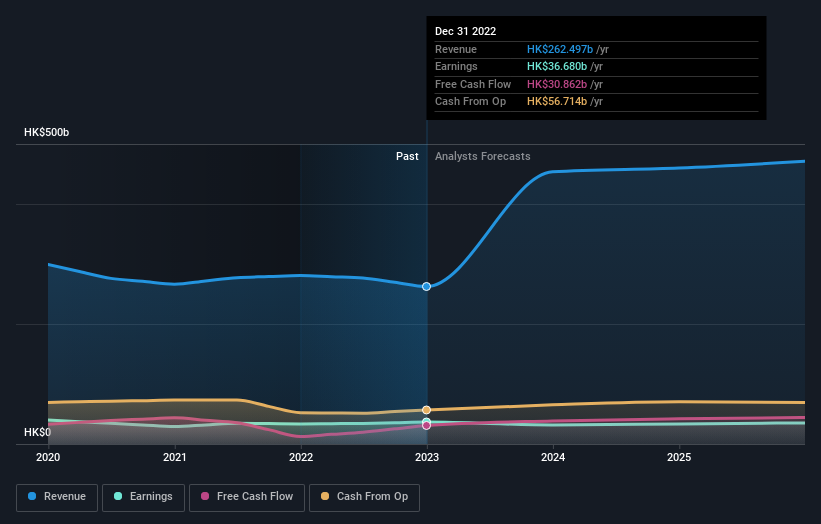

As you can see, institutional investors have a fair amount of stake in CK Hutchison Holdings. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of CK Hutchison Holdings, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don't have a meaningful investment in CK Hutchison Holdings. Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company. In CK Hutchison Holdings' case, its Senior Key Executive, Ka-shing Li, is the largest shareholder, holding 29% of shares outstanding. For context, the second largest shareholder holds about 2.9% of the shares outstanding, followed by an ownership of 2.6% by the third-largest shareholder.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of CK Hutchison Holdings

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of CK Hutchison Holdings Limited. It is very interesting to see that insiders have a meaningful HK$53b stake in this HK$183b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, mostly comprising of individual investors, collectively holds 51% of CK Hutchison Holdings shares. With this amount of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to vote on acquisitions or mergers that may not improve profitability.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with CK Hutchison Holdings (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.