When Jiading International Group Holdings Ltd (HKG:8153) reported its results to March 2023 its auditors, Zhonghui Anda CPA limited could not be sure that it would be able to continue as a going concern in the next year. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So shareholders should absolutely be taking a close look at how risky the balance sheet is. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

See our latest analysis for Jiading International Group Holdings

How Much Debt Does Jiading International Group Holdings Carry?

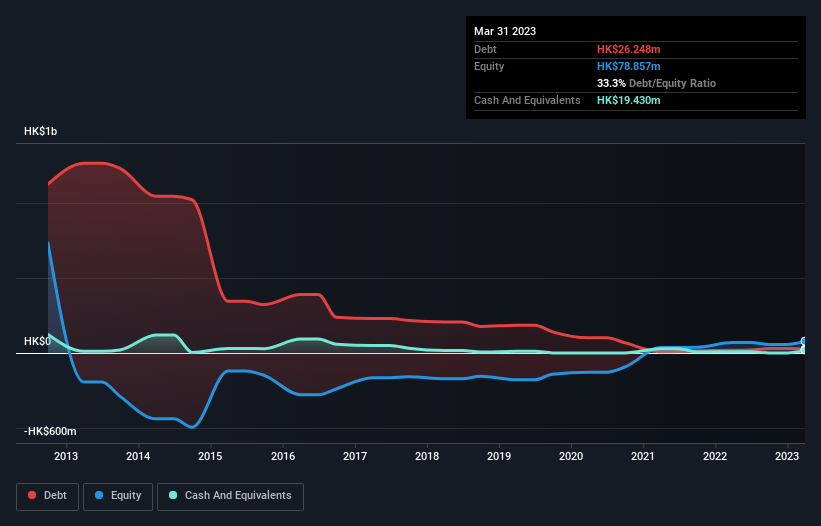

You can click the graphic below for the historical numbers, but it shows that as of March 2023 Jiading International Group Holdings had HK$26.2m of debt, an increase on HK$18.7m, over one year. On the flip side, it has HK$19.4m in cash leading to net debt of about HK$6.82m.

How Healthy Is Jiading International Group Holdings' Balance Sheet?

We can see from the most recent balance sheet that Jiading International Group Holdings had liabilities of HK$48.1m falling due within a year, and liabilities of HK$3.30m due beyond that. Offsetting these obligations, it had cash of HK$19.4m as well as receivables valued at HK$73.1m due within 12 months. So it can boast HK$41.1m more liquid assets than total liabilities.

This excess liquidity suggests that Jiading International Group Holdings is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Jiading International Group Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Jiading International Group Holdings reported revenue of HK$97m, which is a gain of 52%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Despite the top line growth, Jiading International Group Holdings still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost HK$18m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Jiading International Group Holdings (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.