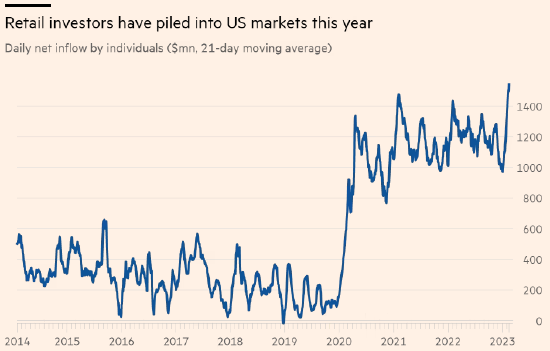

American retail investors are entering the US stock market, and the unprecedented amount of capital they have invested is likely to give them a stronger market influence than “Retail vs. Wall Street” two years ago.

At the time, retail amateurs were stranded at home due to the pandemic, and serendipitously pushed up the stock prices of several struggling small consumer goods companies, such as video game retailer GameStop, cinema operator AMC, and household goods chain Bed Bath & Beyond.

Now, their stalls are more extensive, indicating that after suffering extensive losses last year, retail investors have increased their appetite again. Despite the lack of enthusiasm of professional fund managers, the US stock market still rebounded sharply in early 2023, fueled by retail funds.

According to data compiled by consulting firm Vanda Research, over the past month, the average amount of capital invested by small investors in US stocks reached an unprecedented 1.51 billion US dollars. Meanwhile, data tracked by J.P. Morgan Chase shows that in January of this year, retail investors accounted for a quarter of all US stock trading volume, also setting a record high.

“Recent surveys show that the institutional investor community as a whole is still bearish on the stock market. From this perspective, it is unwise to underestimate the importance of retail investors.” Vanda analysts said, “Most importantly, investors should pay attention to the signals of 'immature fund'.”

Vanda's data shows that small investors' interest in Tesla is at an all-time high — in fact, the stock has always been very volatile and is very popular with retail investors. But in addition to that, retail investors are also buying high-paying stocks such as AT&T and Coca Cola in a big way. Most importantly, these purchases are mainly aimed at the stock itself rather than related options; instead, the latter is a lower-cost tool for shorting or going long.

“We have not seen a change in the direction of long-term investment in options. This is all due to losses over the past year and a half.” Marco Iachini, senior strategist at Vanda, said.

J.P. Morgan said that this year's capital inflow stemmed from younger generation investors' fanaticism about influencer stocks. At the same time, older investors also supported this. The latter tend to prefer funds rather than individual stocks. They sold 340 billion US dollars of ETFs and bond funds last year, but as of February 8 this year, they have bought another 125 billion US dollars.

Bank data shows that young investors are starting to buy small-cap stocks again, but they are also snapping up large-cap technology stocks at the same time. Tesla rose 62% this year, while the Nasdaq Composite Index, which is dominated by tech stocks, rose 12% over the same period. Russell 2000 small-cap stocks also rose 10%.

Two years ago, executives, regulators, and analysts of major US investment firms were summoned to Washington to explain why the surge in retail investment-related investment activities involving influencer stocks would disrupt the entire US stock market.

This has also sparked deep calls for reform. This week, the US Securities and Exchange Commission (SEC) approved a schedule to reduce transaction settlement time by half to one day to reduce the risk of some retail brokerage firms limiting payments during market frenzy.

At the time, many analysts believed that the pandemic had created an excellent period for retail investors to enter the stock market because borrowing costs were extremely low at the time, and a large number of simplified transaction procedures had appeared.

Although borrowing costs rose rapidly as a result of the Fed's rapid interest rate hike last year, it doesn't seem to have dampened the enthusiasm of retail investors. Vanda analysts pointed out that a large number of retail investors have entered the market through ETF funds. If the market environment is attractive enough, these funds will also be used.

Some recent activity may only be seasonal, as the latest profit data released by companies spurs buying activity, and the upcoming US tax season may also prompt some investors to monetize their funds to pay tax bills.

“New account activity usually increases at the end of the year, and I think it's because many people make New Year's resolutions: 'I need to pay more attention to my finances. '” Thomas Peterffy, founder of Interactive Brokers, said the company is paying more attention to experienced investors, and the number of accounts for its clients has increased 23% in one year.

“In my opinion, retail investors are a group of people in their sixties. They are rich and occasionally have the urge to invest in stocks.” He added, “Young people in their 20s don't have much money.”

However, there are also people with different opinions. They believe that as more and more investors become familiar with simple trading procedures such as Robinhood, the market is also undergoing some long-term changes.

Some industry participants said that young people who previously participated in speculating on influencer stocks are mature and are using apps that have emerged during the pandemic to serve more traditional investment purposes.

Zoe Barry, founder of the retail trading app Zigeroo, said that people take it for granted that young investors will follow the trend and speculate on influencer stocks, “but they don't realize that many young investors are also doing research and studying hard.”