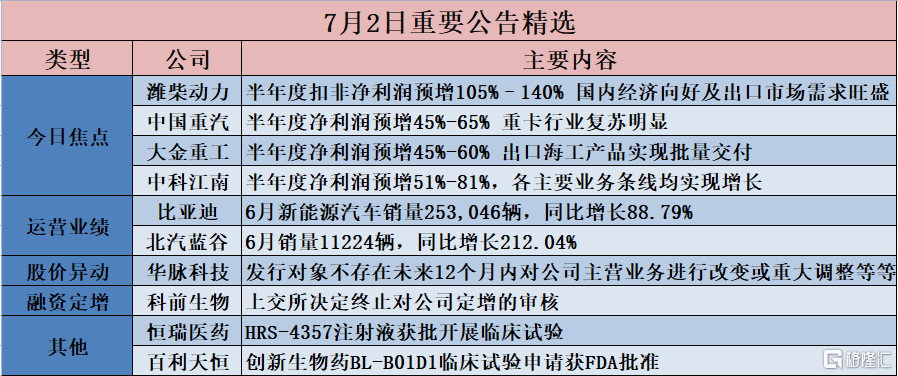

[Today's focus]

With the domestic economy improving and export market demand strong, Weichai Power (000338.SZ) estimated a 105% — 140% increase in semi-annual non-net profit

Weichai Power (000338.SZ) announced that net profit attributable to shareholders of listed companies for the half year of 2023 is estimated to be 3.587 billion yuan to 4,065 billion yuan, an increase of 50% to 70% over the previous year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 3.304 billion yuan to 3.868 billion yuan, an increase of 105% to 140% over the previous year.Benefiting from the improving domestic economy and strong export market demand, there was a recovery in demand in China's heavy truck industry in the first half of 2023. The company continues to promote product and business restructuring, forcefully breaking through strategic markets, sales of related products showed a rapid growth trend, and contributions from strategic emerging businesses such as large bore and hydraulics continued to increase, and jointly promoted significant year-on-year growth in performance.

The heavy truck industry has clearly recovered, and the net profit of Sinotruk (000951.SZ) is expected to increase by 45%-65% in the half year

Sinotruk (000951.SZ) announced that it expects net profit attributable to shareholders of listed companies for the half year 2023 of 465 million yuan to 529 million yuan, an increase of 45%-65% over the previous year; net profit after deducting non-recurring profit and loss is 437 million yuan to 497 million yuan, an increase of 45%-65% over the previous year.The heavy truck industry recovered significantly during the reporting period, benefiting from the steady, moderate and improving domestic macroeconomic economy and increased demand in overseas markets. The company grasps market opportunities, is customer-oriented, product-centered, continuously optimizes products and business structures, continuously improves brand, channels and marketing capabilities. Product sales have achieved good growth, and profitability has improved significantly.

Export of offshore products achieved batch delivery, and Daikin Heavy Industries (002487.SZ)'s net profit for the half year was expected to increase by 45%-60%

Daikin Heavy Industries (002487.SZ) announced that it expects net profit attributable to shareholders of listed companies for the half year 2023 of 255 million yuan to 281 million yuan, an increase of 45%-60% over the previous year; net profit after deducting non-recurring profit and loss is 243 million yuan to 268 million yuan, an increase of 45%-60% over the previous year.The main reasons for the increase in the company's performance include: 1. The structure of the products sold by the company in the current period has changed compared to the same period last year, and exported offshore products have been delivered in batches in this period; 2. The company's self-operated wind farm was connected to the grid in the current period.

Zhongke Jiangnan (301153.SZ)'s net profit for the half year is expected to increase by 51%-81%, and all major business lines have achieved growth

Zhongke Jiangnan (301153.SZ) announced that net profit attributable to shareholders of listed companies for the half year of 2023 is expected to be 92 million yuan to 110 million yuan, an increase of 51%-81% over the previous year; net profit after deducting non-recurring profit and loss is 84 million yuan to 10 million yuan, an increase of 50%-79% over the previous year.

Jikai Co., Ltd. (002691.SZ) had a semi-annual advance loss of 16 million to 21 million yuan, and profit to loss over the previous year

Jikai Co., Ltd. (002691.SZ) announced that net profit attributable to shareholders of listed companies for the half year of 2023 is estimated to be a loss of 16 million yuan to 21 million yuan, compared to a profit of 9771 million yuan for the same period last year; net profit after deducting non-recurring profit and loss is a loss of 19.8 million yuan to 24.8 million yuan, compared to a loss of 2,111,000 yuan for the same period last year. The main reasons are:1. During the reporting period, the company increased its marketing efforts and actively explored the market, taking customer needs as the starting point, but sales revenue decreased during the reporting period due to delays in the annual procurement plans of some customers;2. Due to the restructuring of sales products during the reporting period, gross margin declined. At the same time, management expenses and sales expenses increased compared to the same period last year, resulting in a loss in net profit.

Net profit of Zhongtong Bus (000957.SZ) is expected to increase by 82% to 137% in the half year, and overseas exports expand

Zhongtong Bus (000957.SZ) announced that net profit attributable to shareholders of listed companies for the half year 2023 is estimated to be 40 million yuan to 52 million yuan, an increase of 82% to 137% over the previous year; net profit after deducting non-recurring profit and loss will be 27 million yuan to 36 million yuan, compared to a loss of 4,5548 million yuan for the same period last year.The company adjusted its sales strategy, focused on superior products, and increased sales of high value-added products, especially overseas exports; at the same time, it strictly controlled expenses and implemented measures to reduce costs and increase efficiency, which led to an improvement in the company's business performance in the first half of 2023.

[Operating data]

BYD (002594.SZ): Sales of new energy vehicles in June were 253,046 units, up 88.79% year on year

BYD (002594.SZ) revealed the production and sales report for June 2023. Sales of new energy vehicles were 253,046 units, up 88.79% year on year, of which total sales of new energy passenger vehicles were 10,536 units; in January-June, the cumulative sales volume of new energy vehicles was 1,255,637 units, up 95.78% year on year.The total installed capacity of the company's new energy vehicle power batteries and energy storage batteries in June 2023 was about 11.816 GWh, and the cumulative total installed capacity in 2023 was about 60.250 GWh.

Celis (601127.SH): Sales of 9,348 new energy vehicles in June

Celis (601127.SH) revealed the production and sales report for June 2023. Celis sold 9,348 new energy vehicles, of which 5,668 units were sold; in January-June, the cumulative sales volume of new energy vehicles was 44,800 units.

BAIC Blue Valley (600733.SH): Sales volume in June was 11224 units, up 212.04% year on year

BAIC Blue Valley (600733.SH) revealed the June 2023 production and sales report of its subsidiary Beijing New Energy Vehicle Co., Ltd., which sold 1,1224 units this month, up 212.04% year on year; in January-June, cumulative sales volume was 35,191 units, up 106.88% year on year.

[Stock price changes]

Huamai Technology (603042.SH) suggests stock trading risks, that the issuer does not have any changes or major adjustments to the company's main business within the next 12 months, etc.

Huamai Technology (603042.SH) issued a stock trading risk warning notice. The company's stock recently rose and stopped for six consecutive trading days. The cumulative increase in stock prices during this period reached 77.18%. Investors are kindly requested to pay attention to secondary market trading risks, make rational decisions, and invest prudently.The issuer Shenlan Technology Holdings Co., Ltd. has no plans to change the main business of the listed company or make major adjustments to the main business of the listed company within the next 12 months; there are no plans to sell, merge, joint ventures or cooperate with others, or restructuring plans for listed companies to purchase or replace assets within the next 12 months; there are no other plans that have a significant impact on the listed company's business and organizational structure within the next 12 months.There have been no major changes in the company's main business or main products, and the results of the last year and the first quarter of 2023 have been lost. The company's net profit attributable to shareholders of listed companies in 2022 and the first quarter of 2023 was -954715 million yuan, -197347 million yuan, a sharp decline from the previous year. The company's current business mainly provides communication network physical connection and wireless access products for domestic and foreign telecom operators, telecom main equipment vendors, network integrators and government and enterprise customers. It mainly includes optical communication products such as optical distribution frames, optical splitters, combiners, optical hopping fibers, optical cables, etc., wireless communication network construction products such as microwave passive devices, indoor and outdoor equipment cases, cabinets, antenna series products, etc. The company's business focuses on communication infrastructure and does not involve artificial intelligence.The company's controlling shareholders and actual controllers have a high pledge ratio, accounting for 52.73% of the pledges.As of the disclosure date of the announcement, with the exception of matters that have been publicly disclosed, the company, the company's controlling shareholders, and actual controllers had no significant matters affecting abnormal fluctuations in the company's stock trading, nor did they have material information that should have been disclosed but not disclosed.

[Refinancing]

Keqian Biotech (688526.SH): The Shanghai Stock Exchange decided to stop reviewing the company's fixed increase

Keqian Biotech (688526.SH) announced that on June 30, 2023, the company received the “Decision on Terminating the Review of the Issuance of Shares by Wuhan Keqian Biology Co., Ltd.” (Shanghai Securities Review (Refinancing) [2023] No. 161) issued by the Shanghai Stock Exchange. The Shanghai Stock Exchange decided to terminate the review of the company's issuance of shares to specific targets in accordance with Article 19 of the “Shanghai Stock Exchange Listed Company Securities Issuance and Listing Review Rules” and Article 63 (2) of the “Shanghai Stock Exchange Stock Exchange Stock Issuance and Listing Review Rules”.

[Other]

Hengrui Pharmaceutical (600276.SH): HRS-4357 injection approved for clinical trials

Hengrui Pharmaceutical (600276.SH) announced that recently, Tianjin Hengrui Pharmaceutical Co., Ltd., a subsidiary of the company, received approval from the State Drug Administration (“State Drug Administration”) to issue a “Drug Clinical Trial Approval Notice” for HRS-4357 injections and will conduct clinical trials in the near future.HRS-4357 injection is an innovative chemical class 1 radiotherapy drug independently developed by the company. It is suitable for adult patients with metastatic castration-resistant prostate cancer (mCRPC) who have previously received positive androgen receptor (AR) pathway inhibitors and paclitaxane chemotherapy. The same variety has not been approved for marketing at home or abroad, and there is no relevant sales data yet. Up to now, HRS-4357 injection-related projects have invested a total of about 29.18 million yuan in R&D expenses.

Bailey Tianheng (688506.SH): Innovative Biopharmaceutical BL-B01D1 Clinical Trial Application Approved by FDA

Bailey Tianheng (688506.SH) announced that recently, the company's self-developed innovative biopharmaceutical BL-B01D1 clinical trial application was approved by the US Food and Drug Administration (“FDA”).BL-B01D1 is a globally exclusive dual anti-ADC drug targeting EGFR × HER3 independently developed by the company. BL-B01D1 monotherapy has carried out 5 phase Ia/Ia clinical studies in China, covering 16 types of tumors. BL-B01D1 monopharyngeal drug has shown breakthrough efficacy that can advance to critical clinical registration in patients with non-small cell lung cancer and nasopharyngeal cancer. It has completed the submission of communication applications for 3 single-drug double-arm phase III clinical registration and 2 single-drug single-arm key registration clinical studies in China; BL-B01D1 in combination with SI-B003, combined use with chemotherapy drugs, and combined use with oxitinib have all obtained phase II clinical trial approval and are being promoted to phase II clinical studies of related joint drug use Go in.